Payroll software automates the calculation of wages, deductions, and taxes, saving HR managers valuable time each pay period. Last-minute payroll changes can occur during processing, so businesses need software that allows them to make adjustments quickly. APS is excited to announce significant enhancements to our payroll software functionality. These updates give our customers more control over their payroll process for a better user experience.

The goal of APS’ payroll solution enhancements is to streamline and optimize the payroll process for our customers. We’ve received feedback that our customers want the ability to make payroll batch changes themselves. These updates give our clients more flexibility during the payroll process.

Why the Payroll Software Enhancements are Important

APS started as a full-service payroll company, and we believe we should offer the best payroll software in the market. These software updates streamline payroll anomalies to prevent user frustration while making changes on the fly.

Let’s take a look at the latest enhancements to our software and how they make the payroll process easier:

Overriding Scheduled Incomes and Deductions

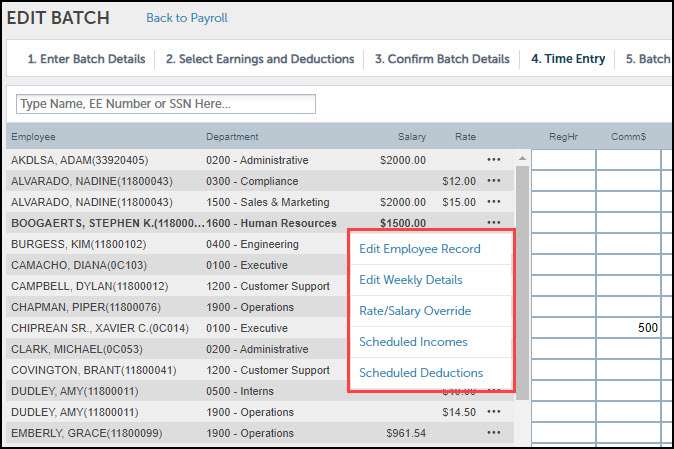

We have provided quick access for users to make one-time changes on the employee level to recurring incomes and deductions in the payroll batch. By clicking the ellipsis for a specific employee, users are provided options in a popup window without having to leave the payroll batch. Payroll admins no longer have to navigate to the employee record to make these changes, providing better ease of use.

Overriding Scheduled Incomes and Deductions

This update increases flexibility within the payroll process, with more user-friendly navigation for one-time changes and a more intuitive batch experience.

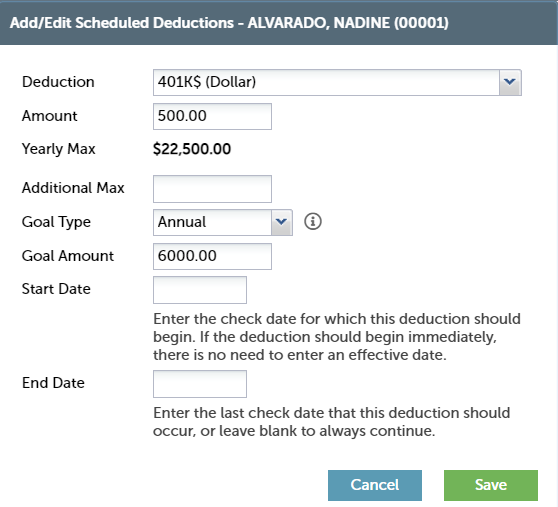

Annual Goal Balances

Annual goal balances allow HR managers to apply a lower annual limit to a retirement deduction with a set regulatory limit. The lower limit will carry over to the following year. HR managers do not need to re-add the deduction to the employee’s record or remember to re-add it.

Example of an Annual Goal Type in APS

Employees can contribute more money to their retirement accounts earlier in the year without reaching the annual limit. Once the annual goal is reached, the deduction will stop until the first check date in the following calendar year. This functionality results in less work for the HR department.

