Understanding the Differences Between Forms W-2 and 1099

If you manage payroll or hiring, your role in understanding the difference between a W-2 and a 1099 is crucial. These forms help identify two distinct worker types—employees and independent contractors. You could face fines, tax issues, and serious payroll headaches without the correct classification. Your understanding and proper classification are key to staying compliant.

Understanding how these forms impact your processes will help you avoid costly errors and improve efficiency. Let’s explore who gets which form, the key differences, and how to make the right call at year-end. By doing so, you can ensure accuracy and avoid unnecessary costs.

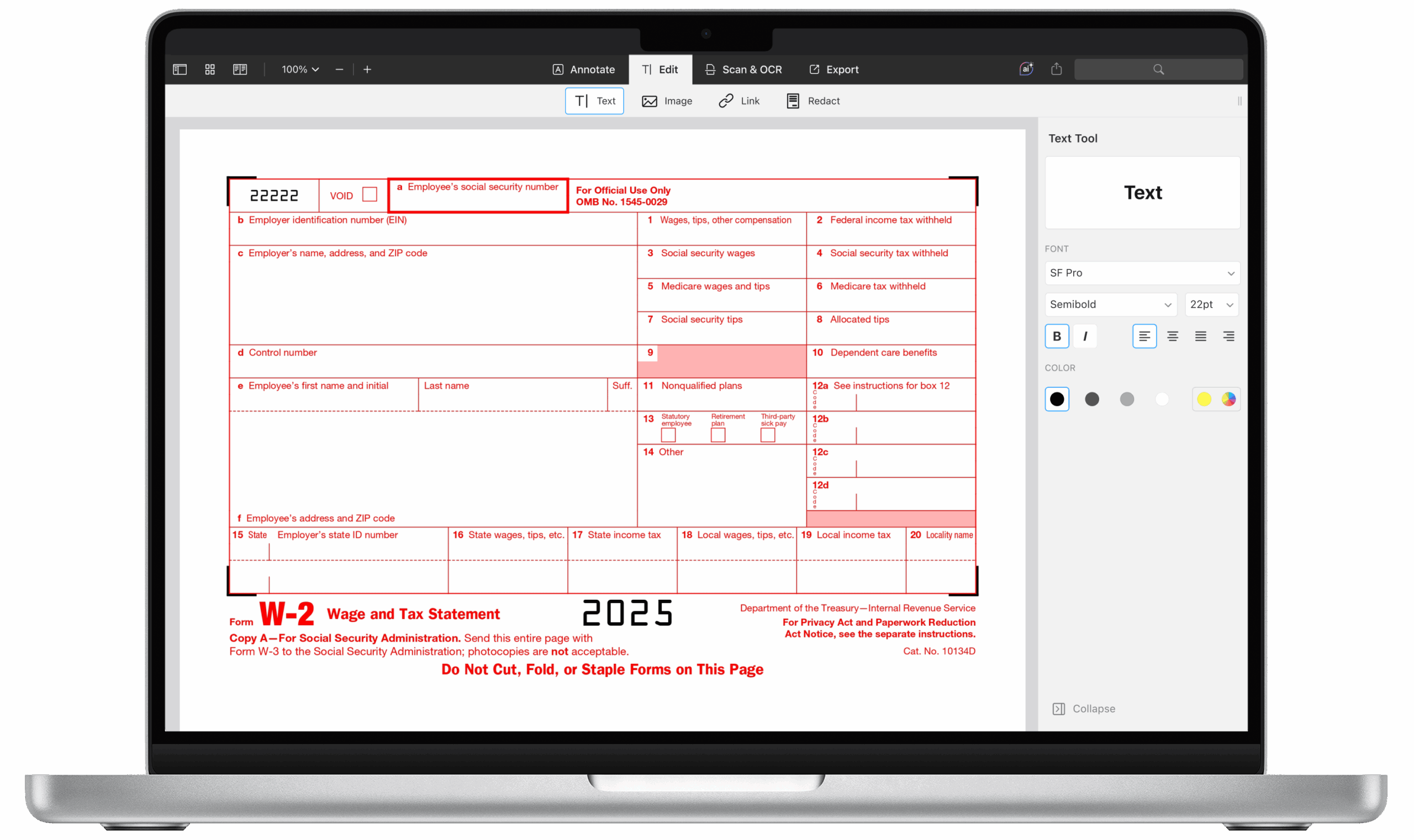

What is a W-2?

