Managing payroll can be a time-consuming and complex task for any business. However, flexible, intuitive payroll software makes the process more efficient and reliable. APS’ recent payroll solution enhancements increase customer autonomy and satisfaction with their payroll process.

These software enhancements aim to maximize payroll processing efficiency for our clients. We’re continuing to expand the functionality of our platform to streamline and optimize payroll processing for businesses even further.

Ask How We Can Make Payroll & HR Easier for You

Why the Recent Payroll Updates are Important

APS started as a payroll services company, and our goal has always been to provide the best payroll software in the industry. The updates to our payroll solution are part of our ongoing commitment to streamlining and optimizing how our customers pay their employees. These updates allow our clients to tailor the payroll process to meet their needs.

Adding and Editing Incomes

Users can effortlessly include new types of income, such as bonuses or commissions, and modify existing incomes, like salaries. They can also set up different income types for each employee, streamlining the payroll process.

This improvement gives users greater flexibility in managing payroll, enabling them to make adjustments as necessary without having to begin the process.

Adding an Income in APS OnLine

Adding and Editing Deductions

Our payroll solution has been enhanced with a valuable feature enabling users to add and edit deductions easily. Users can set up various pre-tax and after-tax deduction types, including taxes, benefits, and retirement contributions, and assign them to specific employees as needed.

This feature also allows users to edit deductions, ensuring employees receive accurate paychecks. The update enables better tracking and reporting of deductions, resulting in more efficient management of payroll expenses.

