As an HR Manager or Payroll Administrator in the healthcare industry, you’re responsible for making sure employees receive the correct type of pay based on the hours worked. Managing various pay rates can be challenging, especially if you manually calculate them. This process can lead to paycheck errors and, even worse, upset employees.

That’s why we’ll discuss your employees’ various pay rates and the importance of having a solution to help manage them accurately.

What Makes Healthcare Payroll Different

Healthcare payroll isn’t like a typical 9-5. You’re juggling shift differentials, cross-functional staff, multiple roles, and strict compliance—all while managing schedules across departments and around the clock.

It’s a lot to track, from on-call and call-back pay to monitoring the proper credentials for every role. When someone calls out, you’re tasked with filling that spot, which adds even more complexity. It can feel like a full-time job without the right payroll system to keep up.

Learn How a Payroll Solution Can Help!

Hospital Shift Differential Pay

What is shift differential pay? It’s essentially the extra compensation an employee receives for hours worked outside of 8:00 a.m. to 5:00 p.m., Monday through Sunday. Some healthcare facilities operate 24/7, 365 days a year, and need to adequately staff their locations beyond regular day shift hours.

Calculating Shift Differential Pay

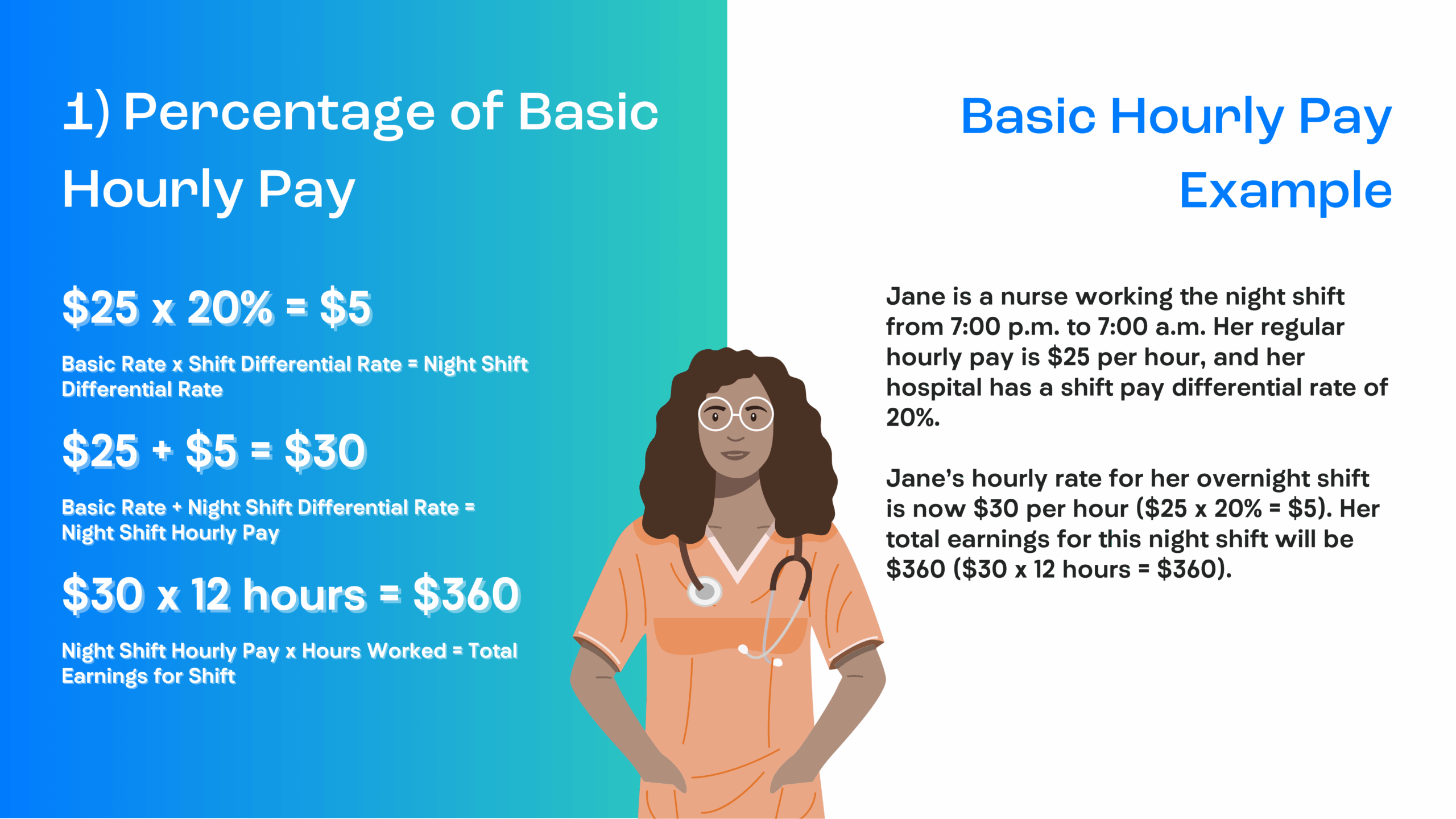

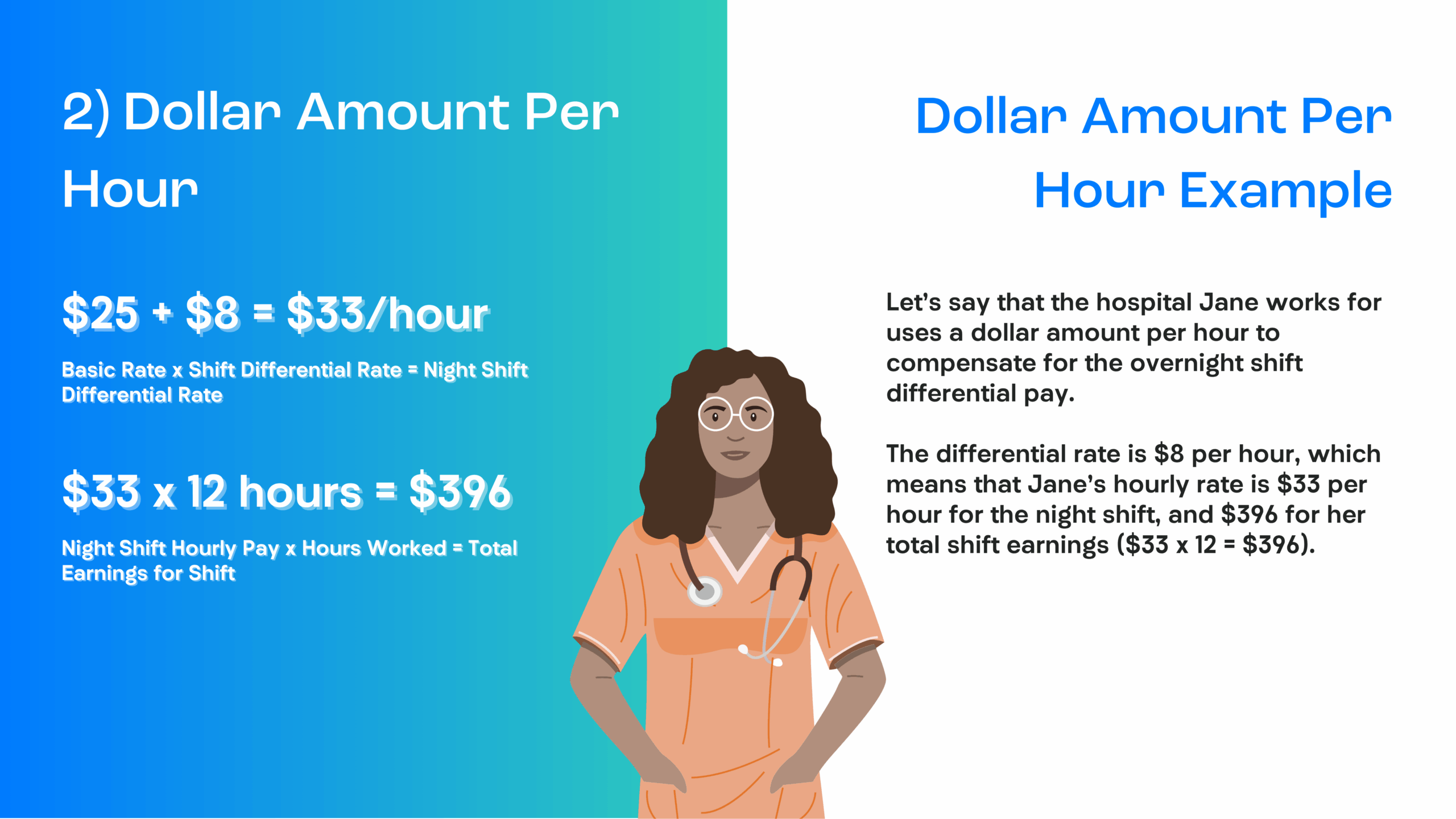

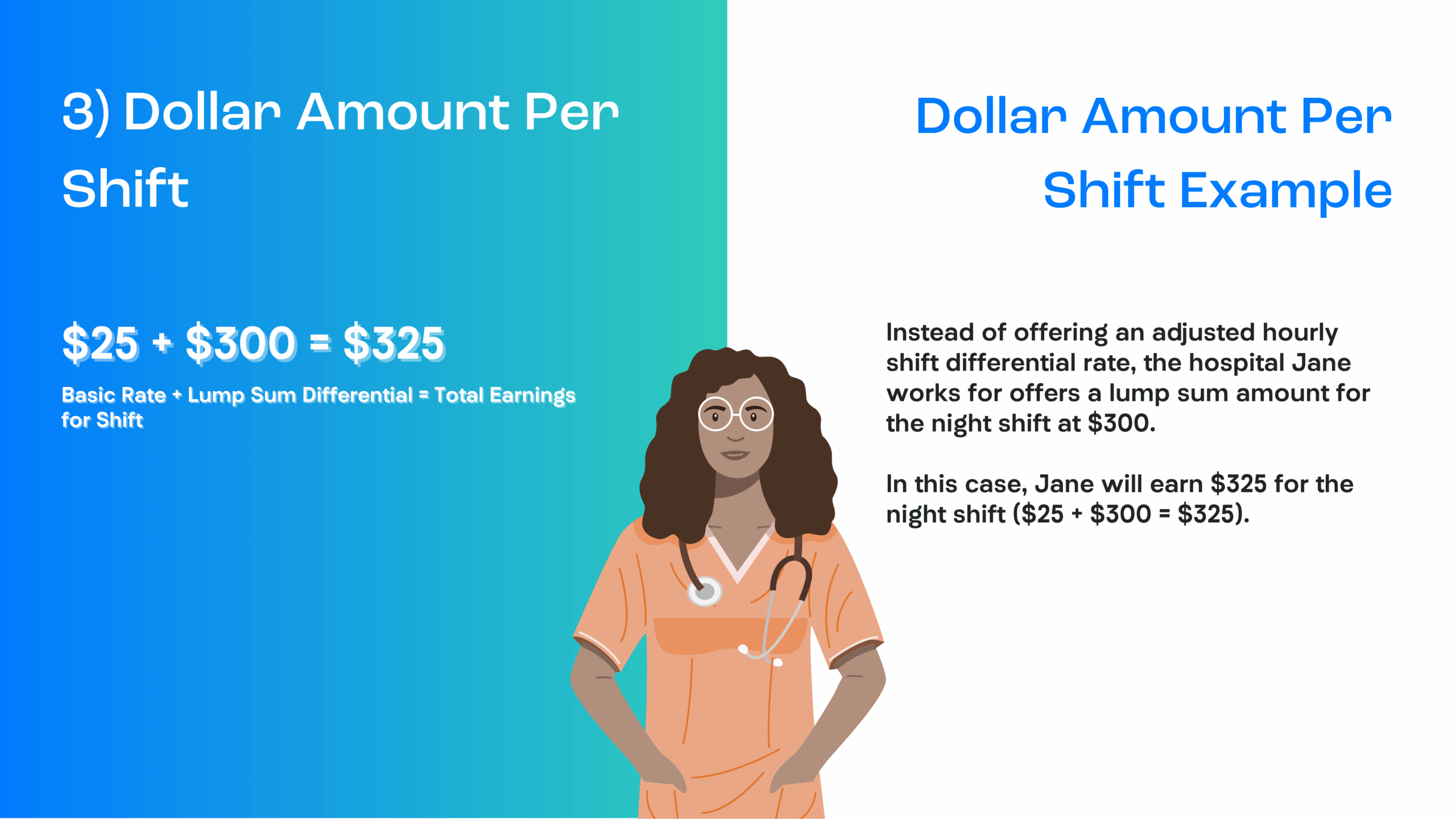

Calculating shift differentials can be tricky. You might offer multiple rates—like 1.5x base pay for holiday shifts—or pay higher differentials for third shift vs. second. Some organizations skip differentials altogether and offer extra PTO, bonuses, or built-in premiums. Stay current on your pay policy, and make sure your team knows what to expect on their paychecks. Here’s how to calculate each rate:

