Understanding IRS Form W-9 in 2025: Who Needs It and Why It Matters

If you’ve ever scrambled in January to chase down W-9s, you know how quickly tax season can become a mess. In 2025, a few small changes could have a big impact—here’s what to know.

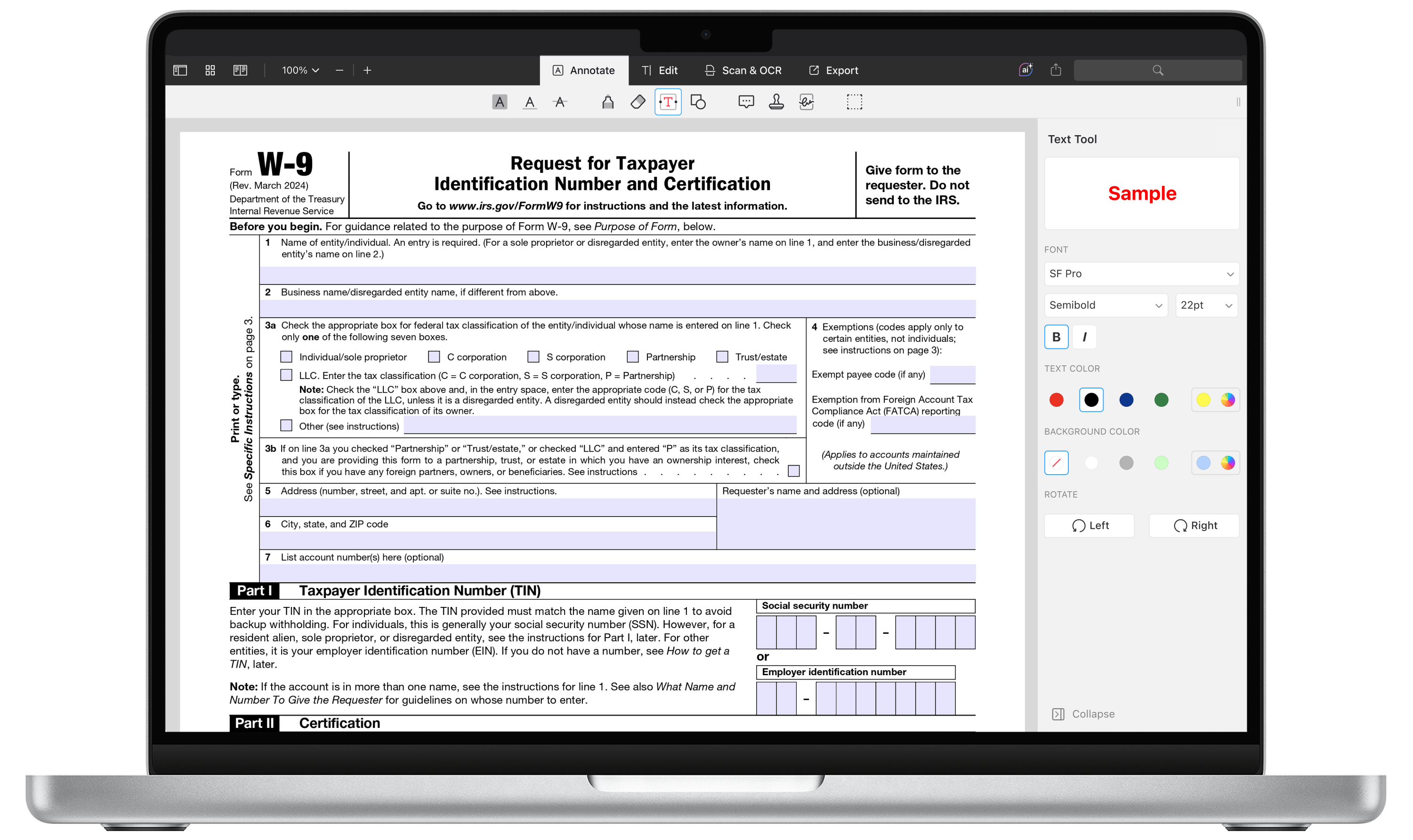

What Is a W-9 Form?

IRS Form W-9, officially titled “Request for Taxpayer Identification Number and Certification,” is a document businesses use to collect tax ID information from individuals or entities they pay who are not employees. This includes:

- Independent contractors

- Freelancers

- Vendors or consultants

- LLCs and partnerships

- Sole proprietors

The form gives the payer essential information to report payments to the IRS, usually via Form 1099-NEC or 1099-MISC.

