Restaurant Payroll Software

APS helps you manage tip-to-min calculations, employee time tracking, and point-of-sales integrations in a single-system restaurant payroll software.

An All-in-One Restaurant HR Software System

Payroll Tax Compliance

Flexible Scheduling

Tip-to-Min Calculations

Integrations

Recruiting & Onboarding

Mobile Management

Intuitive Reporting

Automate PTO & Attendance

Key Features of Our Restaurants Payroll Software & HR Solutions

- Manage everything from tip-to-minimum calculations to overtime pay for your restaurant with our powerful restaurant payroll system.

- Oversee your employee lifecycle with our restaurant HR services, including performance management, benefits administration, and event tracking.

- Simplify your FOH and BOH management with our seamless merchandising systems and point-of-sale integrations.

- Our restaurant payroll software makes it easy to manage training tracking, certification tracking, and other essential employee events.

- We’re your payroll tax compliance partner, paying your restaurant taxes accurately and on time*.

- Use real-time analytics and dashboards for cross-company snapshots of your restaurant’s performance, including turnover rates and overtime.

- Utilize our built-in Affordable Care Act solution to help you manage compliance and reporting for your restaurant.

- Manage Form 8846 reporting of employee social security and Medicare.

- Track and manage restaurant Workers’ Compensation reporting of employee premium base by code.

- Leverage global reporting for actionable insight across locations, and automate report delivery by email.

- Use our employee scheduling software or integrate our restaurant payroll management solution with your time-tracking software for better automation.

- Manage schedules and track attendance for multiple locations.

- Avoid understaffing and overstaffing for better control over labor expenses.

- Time tracking data syncs with your payroll to ensure accurate processing of tips and paychecks.

- Our restaurant recruiting services help create a better candidate experience with customized job postings, automated job promotion, and mobile-optimized applications.

- Communicate more effectively with candidates using our texting solution to minimize application abandonment.

- Filter applicants with assessments and prescreen questions with our restaurant recruiting software to narrow down candidates to find the skilled staff you need faster.

- Order background checks on potential candidates to ensure you’re hiring the best people for your restaurant.

- Schedule interviews with applicants using our calendar integration with Apple, Google, Outlook, and more to decrease your hiring time.

- Create manager and employee checklists for required forms and tasks to ramp up new hires quickly.

- Employee records for new hires are created automatically in our payroll system for restaurants to save you time.

Our Integrations for Restaurant HR Software

We offer integrations with popular time-tracking software and accounting packages and restaurant POS integrations to get the most out of your investments.

Download Our Guide on Restaurant HR Software

Read more about how APS helps restaurants like yours solve their most complex business issues.

Biggest Pain Points for Restaurant HR

Struggling with Multiple Systems?

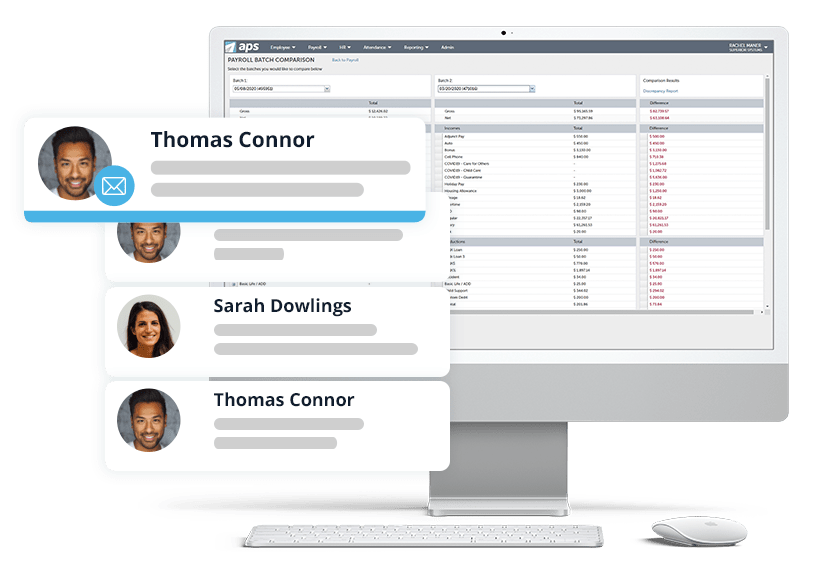

At APS, we understand the complexity of your day-to-day restaurant operations. We offer point-of-sale integrations to eliminate data errors, enabling you to perform your job more efficiently. Our reporting dashboards and analytic tiles pull your restaurant’s critical data into a single view, so you can better identify trends in your business, including:

- Turnover costs

- Overtime expenses

- Hours worked per locaton

- Gross labor expenses on time card hours

You can further streamline your tasks with our all-in-one restaurant payroll software solution. Automate your payroll with your PTO and attendance processes to eliminate duplicate data entry and the potential for errors.

Our restaurant payroll solution will automate tip-to-min and tip credit calculations, so they are accurate every time. We can even alleviate the burden associated with Form 8846 reporting for your restaurant staff. You’ll get more time back in your day to focus on your restaurant, employees, and patrons.

Managing on the Go?

Running a restaurant is no small feat. We understand you’re wearing multiple hats: from managing payroll and training to shift changes and taxes. That’s why we offer unified restaurant HR software through mobile management. Productivity shouldn’t end when you leave your desk.

APS Mobile empowers employees and managers to knock out that to-do list from their preferred device. Employees can clock in and request time off through our convenient mobile app. Managers can approve schedules and BoH time-off requests and see employee information no matter where they work.

Employees and managers can electronically sign documents and time cards. Managers can even receive alerts for employee certification and license renewals to maintain compliance, including ABC and ServSafe. Keep your workforce updated and informed all on their mobile devices.

Spending Days on Payroll and Tax Compliance?

As a restaurant owner or manager, you can spend several hours just calculating tip-to-mins, tip credits, and handling 8846 reporting. With our system’s built-in tip-to-min calculation engine, you can manage your payroll and reporting processes more effortlessly.

Managing employee wage garnishments can be challenging and time-consuming. It’s crucial to calculate garnishment orders correctly and send the appropriate payment amounts to ensure compliance and avoid penalties. We offer garnishment management of calculations, deductions, and payments as an add-on to our restaurant payroll services. This service alleviates the burden of garnishment calculations and payments so you can focus on more strategic growth initiatives.

Our tax-compliance team will help ensure your restaurant’s payroll taxes are paid accurately and on time, with a best-in-class tax error rate of 0.0000003%. Our certified tax experts will also help you with your restaurant’s year-end processing, including W-2s and 1099s. Since we have a thorough understanding of restaurant payroll taxes, you can rest assured we will work with you to help you maintain payroll tax compliance.

Overseeing Multiple Locations?

Restaurants need to track and allocate employee time between locations and departments for optimal productivity. With APS Dimensions, you can closely monitor employee time by location to control labor costs and maximize your restaurant’s profits.

Always know how many hours employees work at all of your locations with our restaurant payroll software. Employees can clock in and out by choosing the location at which they are working. They can even split hours between locations to accurately allocate hours worked every time.

We also offer native integration with Sage Intacct to bring your payroll and financial data together. Automatically sync employee information, dimensions, and general ledger data to create an ecosystem with minimal data entry for your restaurant.

Additional Support for Restaurant HR Software

Everyone in your restaurant should have an enjoyable and personalized payroll and HR experience. Each user can make the most out of their workday with a role-based configuration. When solutions are easy to use, your workforce uses them.

Your dedicated team is available via email, phone, and support requests to answer your questions in a timely manner. You’ll have access to our Help Center’s articles and videos for learning at your own pace.

Our restaurant customers are also assigned a dedicated success coordinator to help achieve optimal usability, system adoption, and return on investment. APS is here to help as a leading restaurant payroll company.

Request Customized Restaurant Payroll Pricing

Suggested Resources for Restaurants

We have informational resources and tools for all your workforce management needs. Check out our handy articles, checklists, eBooks, guides, industry overviews, reports, and white papers with valuable information about Core HR and Payroll.