The One Big Beautiful Bill Act (OBBBA) is more than just another piece of legislation making waves in the news cycle—it has real payroll implications.

Signed into law on July 4, 2025, the OBBBA makes significant changes to federal income taxes, how certain forms of compensation are treated (especially taxes on tips and overtime premiums), and how businesses report this information.

For employers, these changes come with new responsibilities, such as maintaining accurate tracking, updating systems, and keeping up with compliance amid evolving legislation.

In this article, we’ll break down the OBBBA in simple terms so you know exactly what’s changing and why it matters for your payroll. Then, we’ll share a clear action plan and show you how APS can make managing these requirements easier.

2) What Is the OBBBA?

The OBBBA is sweeping legislation that updates wage taxation and reporting rules. It aims to modernize the tax code while supporting economic initiatives.

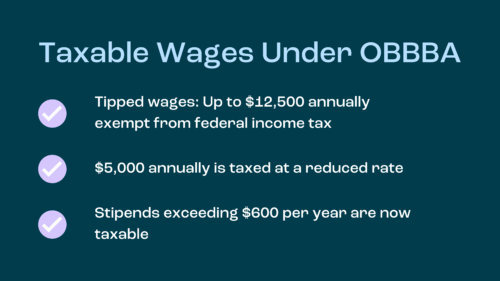

Taxable Wages Under OBBBA:

- Tipped wages: Up to $12,500 annually exempt from federal income tax; amounts above are taxable (taxes on tips still apply beyond the threshold).

- Overtime premiums: First, $5,000 annually is taxed at a reduced rate; remaining overtime premiums are taxed at the employee’s regular rate.

- Employer-provided stipends: Stipends exceeding $600 per year are now treated as taxable income.

Beyond payroll, OBBBA also updates Dependent Care FSAs, HSAs, student loan assistance, childcare credits, telehealth provisions, new eligibility verification rules, and multi-state compliance complexities for Medicaid and health coverage.

The Current Impact

For example, employees may see reduced federal income taxes on qualifying tip income, while employers must handle more detailed year-end reporting. While the law is finalized, the IRS and U.S. Treasury have not yet issued complete guidance—meaning some rules, forms, and deadlines may change.

Key Changes to Your Payroll

1) New Tax Treatment for Tips & Overtime Premiums

The OBBBA changes how specific tips and overtime earnings are handled for federal income taxes.

These updates may also lower employees’ modified adjusted gross income, which could influence eligibility for premium tax credits, the income housing tax credit, or other income-based benefits.

However, all tips and overtime income remain subject to FICA and applicable state and local tax requirements. For employers, especially those in hospitality and food service, this means more precise daily tracking and clearer payroll coding to differentiate these amounts from base wages.

2) Retroactive Payroll Adjustments

Because these changes apply retroactively to January 1, 2025, employers may need to run off-cycle payrolls to adjust over-withheld taxes. This adjustment is significant for businesses that want to ensure employees benefit from lower tax rates as soon as possible.

Failing to make these corrections promptly could result in inaccurate W-2s, amended returns, and possible IRS penalties. Having automated payroll processes—or a provider like APS—becomes essential.

3) W-2 and Reporting Changes

The OBBBA is expected to promptly update Form W-2, possibly adding new boxes or lines to distinguish OBBBA-affected income. These changes echo similar shifts made after the Tax Cuts and Jobs Act and could affect reporting for other tax incentives like research and development credits or energy production deductions.

Year-end will likely be more complex, requiring careful mapping of payroll codes to new reporting categories.

4) Compliance Deadlines & Guidance Gaps

While the law is in place, the IRS has yet to release final forms or instructions. Unanswered questions include:

- How certain stipends interact with existing standard deduction rules.

- Whether adjustments to retirement plan contributions or employer-provided benefits will be affected.

- How to categorize unusual earnings for small businesses that don’t fit standard payroll codes.

What’s changing beyond payroll: The OBBBA impacts benefits, leave policies, workforce verification, and multi-state compliance, which means employers will need more than just payroll adjustments—they’ll need cross-departmental coordination.

Employer Action Plan

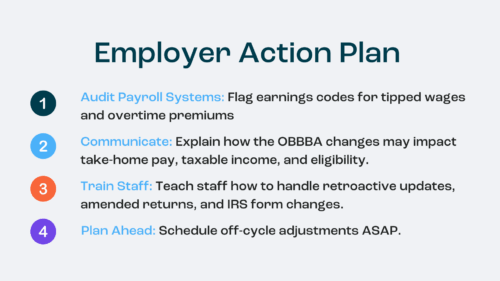

1) Audit Payroll Systems

- Flag earnings codes for tipped wages and overtime premiums to ensure separate tracking.

- Confirm integration between payroll and time/attendance systems for precise overtime capture.

- Test year-end reporting to identify if your organization needs to add new W-2 categories.

2) Communicate with Employees

- Explain how the OBBBA changes may impact take-home pay, taxable income, and eligibility for credits like the premium or income housing tax credit.

- Be transparent about retroactive adjustments and why year-to-date totals may shift.

3) Train Payroll Staff

- Educate your team on the new law, referencing parallels to the Tax Cuts and Jobs Act, Inflation Reduction Act, and other significant federal changes.

- Make sure they know how to handle retroactive updates, amended returns, and any IRS form changes.

4) Plan for Retroactive Updates Early

- Don’t wait until December—schedule off-cycle adjustments as soon as IRS guidance is available.

- Coordinate with your payroll provider to automate all tax deductions and reporting changes.

These steps will keep your business compliant and reduce the risk of costly errors later.

The APS Advantage

At APS, we understand that legislative changes like the OBBBA create uncertainty for employers. That’s why we’ve built processes to reduce administrative burden.

Our platform and tax team update tax tables and settings automatically, quickly applying changes from new IRS guidance so you stay compliant without the extra work. We’re here to support you every step of the way.

We provide:

- Automated payroll tools to manage wages and overtime

- Accurate W-2 and 1099 forms generated in-platform

- Compliance updates to help you meet changing requirements

- Guidance from our payroll and tax experts for adjustments and rate changes

Whether you’re a large corporation or one of the many small businesses adapting to these changes, APS helps you handle everything from taxes on tips to complex year-end reporting.

Ready to see how the right solution makes OBBBA payroll changes simple? Let’s talk today!

Disclaimer

Guidance on the OBBBA is still evolving. This article is for informational purposes and is not legal or tax advice. Always consult a qualified tax or legal professional for guidance specific to your organization.

Sources

- One Big Beautiful Bill Act: Tax deductions for working Americans and seniors | IRS

- What Employers Should Know About the One Big Beautiful Bill Act (OBBBA) | Sheppard Mullin

- What Employers Need to Know About No Tax on Tips and No Tax on Overtime | Akerman

- Analysis of the 2025 Federal Tax Changes Under the “One Big Beautiful Bill” Legislation | Baker Hostetler

- Essential Changes for Employers in the One Big Beautiful Bill Act of 2025 | Jackson Walker

- One Big Beautiful Bill Act (OBBBA) Summary: 4 Key Strategies for Turning Disruption into Opportunity | Premier