Understanding how to choose the correct Form 1095-C codes for lines 14-16 can be overwhelming. Healthcare coverage requirements and ACA compliance are challenging topics to navigate. Entering incorrect codes can lead to ACA penalties and more time spent fixing those errors.

To help you avoid these burdens, let’s review the different codes you can input into lines 14-16 of Form 1095-C so you can submit error-free ACA reporting.

Ask How We Can Make Payroll & HR Easier for You

What is Form 1095-C?

Form 1095-C is the IRS form employers provide to employees detailing employer-based health coverage received during the calendar year. This form informs employees about their total coverage received and the dollar amount of their personal contributions. This includes the information on line 16 of 1095-C and 1095-C box 14 codes.

Every applicable large employer (ALE) must furnish Form 1095-C to individuals considered full-time employees for one or more months of the previous calendar year. Providing employees with information about their medical benefits is essential for ACA reporting compliance.

Who Must File Form 1095-C?

Form 1095-C provides information about medical benefits to employees and assists them in determining tax credit eligibility. Although employees aren’t required to have Form 1095-C to file their tax returns, employers must submit Form 1095-C to their workers and file it with the IRS.

Here’s what you need to include on Form 1095-C for each employee:

- Line 14: What medical benefit did you offer the employee?

- Line 15: How much did the medical benefits offer cost the employee?

- Line 16: What did the employee do when the offer was made, or why was the offer not made?

Note: Form 1095-C gets submitted alongside Form 1094-C, which acts as a “cover sheet” for ACA reporting purposes.

What Do the Codes on Form 1095-C Mean?

Every applicable large employer needs to make sure Form 1095-C has Lines 14-16 completed with the correct information. Here is a breakdown of each line and what the corresponding codes mean:

Line 14 - Offer Coverage

Line 14 on Form 1095-C specifies the type of health coverage, if any, offered to an employee, their spouse, and dependents. Choosing the correct ACA Line 14 codes is crucial for accurate reporting, as this information directly impacts compliance with the Affordable Care Act (ACA).

The 1095-C Line 14 codes describe the type of coverage offered, such as whether it met Minimum Essential Coverage (MEC) and Minimum Value (MV) standards. The Form 1095-C Line 14 codes you select must accurately reflect the coverage offered to the employee, even if the employee chose not to enroll in the coverage.

Example

If an employee is offered family coverage but enrolls in employee-only coverage, Line 14 must reflect that the employee was offered family coverage but chose employee-only coverage.

Here’s how to correctly use the 1095-C Line 14 codes:

ACA Line 14 Codes | Line 14 Code Descriptions | Line 15 Entry |

|---|---|---|

1A | Qualifying Offer: Minimum essential coverage (MEC) providing

the minimum value (MV) offered to full-time employees with Employee Required Contribution equal to or less than 9.5% (as adjusted) of the mainland single federal poverty line, and at least MEC offered to spouse and dependent(s). | Leave Blank

|

1B | MEC providing MV offered to the employee only. | Required |

1C | MEC providing MV offered to the employee and at least MEC offered to dependent(s) (not spouse). | Required |

1D | MEC providing MV offered to the employee, and at least MEC offered to the spouse, not dependent(s). Do not use code 1D if the coverage for the spouse was offered conditionally. Instead, use

code 1J.

| Required |

1E | MEC providing MV offered to the employee, and at least MEC was offered to dependent(s) and spouse. Do not use code 1E if the coverage for the spouse was offered conditionally. Instead, use

code 1K.

| Required |

1F | MEC NOT providing MV offered to the employee; employee and spouse or dependent(s); or employee, spouse, and dependents. | |

1G | An offer of coverage for at least one month of the calendar

year to an individual who was not an employee for any month of

the calendar year or to an employee who was not a full-time employee for any month of the calendar year (which may include

one or more months in which the individual was not an employee) and who enrolled in self-insured coverage for one or more months of the calendar year.

NOTE: Code 1G applies either for the entire year or not at all. | Leave Blank

|

1H | No offer of coverage (employee was not offered any health coverage or employee offered coverage that is not MEC, which may include one or more months in which the individual was not an employee). | Leave Blank

|

1J | MEC providing MV was offered to the employee, and at least MEC conditionally offered to the spouse; MEC was not offered to dependent(s). | Required |

1K | MEC providing MV offered to the employee; at least MEC offered to dependents, and at least MEC conditionally offered to the spouse. | Required |

1L | Individual coverage health reimbursement arrangement (HRA) is offered only with affordability determined by using the employee’s primary residence location ZIP Code.

| Required |

1M | Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined using the employee’s primary residence location ZIP Code. | Required |

1N | Individual coverage HRA offered to you, spouse, and dependent(s) with affordability determined using the employee’s primary residence location ZIP Code. | Required |

1O | Individual coverage HRA offered to you only using the employee’s primary employment site ZIP Code affordability safe harbor. | Required |

1P | Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee’s primary employment site ZIP Code affordability safe harbor. | Required |

