Multi-state payroll is where complexity meets compliance. For CPAs, the stakes are high: errors can mean material misstatements, penalties, and damaged client relationships. This practical guide distills the complexity into standard operating procedures CPAs can apply today — from intake to reconciliation — and explains how a payroll partner that acts as a tax reporting agent can materially reduce risk.

Why Multi-State Payroll Can Be Challenging

Even experienced accounting firms can find multi-state payroll challenging. There are several recurring problem areas:

- Resident vs. Work State Withholding: Employees may reside in one state and work in another, where each state may have different withholding obligations.

- Local Jurisdictions: City or county taxes and filing rules create hundreds of local variations that can be easily overlooked.

- SUTA & Unemployment: Experience rating and taxable wage bases differ by state; misclassification can affect employer liabilities.

- Nexus and Registration: A single remote employee can trigger registration requirements for an employer in a new state.

- Different Filing Cadences and Forms: States and localities have disparate due dates and form types.

This combination of variables creates operational gaps — not theoretical ones. Your team’s objective is not to memorize every exception; it’s to create repeatable processes and controls that prevent the most common failures.

Pre-Payroll: The Handy Checklist Every CPA Can Use

A repeatable onboarding checklist mitigates multi-state risk and sets clear responsibility lines.

- Employee Data Verification

- Confirm legal name, SSN, home address, primary work location, and any work-from-home arrangements.

- Capture tax withholding allowances and exemption documentation.

- Client Tax Registrations

- Verify state withholding registrations, SUTA accounts, and local tax registrations.

- If registration is missing, record whether the payroll partner will register on behalf of the client.

- Classification and Job Structure

- Confirm exempt vs. non-exempt status, independent contractor status, and any union rules that affect pay or tax withholding.

- Funding and Approvals

- Define funding cadence and approval workflows before running each payroll.

- Accounting Integration Readiness

- Map GL codes and confirm how GL exports or integrations will post journal entries into the client’s ledger.

Standardizing these steps reduces ad-hoc exceptions and provides a defensible audit trail.

Run Day: Validation Controls That Matter

On payroll day, implement controls that are fast, routine, and can be verified.

- Audit the Approval Log: Verify that the payroll batch has documented approvals and exception notes.

- Validate Tax Jurisdictions: Review any employees with out-of-pattern locations or recent relocations.

- Preview the GL File: Confirm that department and location allocations are correct before journal entries post. Automation that pushes journal entries into the ERP reduces the need for manual manipulation and reconciliation time.

- Exception Review: Confirm that overtime, retroactive pay, and deductions have documented justifications.

If you build these checks into a single checklist used for each client launch, you dramatically reduce the need for firefighting during audits.

Post-Payroll Reconciliation & Audit Readiness

After payroll posts, reconciliation is the immediate next step:

- Post-to-GL Reconciliation: Match payroll totals to general ledger entries and drill down to identify variances.

- Save Audit Trails: Store approval logs, exception approvals, and interface files for the audit window to facilitate efficient review and analysis.

- Tax Correspondence Tracking: Maintain a single folder for agency notices and the history of responses.

A payroll partner that provides reliable audit trails and consistent GL feeds takes most of this burden off your firm.