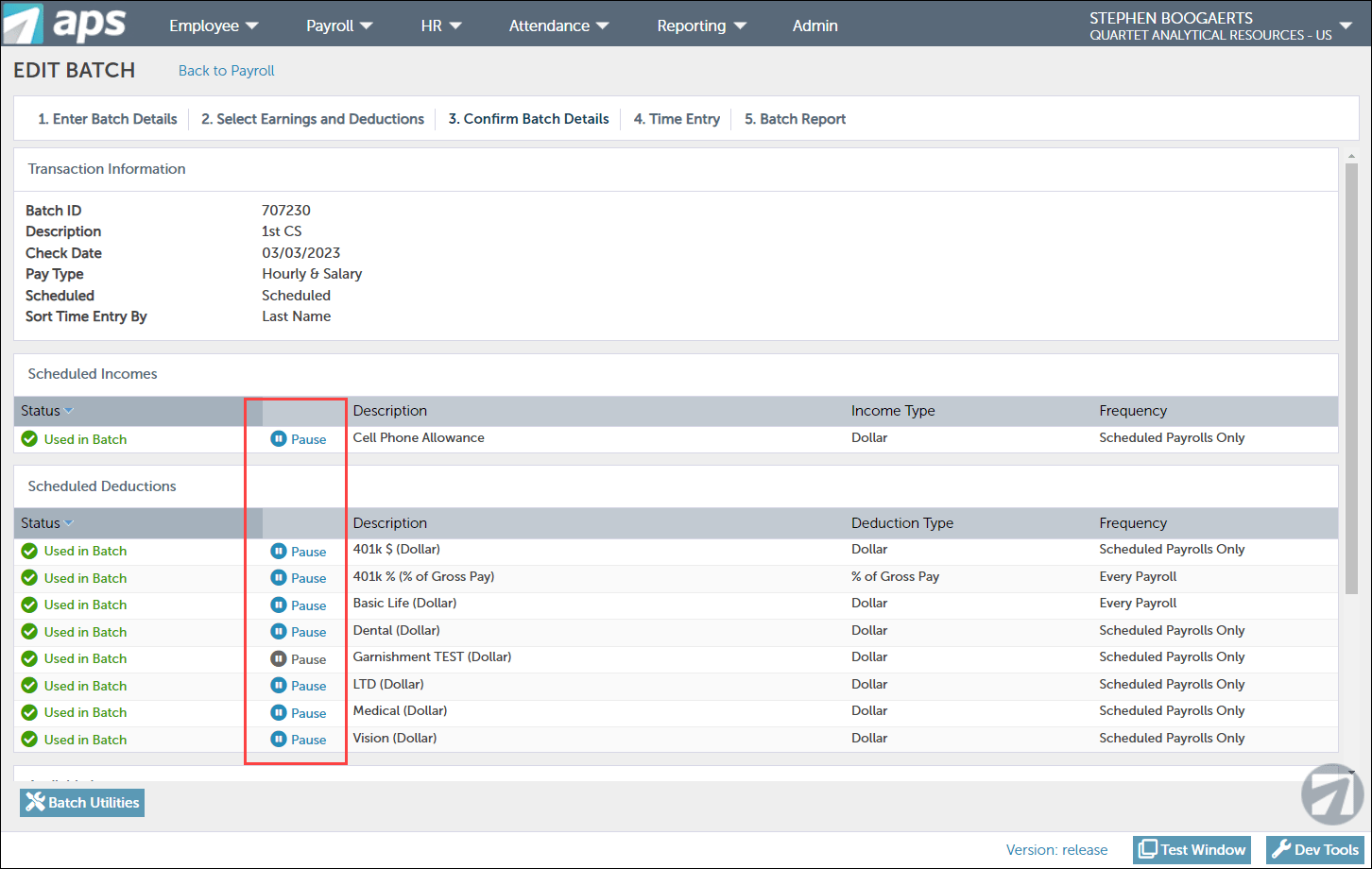

Pausing Scheduled Incomes and Deductions

Users can now pause a scheduled income or deduction during the payroll process. When a Payroll Admin pauses an income or deduction, the change applies to all employees with that specific income or deduction in the batch.