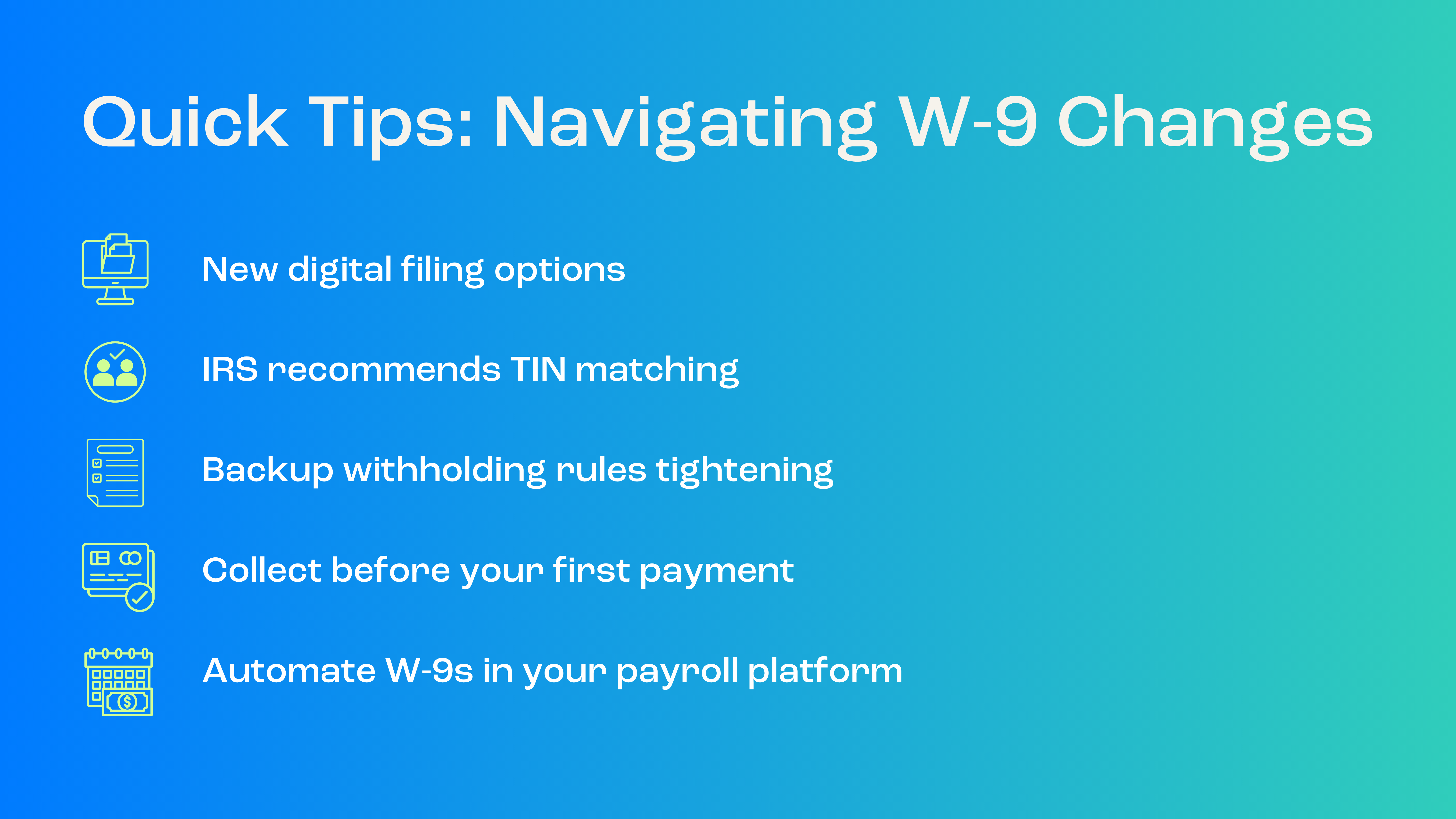

What’s New with the W-9 Form in 2025?

As of 2025, the IRS has made a few notable updates to the W-9 process:

1. Digital Submissions Are More Widely Accepted

The IRS continues to support electronic W-9 collection, and more businesses are ditching paper. Platforms that automate the request and storage of W-9s are helping reduce errors and save time, which is especially important for hybrid workforces and remote contractors.

2. TIN Matching Is Strongly Recommended

The IRS emphasizes using its TIN Matching Program for payers submitting 1099s. This helps confirm that the taxpayer’s name and number match IRS records, reducing the chance of penalties.

3. Greater Emphasis on Backup Withholding Rules

If a contractor fails to provide a correct TIN, you may be required to withhold 24% of payments under IRS backup withholding rules. The IRS has signaled increased scrutiny on compliance in 2025.

Who Needs to Fill Out a W-9?

The payee generally completes the W-9—the individual or business receiving funds. This includes:

- Contractors and gig workers

- Freelancers on 1099 contracts

- Landlords receiving rent payments

- Anyone receiving a legal settlement or dividend income

If you’re paying someone not on your company payroll, collecting a W-9 before the first payment is smart.