1Q | Individual coverage HRA offered to you, spouse, and dependent(s) using the employee’s primary employment site ZIP Code affordability safe harbor. | Required |

1R | Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse, and dependents. | Required |

1S | Individual coverage HRA offered to an individual who was not a full-time employee. | Required |

1T | Individual coverage HRA offered to employee and spouse

(not dependents) with affordability determined using employee’s

primary residence location ZIP code. | |

1U | Individual coverage HRA offered to employee and spouse

(not dependents) using employee’s primary employment site ZIP

code affordability safe harbor. |

When selecting the correct Form 1095-C Line 14 codes, it’s essential to account for each month of the calendar year. If the same offer applies for all 12 months, you can use the “All 12 Months” box. If the offer of coverage varied from month to month, you must enter the appropriate ACA Line 14 codes for each month individually.

Please Note: W-2 Form Line 14 codes serve different reporting purposes. The 1095-C Line 14 codes specifically relate to health coverage offers and are critical for ACA compliance.

Using the correct 1095-C Line 14 codes ensures that your reporting accurately reflects the coverage offered and helps avoid potential penalties for non-compliance. Correctly filling out this form section is crucial for employers and employees.

Example

An employee enrolled in family coverage with a monthly premium of $250.00. The monthly premium for employee-only coverage is $150.00, so $150.00 would be entered on Line 15.

Line 15 - Employee Share of Lowest Cost Monthly Premium for Self-Only Minimum Value Coverage

For Line 15, enter the employee share of the lowest-cost monthly premium for self-only minimum essential coverage (MEC), providing minimum value (MV) offered to the employee. This amount may not equal the actual amount the employee is paying for coverage.

Line 16 – Section 4980H Safe Harbor Codes and Other Relief

Line 16 provides the IRS information to administer the employer shared responsibility provisions. The following are the available codes in Code Series 2 that an employer may choose from and what they mean. If the same code applies for all 12 calendar months, you may enter it in the “All 12 Months” box. You will also leave the monthly boxes blank. If none of the codes apply for a calendar month, leave the line blank for that month.

1095 Line 16 Codes | Line 16 Code Descriptions |

|---|---|

2A | Employee not employed during the month

|

2 | Employee not a full-time employee for the month. |

2C | Employee enrolled in health coverage offered for the entire month. |

2D | The employee in section 4980H(b) Limited Non-Assessment Period: The employee is waiting period and not yet eligible for coverage.

|

2E | Multi-employer interim rule relief. |

Affordability Safe Harbor Codes (2F, 2G, 2H) | These codes indicate that the coverage offered was considered affordable based on different safe harbor methods. For example, Code 2G is used when affordability is determined using the Federal Poverty Line safe harbor, and Code 2H applies when the rate of pay safe harbor is used. These IRS Form 1095-C Line 16 codes are essential for demonstrating that the employer met the affordability criteria, even if the employee did not enroll in coverage. |

If more than one code applies to Line 16, use the following guidelines:

- If 2E and any other Code series 2 applies, enter 2E

- If 2C and any other Code series 2 applies other than Code 2E, enter 2C

- If 2B and 2D apply, enter 2D

When completing Line 16 on 1095-C, it’s crucial to ensure that the appropriate code is entered for each month based on the employee’s situation and the coverage offered. If the same situation applies for all 12 months, you can use the “All 12 Months” box; otherwise, the correct 1095-C Line 16 codes should be entered individually for each month.

Accurate use of Form 1095-C Line 16 codes ensures compliance with ACA reporting requirements and helps avoid potential penalties. Understanding 1095-C Line 16 codes explained can also clarify the specific circumstances that apply to each employee regarding health coverage and employer responsibilities.

Please Note: 1095-C codes on Line 16 are different than codes Line 16 on W-2, which serves a different purpose. The 1095-C Line 16 specifically addresses ACA compliance and the employer’s obligations under the law.

By accurately completing Form 1095-C Line 16, employers can clearly communicate their compliance with ACA requirements and ensure that all relevant circumstances are reported correctly. Understanding and applying the correct 1095 C Line 16 codes is essential for fulfilling your ACA reporting obligations.

Need Help with ACA Annual Reporting?

Common Questions About Form 1095-C

Code 1A on Form 1095-C signifies that the employer made a Qualifying Offer, meaning MEC providing MV was offered to full-time employees, and the required contribution was within the affordability guidelines. The 1095-C 1A meaning reflects that the offer met all necessary ACA requirements for affordability.

Code 1E on Form 1095-C, also known as the 1E ACA code, indicates that Minimum Essential Coverage (MEC) providing Minimum Value (MV) was offered to the employee, and at least MEC was also offered to both the employee’s dependents and spouse. The 1095-C 1E meaning is significant because it shows that the employer met the ACA requirements by offering comprehensive health coverage. When you see 1E on 1095-C, it means that the employer provided an offer of coverage that satisfies the criteria set by the ACA.