Pausing Scheduled Incomes and Deductions

For example, if one user is working on payroll and another is working on deductions, those changes can happen concurrently. Another example of this feature’s benefits is during open enrollment. An HR manager can approve deductions and pause them until the effective date. This update provides users more control over their payroll process and creates more efficiency in their day.

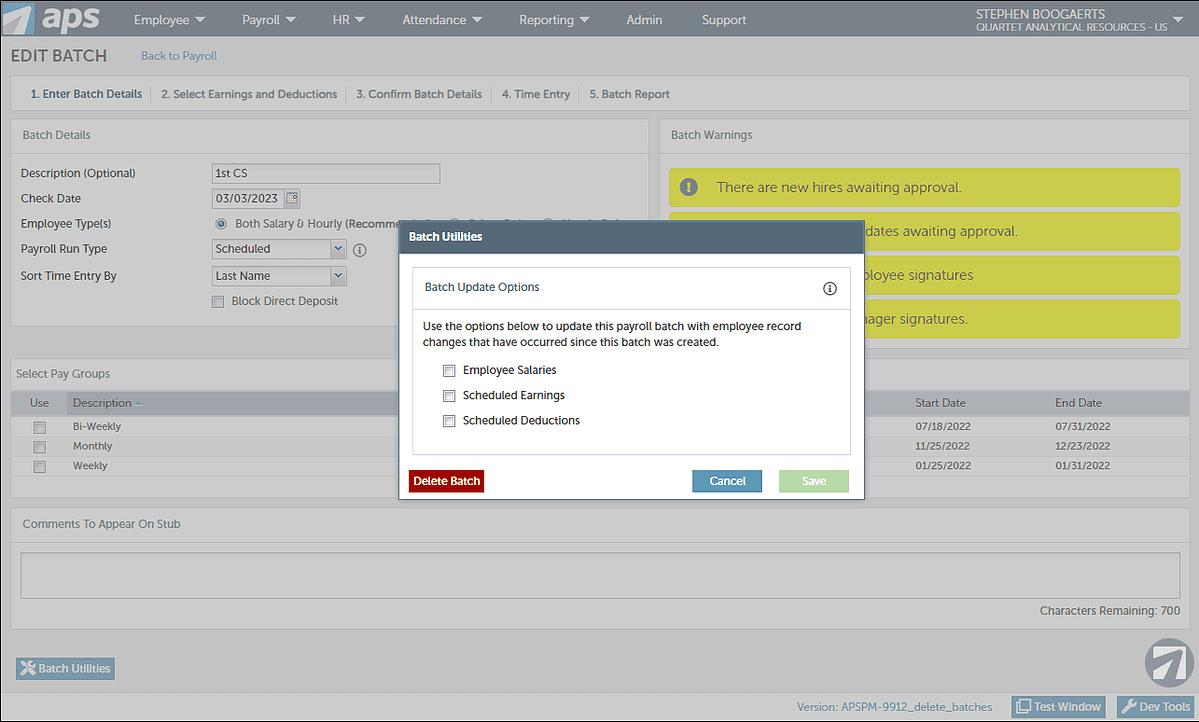

Deleting a Batch

This update allows users to delete payroll batches they started in error or created for testing purposes without contacting support. For example, suppose a user wants to create batch scenarios and use the payroll batch comparison feature to see a specific change’s impact. Then, they can delete those scenarios to keep their system instance clean.

Deleting a Batch

Deleting a batch gives users the ability to have more control over different functionality within the payroll process for a more intuitive experience. Users get more time back in their day and can be more strategic with payroll.

