Fringe benefits are a powerful way to recruit, reward, and retain employees—but they also come with tax rules you can’t ignore. The IRS defines fringe benefits as a form of pay for services.

The official Employer’s Tax Guide to Fringe Benefits (Publication 15-B / Publication 15-b) explains how to value, withhold, and report them. Below is a concise overview you can use as a working tax guide to fringe benefits for your team.

Disclaimer: This overview is for general education only. Always confirm details with your CPA or tax advisor.

What Counts as a Fringe Benefit?

Anything of value you provide besides wages can be a fringe benefit: health insurance, retirement matches, commuter subsidies, dependent care, tuition assistance, cell phones, company cars, and more. Some are required by law; others are optional.

Legally Required Benefits

- Social Security and Medicare (FICA): Employers and employees contribute to covered wages, and taxable fringe benefits are generally subject to FICA.

- Unemployment insurance (FUTA/SUTA): Employer-paid employment taxes that fund benefits for qualified unemployed workers.

- Health benefits / medical leave under federal law: Large Applicable Employers must offer health insurance that meets ACA requirements. FMLA provides job-protected leave and continuation of group health benefits.

- Workers’ compensation: State programs covering work-related injuries and illnesses.

Common Optional Benefits (high-impact)

- Group-term life insurance

- Retirement plan matches

- Transportation/parking subsidies

- Tuition assistance and professional development

- Gym memberships and wellness stipends

- Equity/Employee Stock Options

- Childcare/Dependent care assistance

- Cell phones, internet stipends, equipment

Taxable vs. Nontaxable: The Core Rules

General rule: A fringe benefit is taxable and must be included in wages unless the law specifically excludes it. When taxable, it’s usually subject to income tax withholding, Social Security, and Medicare, and reported on Form W-2 (often Box 14 for description).

Standard nontaxable exclusions (when IRS conditions are met):

- Employer-paid health insurance premiums and many medical reimbursements

- De minimis benefits (low-value, infrequent)

- Qualified transportation fringes (subject to monthly limits)

- Group-term life insurance up to $50,000

- Qualified moving expense reimbursements (limited cases)

- Working condition fringes (e.g., business use of a phone or tools)

- Qualified dependent care assistance (e.g., a Dependent Care FSA within annual limits)

Common taxable examples:

- Cash bonuses and gift cards

- Personal use of a company car (outside business use rules)

- Group-term life insurance over $50,000

- Some club dues, prizes, and awards that don’t meet IRS requirements

Publication 15-B gives the precise criteria for each exclusion and whether employment taxes and income tax withholding apply.

Valuing Fringe Benefits (Fair Market Value)

To calculate taxability, determine the fair market value (FMV): what a willing buyer would pay for the benefit. Examples:

- Gym access → use the local annual membership price (less any employee after-tax share).

- Company car personal miles → use IRS special valuation methods.

- Cell phones are often used for substantial business reasons → often a working condition fringe (nontaxable) if used primarily for business.

Taxable amount = FMV − any amount the employee paid with after-tax dollars − any legally excludable portion.

Accountable Plans: Reimbursements Done Right

Use an accountable plan to reimburse business expenses (travel, mileage, tools, home-office items for eligible roles) without creating taxable income. To qualify:

- Expenses have a business connection.

- Employees substantiate amounts, time, place, and purpose in a reasonable period.

- Employees return excess advances.

If these conditions aren’t met, reimbursements become taxable wages subject to income tax withholding and employment taxes.