Form W-2 is the go-to tax form for employees. It shows total wages earned, taxes withheld, and deductions for things like health insurance or retirement contributions—all the key information employees need to file their tax returns. As an employer, you must submit W-2s to the IRS and provide copies to your employees by January 31st. If employees misplace their W-2, encourage them to visit the IRS website for a copy.

W-2s reflect a structured working relationship. You’re responsible for withholding income taxes and covering your share of Social Security, Medicare, and unemployment taxes. From the first paycheck to year-end reporting, everything flows into the W-2 to ensure accuracy and compliance.

Reporting W-2 Income for Employees

You must report each employee’s wages, tax withholdings, and employer-paid contributions as part of your year-end responsibilities. This requirement includes federal income tax, Social Security, Medicare, and unemployment (FUTA) taxes. Year-end reporting involves compiling and submitting this information to the appropriate tax authorities.

Social Security tax is split evenly between you and the employee at 6.2% each. The same goes for Medicare, with both sides contributing 1.45%. These amounts and any additional deductions are reflected on the employee’s W-2 and used to file their annual tax return.

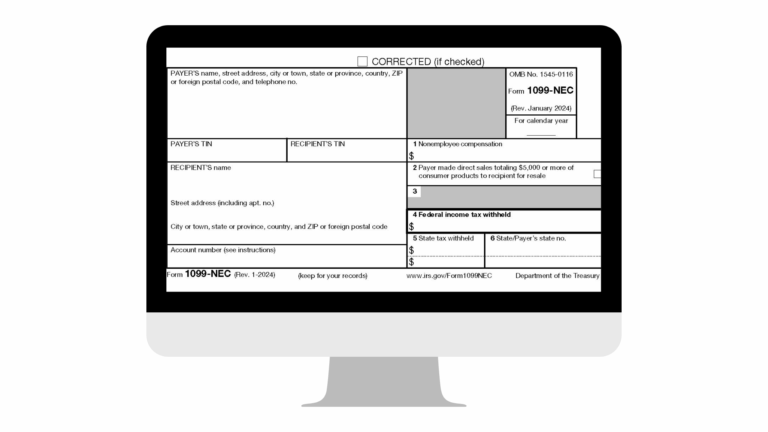

What is a 1099?

Form 1099 is used for non-employees—typically independent contractors, freelancers, or consultants—who earn $600 or more in a calendar year. The most common versions are 1099-NEC and 1099-MISC. Unlike W-2 workers, these individuals handle their taxes, so no withholdings are required from your side.

Issuing a 1099 signals a more flexible working relationship. Contractors usually set their schedules, use tools, and work with multiple clients. You must send them their 1099 and report it to the IRS by January 31. Getting this right helps you avoid costly missteps at tax time.

Reporting 1099 Income for Contractors

For independent contractors, you don’t withhold taxes but are responsible for reporting payments of $600 or more using Form 1099-NEC. Submit the form to the IRS and provide a copy to each contractor by January 31.

What is Form 1099-NEC, and Who Receives It?

Form 1099-NEC reports non-employee compensation of $600 or more, typically paid to independent contractors or freelancers. If a worker isn’t classified as an employee and earns $600 or more in a calendar year, you must issue a 1099-NEC and file it with the IRS, and in some cases, with state or local agencies.

These payments must also be reported using Form 1096 when submitting paper filings. To simplify year-end processing, verify contractor names, addresses, and Social Security numbers beforehand. Distributing 1099s can be quick and efficient if you use a payroll provider.

What is Form 1099-MISC?