Call-back Pay and On-call Pay

It’s essential to understand how on-call and call-back pay differ. Call-back pay occurs when an employer calls back an employee after their shift, usually at their regular or overtime rate. On-call pay only covers time worked, not time waiting at home. These shifts are standard, so double-check hours worked and keep your policy clear to avoid payroll errors.

Calculating Call-Back Pay: A Quick Example

Nurse Jane worked 36 hours this week and was on call from 8 a.m. to 5 p.m. She wasn’t called in until 1 p.m. and worked until 5 p.m., totaling four additional hours. Since her weekly total is now 40 hours, no overtime applies. At $25/hour, Jane earns $100 for the four hours worked. Even though she was on call for 8 hours, Jane is only paid for her time at the hospital.

In-Charge Pay: Why It Matters

In-charge roles like Charge Nurse or Pharmacist-In-Charge come with extra responsibility and should be compensated accordingly. These positions often qualify for a higher pay grade or a shift differential rate. If you’re offering shift differential pay, make sure it’s reflected accurately on their pay stubs to eliminate confusion.

In-charge pay isn’t one-size-fits-all. It depends on factors like experience, education, location, employer type, and even assigned work hours, with experience often carrying the most weight.

Calculating In-Charge Pay: Key Factors

In-charge pay isn’t one-size-fits-all. It depends on factors like experience, education, location, employer type, and even assigned work hours, with experience often carrying the most weight. Some nurses can earn over $9 more per hour with 20+ years of experience. In health systems, where staffing and scheduling are complex, it’s essential to factor these variables in when offering shift differentials or setting a shift differential rate. Non-pay perks like PTO, tuition support, and on-site childcare can also help compensate those in charge.