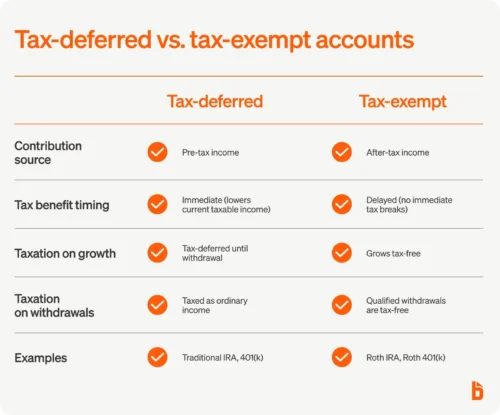

Tax-Advantaged Benefits to Consider

These programs can lower taxable pay for employees and reduce payroll tax exposure for employers:

- Health benefits through Section 125 cafeteria plans (pre-tax premiums, HSAs/HRA/FSAs where eligible).

- Dependent care assistance (e.g., a DCAP/FSA) up to annual IRS limits.

- Commuter benefits (transit/parking) within monthly caps.

Follow the plan document and nondiscrimination rules to keep these benefits pre-tax.

How to Handle Fringe Benefits in Payroll

Taxable fringe benefits are processed as imputed income:

- Identify the benefit and determine if it’s taxable under Publication 15-B.

- Value the benefit (FMV minus employee after-tax payments and excludable amounts).

- Add the taxable value to wages for the period (monthly/quarterly/annually).

- Apply income tax withholding (or consider the “no-withholding” option for certain benefits, then withhold later in the year), plus Social Security and Medicare if applicable.

- Report on Form W-2 (often in Box 1, 3, and 5 as required; description can go in Box 14).

Timing tip: Publication 15-B allows you to add taxable fringe values to payroll periodically or as a year-end lump sum, as long as withholdings and deposits are handled correctly.

Quick Reference: Popular Benefits and Typical Tax Treatment

- Employer health insurance premiums: Generally nontaxable to the employee; subject to ACA rules.

- HSA contributions: Pre-tax if made through a cafeteria plan; otherwise, subject to special reporting.

- Dependent care benefits: Nontaxable up to the annual limit if provided under a qualified plan; excess is taxable.

- Group-term life insurance: Nontaxable up to $50,000; above that, imputed income using IRS tables.

- Commuter/parking benefits: Excess is taxable up to monthly limits.

- Bonuses/gift cards: Taxable wages, always.

- Personal use of company car: Taxable unless excluded; use IRS valuation methods.

- Achievement awards: Potentially nontaxable if tangible property and within dollar limits for qualified plans.

Always confirm specifics in Publication 15-B—it’s the definitive tax guide to fringe benefits.

Why Offer Fringe Benefits?

Done right, benefits:

- Strengthen recruiting and retention

- Boost morale and wellness

- Support productivity with the right health benefits and flexibility

- Provide tax efficiency through pre-tax programs and thoughtful plan design

Where APS Fits In

Tracking who gets which benefit—and when it becomes taxable—can get messy. APS helps you simplify:

- Store benefit settings and apply them during payroll runs

- Add imputed income items (monthly, quarterly, or year-end)

- Automate recurring items and reduce manual keying errors

- Keep reporting aligned with employment taxes and W-2 requirements

Your CPA can calculate benefit values; APS makes applying income tax withholding, Social Security, and Medicare straightforward inside payroll.

Want to see how APS can simplify payroll and compliance reporting for your team? Explore our Payroll solution.

Sources

- Publication 15-B (2025), Employer’s Tax Guide to Fringe Benefits | IRS

- Employer Costs for Employee Compensation | U.S. Bureau of Labor Statistics

- Fringe Benefits | CFI

- How to Calculate Fringe Benefits | HR University

- What Is Taxable and Non-Taxable Income? | IRS

- What You Should Know About Group Life Insurance at Work | Guardian

- Fringe Benefit Guide | IRS

- Accountable Plans Made Easy | Brotman Law

- The Small Business Owner’s Guide to Starting a Section 125 Cafeteria Plan | HSA for America

- Tax-Advantaged Account | Bill

- Fringe Benefits & Payroll | Groom Law Group

- Form W-2 Reporting of Employer-Sponsored Health Coverage | IRS

- Employee Fringe Benefits Increase Job Satisfaction | Wolters Kluwer