Immediate partners with employers to provide their employees with wages that have been earned but not paid whenever they are needed. With seamless time tracking and payroll integrations, same-day, and next-day bank transfers, and the ability to put earnings directly on a debit card, Immediate is working to improve financial wellness and eliminate cycles of debt for employees by allowing them to access their hard-earned wages. To learn more, visit joinimmediate.com.

"Our mission is to better financial well-being and empower employees with pay access. With earned wage access, employees can access their earnings when they need them most. Thanks to our partnership with APS, we can seamlessly deliver an essential financial service across various industries, enabling employees to take control of their financial futures."

Matt Pierce

Founder and CEO

About

How it Works

Resources

About

Immediate

Services Provided

- Earned Wage Access

How it Works

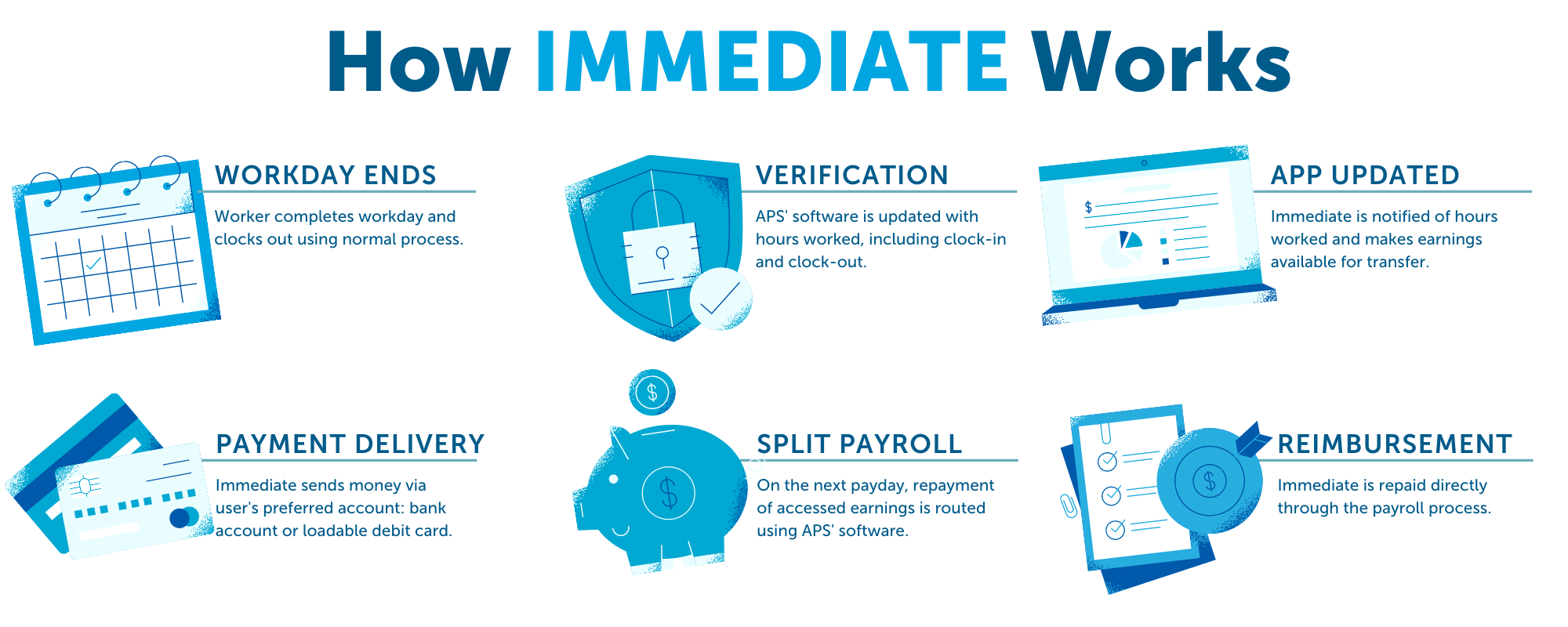

Immediate can be used with the APS platform or external time tracking software. When a worker’s shift ends, APS or the external time tracking software is updated to reflect the time worked. The EWA app is also updated for the worker to request wages for work before the scheduled payday.

When the scheduled payday occurs and a payroll batch is processed, the wages taken early by the worker are subtracted from the pay. The worker can avoid the interest on an exorbitant payday loan or having to ask for an advance for an emergency financial need.

Employees pay a nominal ATM-like transaction fee. Employers are not charged a fee.