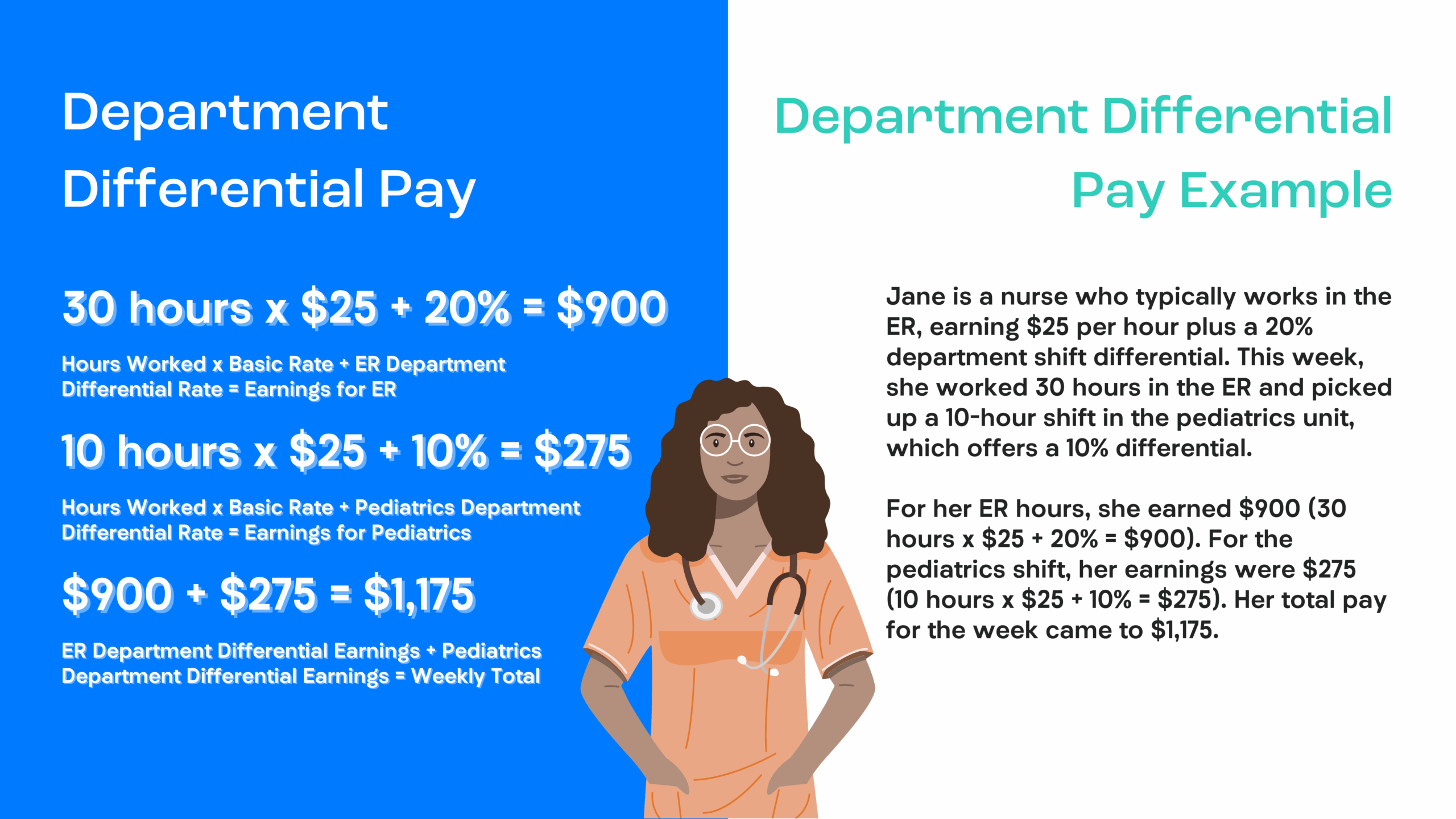

Department Differential Pay: What You Need to Know

When your team works across departments, shift differentials can vary, and they must know what to expect. Say Jane typically works in the ER with a 20% shift differential rate, but she picks up a 10-hour pediatric shift, which offers only a 10% differential. Jane’s base rate is $25/hour. She works 30 hours in the ER and 10 in pediatrics. Here’s her pay breakdown:

- ER: 30 hrs x $25 + 20% = $900

- Pediatrics: 10 hrs x $25 + 10% = $275

- Total Pay: $900 + $275 = $1,175

Department rate differences are key in busy health systems, primarily if someone covers a lower-paying shift. This practice helps you stay in control and maintain transparency and trust across your healthcare organization.

Calculating In-Charge Pay: Key Factors

When your team works across departments, shift differentials can vary, and they must know what to expect. Say Jane typically works in the ER with a 20% shift differential rate, but she picks up a 10-hour pediatric shift, which offers only a 10% differential. Jane’s base rate is $25/hour. She works 30 hours in the ER and 10 in pediatrics. Here’s her pay breakdown:

- ER: 30 hrs x $25 + 20% = $900

- Pediatrics: 10 hrs x $25 + 10% = $275

- Total Pay: $900 + $275 = $1,175

Department rate differences are key in busy health systems, primarily if someone covers a lower-paying shift. This practice helps you stay in control and maintain transparency and trust across your healthcare organization.

Hospital Overtime Pay

If your team works over 40 hours in a week, they’re likely eligible for overtime pay—at least 1.5x their regular rate, per FLSA guidelines. While extra hours aren’t always ideal, overtime can motivate employees when you’re short-staffed. Just be sure to track it closely; consistent overtime may signal it’s time to adjust schedules or bring on additional support.