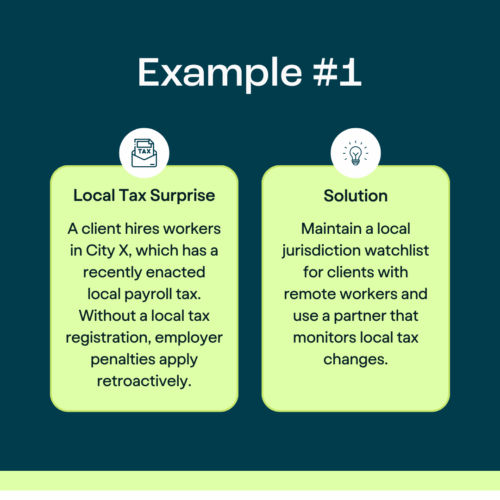

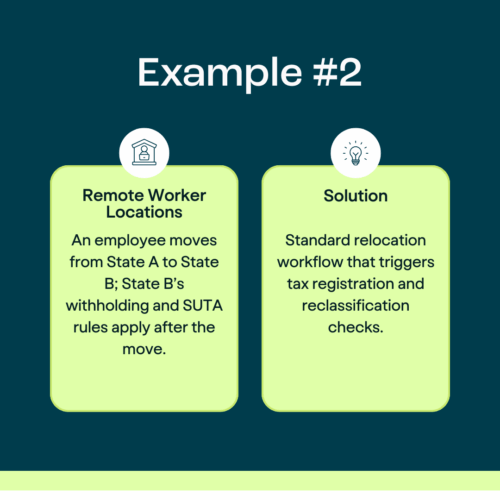

Examples and Mitigation of Local Jurisdiction Compliance

Operational playbooks that capture these examples make the edge cases manageable and defensible.

Why Using a Tax Reporting Agent Matters (and What it Means)

A payroll provider that serves as the tax reporting agent files returns and remits payments on behalf of your clients, responds to agency correspondence, and reduces the firm’s compliance exposure. APS provides payroll tax filing and payments across all 50 states and many local jurisdictions, and will engage in the abatement process if a penalty results from an APS error—that level of accountability matters for CPAs who sign off on financials.

GL Automation: The Single Biggest Operational Win

Manual journal entry is the most significant time sink and a frequent source of error. Automating GL exports or using native integrations that generate journal entries in the ERP creates reliable month-end closes and reduces reconciliation time. When evaluating vendors, prioritize those that offer dimension synchronization and automated journal posting.

Quick Action Plan for CPAs (First 30 Days)

- Adopt a standardized intake form that captures both home/work locations, as well as tax registrations.

- Pilot GL automation with 5–10 clients and measure reconciliation hours saved.

- Create a local tax watchlist for clients with remote employees to accurately and efficiently track their tax obligations.

- Assess payroll partners for tax reporting agent capabilities and SLA on agency correspondence.

Partnering with APS: Streamlining Payroll for CPAs

For CPAs navigating the complexities of multi-state payroll, a strategic partnership with a dedicated payroll provider, such as APS, can be a game-changer. Beyond simply processing payroll, APS acts as a tax reporting agent, shouldering the responsibility of filing returns and remitting payments across all 50 states and numerous local jurisdictions.

Benefits of a Value-Added Reseller Partnership with APS:

- Reduced Compliance Risk: APS assumes the burden of tax filings and agency correspondence, including participation in the abatement process if a penalty arises from an APS error. This level of accountability provides peace of mind for CPAs who are ultimately responsible for signing off on financials.

- Operational Efficiency: By automating the intricacies of multi-state payroll in an intuitive platform, your firm can streamline its internal processes. You’ll spend less time on manual tasks, see fewer errors, and have more consistent, audit-ready payroll.

- Enhanced Client Service: With the operational burden reduced, your team can focus on higher-value advisory services for your clients. You can provide more strategic guidance, and your clients will receive personalized, day-to-day support.

- Streamlined GL: APS offers GL exports and integrations with accounting systems, including Sage Intacct and QuickBooks Online. You can eliminate the significant time sink and error potential associated with manual journal entries, resulting in reliable month-end closes and reduced reconciliation time.

- In-House Tax Team: Gain access to a partner who works with you to stay on top of local tax changes and provides support for complex scenarios, such as new local tax enactments or remote worker relocations. This proactive approach helps prevent costly surprises.

By partnering with APS, CPAs can transform multi-state payroll from a source of stress into a streamlined, efficient, and compliant process, ultimately enhancing client relationships and freeing up resources for growth.

Simplifying Multi-State Payroll: Your Path Forward

Multi-state payroll is less about memorizing exceptions and more about designing controls that scale. Standardize intake, automate GL, and partner with a payroll provider that acts as your tax reporting agent — you’ll reduce risk and free time for advisory work.