Adding an Deduction in APS OnLine

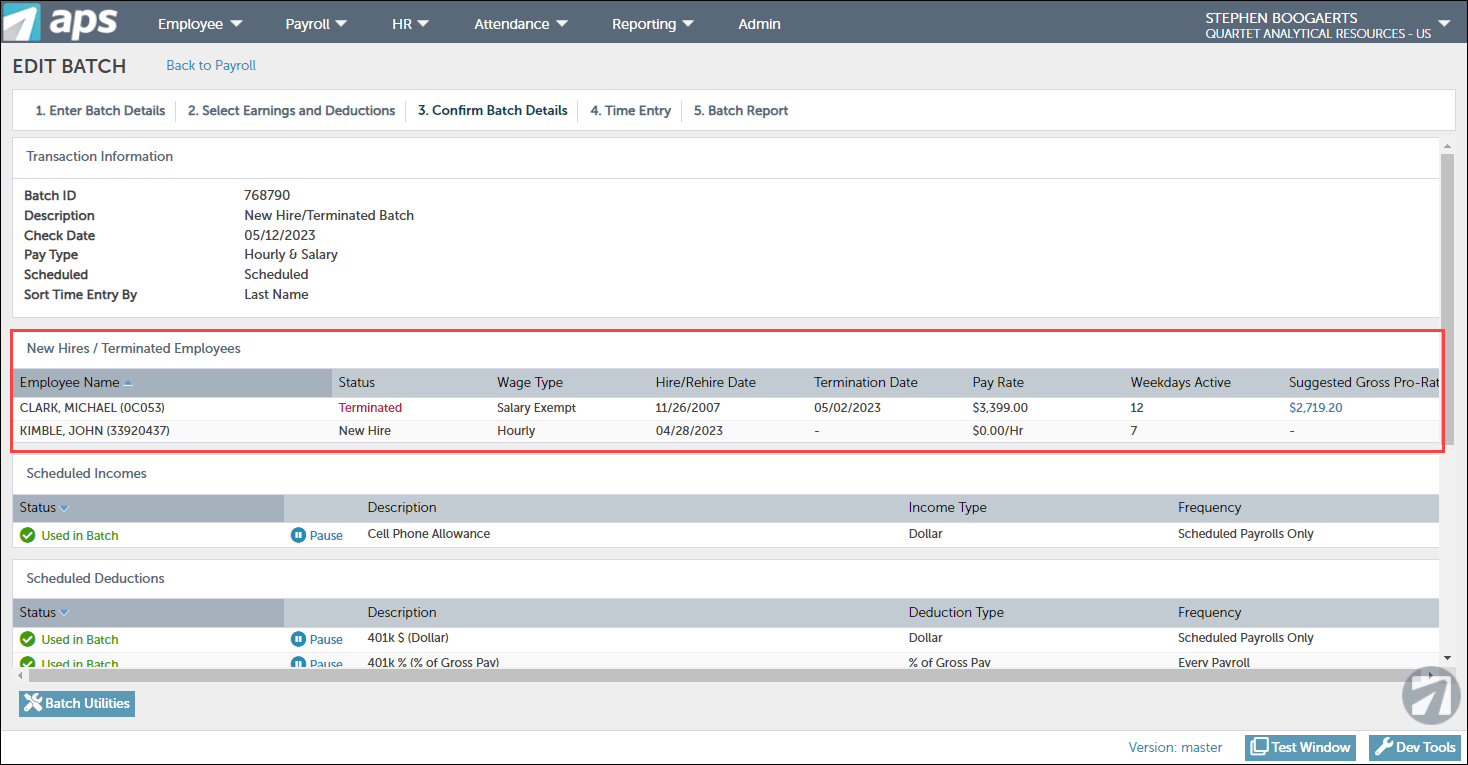

New Hires and Terminated Employees in Payroll

We have introduced a more efficient, logical workflow for managing new hires and terminated employees’ compensation. With this new feature, users can now future-date a new hire’s start date and terminated employees can be included in a future payroll date for payout.

This new functionality is a time-saver as HR managers can now onboard employees before their official start date without the extra step of excluding them from payroll until that date. Similarly, when terminating employees, you can remove their access to self-service functionality while ensuring they receive their final pay, saving you valuable time.

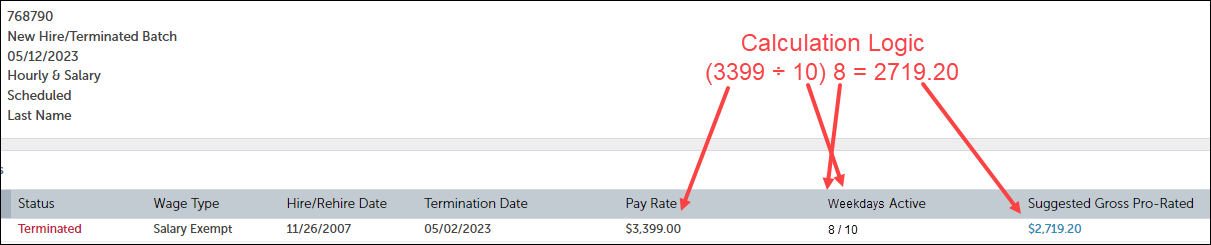

Suggested Gross Pro-Rated Calculation in APS OnLine

Our system provides payroll admins with a list of new hires and terminated employees in the payroll batch, making it easy to make necessary adjustments for a particular pay period. APS OnLine also includes suggested gross pro-rated dollar amounts for salaried employees, simplifying payroll calculations and ensuring accurate final compensation.

New Hires/Terminated Employees List in APS OnLine

Continuing to Make Payroll Easier

APS has also made several other updates to our payroll solution, including:

-

Overriding Scheduled Incomes and Deductions -

Annual Goal Balances -

Pausing Scheduled Incomes and Deductions -

Deleting a Batch -

Recalling a Batch

These enhancements are part of our continued efforts to make payroll easier for our customers.

How Organizations Benefit from Our Recent Payroll Enhancements

With these recent payroll software enhancements, businesses can enjoy a more streamlined and efficient payroll management process. The ability to add and edit incomes, add and edit deductions, and manage new hires and terminated employees in payroll ensures efficiency, accuracy, and compliance, providing you with a sense of security and confidence in your payroll processes.

If you’re interested in learning more about these payroll software updates, please visit the APS Help Center, reach out to your customer support team, or contact us.