Common Mistakes to Avoid

Here are a few W-9 pitfalls that can lead to IRS issues:

- Not requesting a W-9 from every contractor

- Accepting incomplete forms (missing TIN or signature)

- Using an outdated version of the form

- Forgetting to verify business type (LLC, S-Corp, Sole Proprietor, etc.)

- Failing to store W-9s securely

Reviewing your contractor onboarding process is essential to ensure W-9s are part of the workflow.

Best Practices for Managing W-9s

To stay organized and compliant:

- Automate your W-9 collection during contractor onboarding.

- Use e-signature tools to simplify completion and reduce paper clutter.

- Store forms securely, ideally in your HRIS or payroll system.

- Verify TINs against IRS records to prevent mismatches.

Some payroll and HR platforms—like APS—offer built-in contractor management features, allowing W-9s, 1099s, and payments to be handled from a single, secure system.

When Should You Request a W-9?

To stay compliant, requesting a completed W-9 form before making the first payment to a contractor or vendor is best. Waiting until the end of the year creates unnecessary stress, especially if you can’t reach the payee or they delay sending their information.

W-9s should also be collected anytime the following occurs:

- You’re onboarding a new 1099 contractor or freelancer

- A vendor changes their business structure or tax classification

- There’s a name or TIN change

- You resume payments to a vendor after a long period of inactivity

Proactive collection helps avoid 1099 filing delays and ensures you have the documentation needed in case of an audit.

W-9 vs. W-4: What’s the Difference?

While W-9s and W-4s are both IRS forms related to tax reporting, they serve different purposes and apply to various types of workers.

- Form W-9 is used for independent contractors and vendors. It provides the information needed to issue a 1099.

- Form W-4 is used for employees. It tells the employer how much federal income tax to withhold from the employee’s paycheck.

Confusing the two could lead to misclassification—a significant compliance risk. Be sure your team understands the difference and applies the correct form based on worker classification.

“APS Payroll saves us time and money. Their highly skilled employees are available from setup to whenever you need them. We no longer have to worry about the IRS and Year-End documents because they complete them. Our payroll is now correct–every payday.”

Patti Malott

CEO of The Church Co+Op

What Happens If You Don’t Collect a W-9?

Failing to collect a W-9 can have serious financial consequences for your business. If the IRS audits your 1099s and finds missing or incorrect taxpayer information, you may face:

- Backup withholding requirements (24% of each payment)

- Filing penalties for inaccurate or late 1099 forms

- Fines for failure to provide payee information

Even worse, incomplete documentation can raise red flags around worker misclassification or tax evasion. The best protection is a well-documented onboarding process that includes timely W-9 collection.

What to Look for in W-9 Software or Tools

Many modern HR and payroll platforms now include features that make W-9 management easier. If you’re evaluating tools, look for:

- Secure electronic form collection with e-signature support

- Automated reminders to follow up on incomplete or missing W-9s

- Integration with 1099 reporting to eliminate data entry errors

- Cloud-based storage with role-based access for security

- TIN Matching integration to verify data before submitting 1099s

APS, for example, helps businesses simplify W-9 workflows by embedding the form directly into the contractor onboarding process, along with automated storage and 1099 prep, saving hours of manual follow-up.

W-9 Compliance = Peace of Mind

In 2025, businesses will be scrutinized regarding contractor management and tax reporting. Handling W-9s correctly is a simple but powerful way to protect your business and keep your tax filings on track.

By creating a repeatable, tech-enabled process for requesting, verifying, and storing W-9s, you’ll be able to:

- Eliminate last-minute scrambling

- Reduce IRS risk

- Ensure smooth 1099 prep

- Build a professional onboarding experience for contractors

Final Thoughts: Stay Proactive With W-9 Compliance

Form W-9 may seem like a minor task, but in 2025’s tax environment, it’s more important than ever to get it right. Whether hiring a new freelancer or paying annual vendor fees, collecting accurate W-9s helps you stay compliant, avoid IRS penalties, and ensure smooth year-end reporting.

Looking for a more straightforward way to manage contractor payments and tax forms?

Book a demo with APS to see how we streamline payroll, 1099 reporting, and W-9 compliance in one system.

Sources

- About Form W-9, Request for Taxpayer Identification Number and Certification | IRS

- About Form 1099-NEC, Nonemployee Compensation | IRS

- Form W-4 Jan 2025 | Lumin

- Am I required to file a Form 1099 or other information return? | IRS

- Key 2025 W-9 Form Updates for Small Businesses | Palm

- Forms and associated taxes for independent contractors | IRS

- What Is a W-9 Form? Who Can File and How to Fill It Out | Investopedia

- W-4 vs. W-9: What’s the Difference? (With FAQs) | Indeed

- Topic no. 307, Backup withholding | IRS