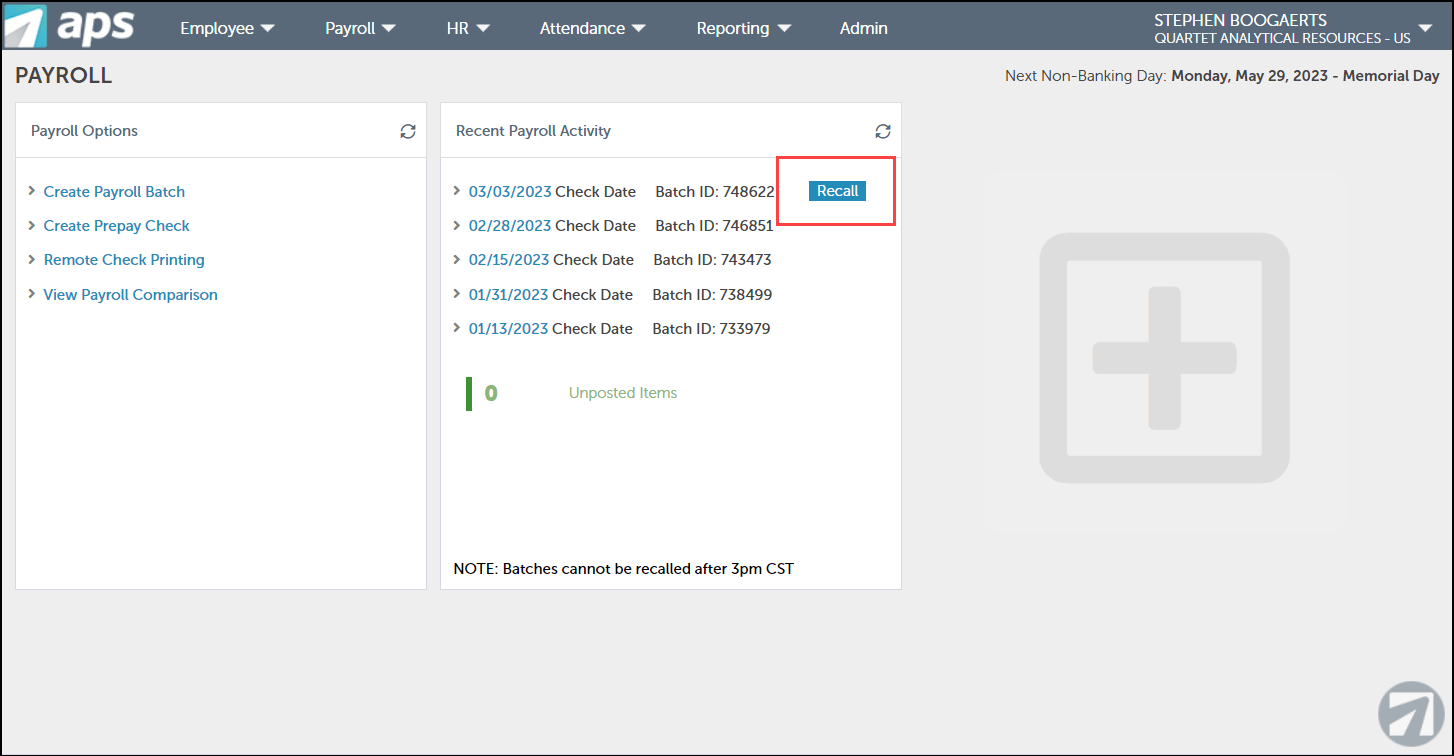

Recalling a Batch

This feature is only available for customers that use our remote check printing service. Remote check printing users can make last-minute adjustments after releasing a payroll batch that APS has not completed production on yet. This feature is part of our self-service initiative for our customers.

Recalling a Batch

Learn More About Our Intuitive Payroll Solution

How Organizations Benefit from Our Payroll Software Enhancements

APS made these changes to our flagship solution to continue our mission of making payroll and HR easier for our clients. We understand that payroll management can be complex. Therefore, we want to provide an intuitive platform that simplifies payroll so our customers can complete it in hours, not days. These software updates empower users to make payroll changes without contacting support or waiting for someone else in their organization to handle them.

Some of these payroll system enhancements are now in General Availability, while others are in Early Access for current APS customers. You can visit the APS Help Center for more information about these updates.

If you’re interested in learning more about these employee self-service updates, reach out to your support team or contact us.