Form 1099-MISC reports miscellaneous $600 or more outside standard contractor compensation. Types of compensation to report include rent, prizes, legal fees, and other non-employee payments. Like the 1099-NEC, the 1099-MISC must be filed with the IRS, and Form 1096, if filed by paper, along with copies provided to recipients by January 31st.

W-2 and 1099 Deadlines

| Deadline to Send Forms to Employees & Contractors | Deadline to File W-2 With Social Security Administration | Deadline to File 1099 MISC with the Social Security Administration |

|---|---|---|

| January 31st | January 31st: Employers should file forms along with a W-3 transmittal | January 31st: Employers should file forms along with a 1096 transmittal |

Difference in W-2 and 1099 Employees

Employment Status

- W-2: Issued to employees by their employers, who withhold taxes from employees’ salaries and forward those withholdings to the appropriate tax authorities.

- 1099: Issued to independent contractors or freelancers responsible for paying their taxes.

Tax Withholding

- W-2: Employers withhold federal, state, and local taxes from employees’ paychecks.

- 1099: Independent contractors must withhold taxes themselves and pay estimated taxes quarterly.

Benefits and Protections

- W-2: Workers frequently qualify for health insurance, pension schemes, and unemployment benefits.

- 1099: Independent contractors typically do not receive benefits from the payer.

Types of 1099 Workers

You can provide 1099s to several types of workers, and knowing these distinctions will streamline your recruiting process. Here’s a list of the most common types:

Freelancers

These individuals often work with organizations on a per-project basis. Some freelancers work with multiple businesses simultaneously, maximizing their earning potential. In addition, they usually choose when they can and can’t work and set their rates.

Consultants

Like freelancers, these individuals are self-employed. However, the difference lies in their skill set. Often, these individuals have unique or highly crafted experiences, education, and training that make their knowledge invaluable. These workers usually demand high compensation for their time and efforts.

Independent Contractors

If an evaluation system is in place that measures performance, then these factors would indicate an employee. However, if the evaluation system only measures the result, this could mean either an employee or an independent contractor.

Gig Workers

These individuals are similar to freelancers; however, their offerings and payouts differ. Because these workers usually opt to perform small jobs, they are often paid per task completed.

How to Determine if a Worker is an Employee or Independent Contractor

Worker classification impacts how you pay employer taxes and how your employees pay theirs. Here are the three categories the IRS looks at when making employment classifications:

1. Behavioral Control

Behavioral control demonstrates whether you have the right to direct or control how workers complete their tasks. If a business has the right to direct or control task completion, the worker gets classified as an employee. The employer does not have to handle how the work gets done as long as they own it. Behavioral control falls into the following categories:

Type of Instructions Given

Workers will likely be employees if they receive detailed instructions on when, where, and how to do their job. Instructions can include what tools to use, who to work with, and the order of tasks.

On the other hand, independent contractors typically receive less direction and have more control over how the work gets done. Even without direct instructions, an employer may still have behavioral control if they retain the right to dictate how results are achieved.

Degree of Instruction

Workers may be independent contractors if they’re told what to do but not how. While the level of instruction can vary by role, behavioral control may still exist if the employer retains the right to direct how results are achieved.

Evaluation System

If an evaluation system is in place that measures performance, then these factors would indicate an employee. However, if the evaluation system only measures the result, this could mean either an employee or an independent contractor.

Training

If an organization dictates how someone should perform the work or provides ongoing training, the worker is likely an employee. Independent contractors typically use their own methods.

2. Financial Control

Financial control refers to the facts determining whether or not an employer has the right to control economic aspects of the worker’s job. These categories include:

Significant Investment

Independent contractors often invest in their tools, but some employees do too. There’s no set dollar amount for what qualifies as a “significant investment,” and some roles require minimal expenses.

Unreimbursed Expenses

Unreimbursed expenses are more common for contractors, but some employees may have them too. Consider whether the worker regularly incurs fixed costs, even when not actively working.

Control Over Earnings and Client Base

Workers who invest in their tools, incur unreimbursed expenses, and risk financial loss are more likely to be independent contractors. They often promote their services, work with multiple clients, and operate openly in the marketplace.