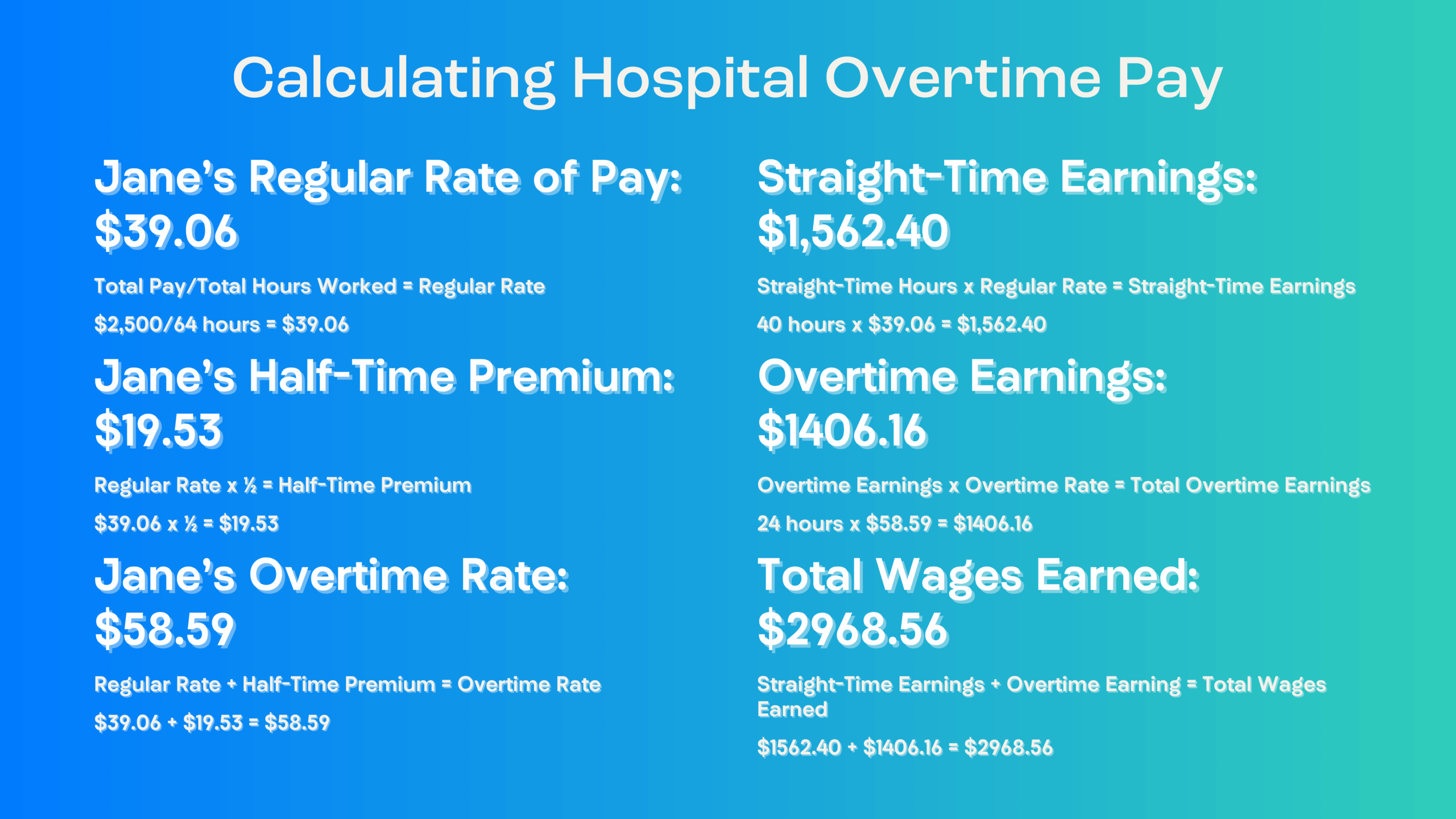

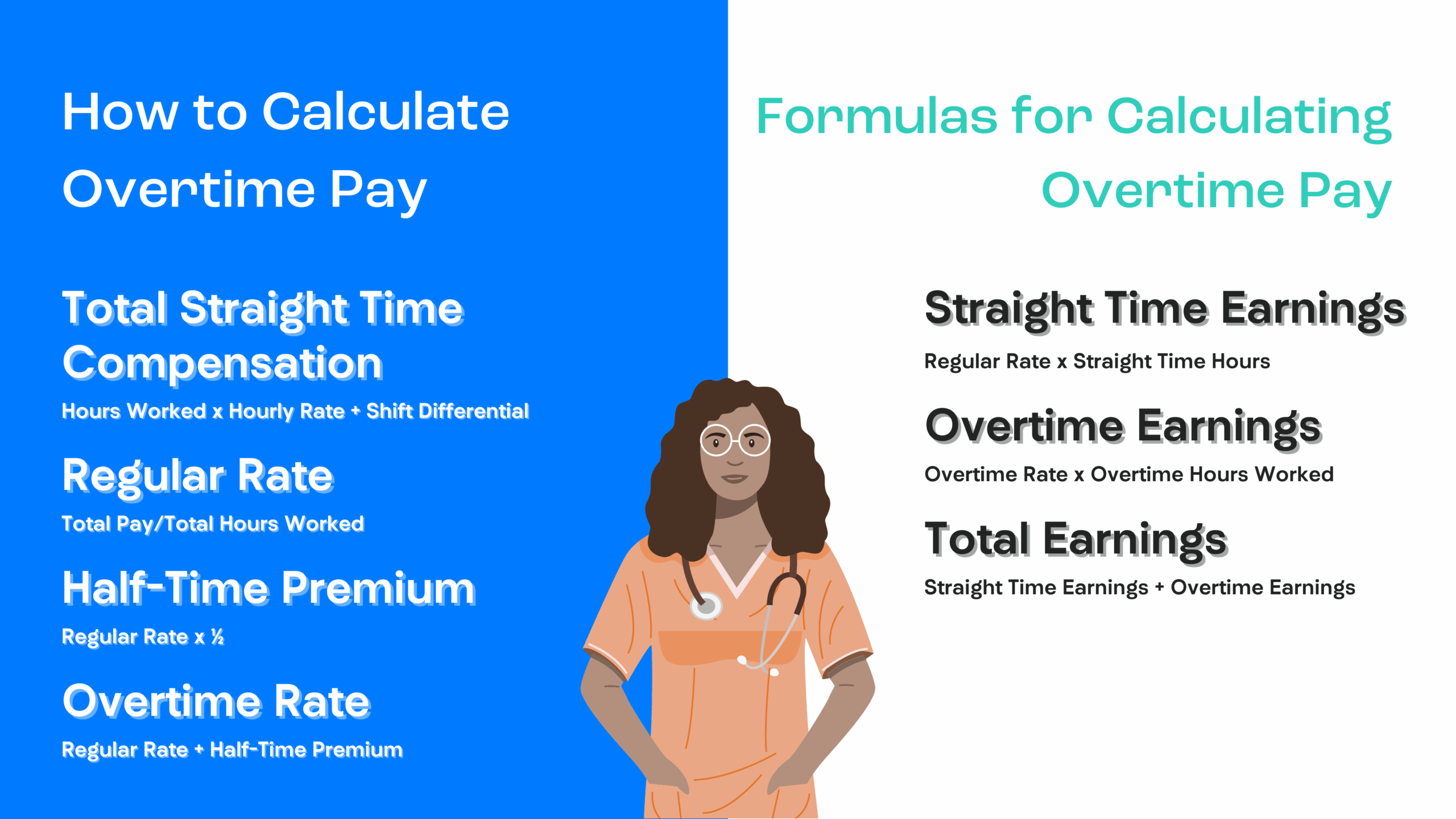

Calculating Hospital Overtime Pay: A Practical Example

Jane worked 64 hours this week, including two extra night shifts with a $300 differential each. Since she’s a non-exempt employee under the FLSA, she must be paid 1.5 times her regular rate for any time worked over 40 hours. While you might assume her overtime pay is $900 [($25 x 1.5) x 24], bringing her total to $2,500 [($25 x 40) + $900 + $600 in shift differentials], the FLSA requires a more precise calculation using her regular rate of pay (RROP). Here’s Jane’s time card for the week:

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | Sunday | |

| Day Shift | 10 | 10 | 10 | 10 | ||||

| Night Shift | 12 | 12 |

To calculate RROP, divide total earnings by total hours worked: $2,500 ÷ 64 = $39.06. Her half-time premium is $19.53 ($39.06 x 0.5), making her overtime rate $58.59 ($39.06 + $19.53). This method calculates overtime accurately for employees who work beyond 40 hours, like Jane. Jane’s final pay for the week includes straight-time plus overtime based on that adjusted rate, ensuring full FLSA compliance.

The Eight and Eighty (8 and 80) Overtime System

If you work in a hospital or residential care facility, you may use the 8 and 80 overtime system instead of the standard 40-hour workweek. Under this FLSA exception, employees earn overtime after 8 hours in a day or 80 hours in 14 days, not just after 40 hours in one week.

Understanding the 8 and 80 overtime system is crucial for HR managers and payroll administrators in hospitals or residential care facilities. This knowledge helps you stay prepared and ensures that you are on the right track toward establishing the right agreements with your employees.

Calculating Eight and Eighty Overtime: An Example

Jane opted into the 8 and 80 overtime system instead of a 40-hour workweek. Over two weeks, she worked 104 hours total—56 hours in Week 1 and 48 in Week 2.

She earned 16 hours of daily overtime in Week 1 (8 hours each on Wednesday and Friday) and 8 hours in Week 2 (Tuesday’s long shift). She also received $300 in night shift differential each week, totaling $600.

Even though she had 24 hours of daily OT and worked over 80 hours in the pay period, the FLSA only requires her employer to pay the greater total, not both. Jane is owed 24 hours of overtime. Here’s her pay breakdown:

- Total hours: 104

- Total straight-time pay: $3,200 (104 x $25 + $600 differential)

- Regular rate: $30.78 ($3,200 ÷ 104)

- Half-time premium: $15.39

- Overtime rate: $46.17

- Straight-time earnings: $2,462.40

- Overtime earnings: $1,108.08

- Total pay for the period: $3,570.48

This method ensures Jane is fully compensated and checks your FLSA compliance.

Week 1:

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | Sunday | |

| Day Shift | 8 | 8 | 8 | 8 | 8 | 8 (OT) | ||

| Night Shift | 8 (OT) |

Week 2:

| Sunday | Monday | Tuesday | Wednesday | Thursday | Friday | Saturday | Sunday | |

| Day Shift | 8 | 8 | 8 | 8 | 8 | |||

| Night Shift | 8 (OT) |

Using Technology to Streamline Healthcare Payroll

Using multiple systems to calculate and manage different forms of payment is time-consuming and prone to errors. A unified payroll and HR solution with a centralized database helps streamline complex healthcare pay workflows. The data syncs across your payroll, HR, and attendance workflows, eliminating potential errors.

Here are a few more ways payroll and HR technology can help you automate even your most challenging workforce processes:

- Advanced clock rules are assigned to employees with shift differentials, overtime pay, and more, saving you valuable time.

- Multiple pay rates are automatically calculated and applied to the correct workers for accurate paychecks and happy employees.

- Advanced scheduling lets you track and manage employee shifts to avoid under- or overstaffing while gaining better control of labor expenses.

From shift differential pay to overtime pay, healthcare employers oversee many pay rates. With intuitive payroll and HR technology, managing those pay rates is no longer a headache. Implement a solution that accurately pays your employees, and you can dedicate your workday to more strategic healthcare-related tasks.

Sources

- Shift Differential Pay: How Does It Work?

- How to Calculate Overtime Rates for Shift Differentials

- Clarify Overtime Pay In The Healthcare Industry By Understanding the 80/20 Rule

- How to use the 8/80 rule for overtime pay in the residential health care industry

- Is an 8 and 80 Overtime Schedule Right for my Facility?