Method of Payment

Employees are typically paid a consistent wage on a set schedule, while contractors are often paid a flat fee per project; however, hourly pay is also standard in some contract roles.

3. Type of Relationship

Type of relationship refers to facts about how the worker and employer perceive their relationship. These factors include the following categories:

Written Contracts

A written contract alone doesn’t define worker status; the working relationship matters.

Benefits and Duration of the Relationship

Offering benefits like health insurance, paid time off, or retirement plans typically indicates an employee relationship. Similarly, if the working relationship is expected to continue long-term, it’s more likely that the worker is an employee.

Independent contractors usually work on specific projects for a set period and do not receive traditional employee benefits, though the absence of benefits alone doesn’t guarantee contractor status.

Services Provided as Key Activity of the Business

If a worker performs essential services for the business, the employer is more likely to have control over their work, indicating an employee relationship. This approach aligns with how the IRS evaluates worker classification.

Common Questions About W-2 and 1099 Forms

Can you receive both a W-2 and a 1099 in the same year?

Yes, it is possible to obtain both forms if you have been employed as a regular employee and also performed work as an independent contractor.

What happens if I don’t receive my W-2 or 1099?

Contact your employer if you are still waiting to receive your W-2 by mid-February. For a missing 1099, contact the payer. If you still do not receive the forms, you can use IRS Form 4852 (substitute for Form W-2) or IRS Form 1099-R (substitute for Form 1099).

How do I report income from a 1099 on my tax return?

Income from a 1099-NEC is reported on Schedule C (Profit or Loss from Business) and may require filing Schedule SE (Self-Employment Tax).

How APS Simplifies Tax Form Management

Managing and distributing tax forms can be complex and time-consuming, but APS is here to help. Our unified payroll and HR solution streamlines the process, ensuring accuracy and compliance. Here’s how APS can assist:

- Automated Tax Form Generation: Easily generate and distribute W-2 and 1099 documents to your workers and independent contractors.

- Compliance and Accuracy: Ensure all tax forms are accurate and compliant with federal and state regulations.

- Employee Self-Service: Allow employees and contractors to access their tax forms online anytime.

Practical Scenarios and Examples

Full-Time Employee with a Side Gig

Jane works full-time at a marketing agency and receives a W-2 form at the end of the year. She does freelance graphic design work on weekends, for which she receives a 1099-NEC. Jane must report both forms on her tax return, detailing her wages and non-employee compensation.

Freelancer with Multiple Clients

John is a freelance writer who works for several clients yearly. Each client provides him with a 1099-NEC form reporting the income paid to him. John must keep track of his income and expenses, filing a Schedule C to report his business earnings and a Schedule SE to pay self-employment taxes.

Employer with Mixed Workforce

XYZ Corp employs a mix of full-time employees and independent contractors. The company issues W-2 forms to its employees and 1099-NEC forms to its contractors. To streamline this process, XYZ Corp uses APS to automate the generation and distribution of these tax forms, ensuring timely and accurate filing.

Demystifying Tax Forms: W-2s and 1099s

Knowing the difference between W-2 and 1099 forms is key to accurate tax reporting and compliance. Understanding which form to use helps ensure proper classification and fewer year-end headaches. APS makes managing payroll and tax forms easier—explore our Payroll Solution to see how we can help.

Sources

- About Form W-2, Wage and Tax Statement

- What Is an IRS 1099 Form? What It Means, How 1099s Work

- Form 1096, Annual Summary and Transmittal of U.S. Information Returns

- Form 1099-NEC, Nonemployee Compensation

- Instructions for Forms 1099-MISC and 1099-NEC

- About Form 1099-MISC, Miscellaneous Income

- Independent Contractor (Self-Employed) or Employee?

- Employee (Common-Law Employee)

- Behavioral Control

- Financial Control

- Type of Relationship

- Publication 15-A, Employer’s Supplemental Tax Guide

- How to Fill W-2 Form | PDF Expert

- 1099 Misc. Form | Investopedia