The 1E code on 1095-C is commonly used on Line 14 of the form. If you’re looking at the 1095-C 1E code, or if you encounter this code on your 1095-C form, it signifies the same detailed offer of coverage. Understanding the 1E on 1095-C is crucial for accurate ACA reporting, as the 1E offer of coverage is one of the key indicators that the employer fulfilled their responsibility under the ACA guidelines. Whether referred to as the 1E 1095-C code, 1095-C 1E code, or simply 1E ACA code, it all points to the same compliance standard.

The 1095-C 1H code, also referred to as the 1H ACA code, indicates that no offer of health coverage was made to the employee, or that the coverage offered did not meet the Minimum Essential Coverage (MEC) standards. When you see 1H on 1095-C or code 1H on 1095-C, it means that during the relevant month(s), the employee was either not offered any health coverage or the coverage did not qualify as MEC.

The 1095-C 1H meaning is crucial for understanding the employer’s compliance status under ACA guidelines. This code is used on Line 14 of the form and signals that the employer did not provide an offer of coverage that meets ACA requirements. Whether you encounter 1095 1H, form 1095-C code 1H, 1095 C code 1H, 1H 1095-C, or 1H on 1095-C, it consistently represents the absence of an adequate offer of coverage.

Understanding, “what does 1H mean on 1095-C” or the significance of 1H code on 1095-C is vital for proper ACA reporting and compliance. The 1095-C 1H code is a critical indicator for employers and employees to be aware of, ensuring that all parties know the status of health coverage offers made during the reporting period. The use of ACA code 1H reflects a situation where the employer did not meet the MEC requirements, which could have implications for the employer’s responsibilities and the employee’s health coverage options.

Whether it’s referred to as 1095 C 1H, 1095 C 1H meaning, 1095-C code 1H, 1H on 1095-C, 1095c 1H, 1095 code 1H, 1H ACA code, 1H code on 1095-C, what is 1H on 1095-C, 1H 1095-C, or 1095 C codes 1H, they all denote the same situation: the employer did not offer MEC-compliant coverage during the specified months. Form 1095-C code 1H or 1095 C 1H code directly affects ACA compliance and the reporting obligations of both the employer and employee.

The 1095-C 2A code, also referred to as code 2A on 1095-C, indicates that the employee was not employed during the month. This code is used on Line 16 when the employee was either not a full-time employee or was not employed at all during the specified month(s). When you see 2A on 1095-C or 2A on 1095 C, it signifies that the employer was not required to offer health coverage for that period because the employee did not work during that time.

Understanding “what does 2A mean on 1095-C” or “what does 2A mean on 1095 C” is crucial for accurate ACA reporting. The 1095-C 2A meaning ensures clarity regarding the employee’s employment status during the reporting period.

Whether referred to as 1095-C code 2A or 1095 C code 2A, the use of this code is essential for both employers and employees to reflect the absence of employment and, consequently, the lack of an obligation to offer coverage during that time.

The 1095-C 2C code, also known as the 2C ACA code, indicates that the employee was enrolled in the health coverage offered by the employer for the entire month. When you see 2C on 1095-C or code 2C on 1095-C, the employer met their obligation by ensuring the employee had continuous coverage throughout the month.

The 1095-C code 2C is used on Line 16 of the form and is critical for ACA compliance. The 1095-C 2C meaning is consistent across all references and shows that the employee accepted the offer of coverage and maintained their enrollment. Understanding code 2C on 1095-C helps clarify the employee’s status regarding health coverage, which is essential for reporting and compliance purposes.

Whether you encounter 1095 C 2C, 1095 code 2C, or ACA code 2C, it all refers to the confirmation that the employee was covered under the health plan offered by the employer for the entire month.

The 1095-C 2G code indicates that the employer used the Section 4980H affordability federal poverty line safe harbor to determine the affordability of the health coverage offered to the employee. When you see 2G on 1095-C or 1095-C code 2G, it means that the employer’s offer of coverage was considered affordable based on the federal poverty line, even if the employee did not enroll in the offered plan.

The 1095-C 2G or ACA code 2G is used on Line 16 of the form and is essential for demonstrating that the employer made an affordable offer of coverage according to ACA standards. Understanding, “what does 2G mean on 1095-C” is vital for employees and employers to ensure proper compliance and reporting. Whether referred to as 1095 C 2G or 1095 C code 2G, the employer met the affordability criteria under the ACA using the federal poverty line as the benchmark.

The 1095-C 2H code, also known as the 2H ACA code, indicates that the employer used the Section 4980H affordability rate of pay safe harbor to determine the affordability of the health coverage offered to the employee. When you see 2H on 1095-C or code 2H on 1095-C, the employer offered coverage that is considered affordable based on the employee’s rate of pay, even if the employee did not enroll in the offered plan.

The 1095-C 2H meaning is essential for ACA compliance, as it shows that the employer met the affordability criteria using the rate of pay as the benchmark. This code is used on Line 16 of the form. Understanding 1095-C code 2H or 1095 C code 2H helps clarify how the employer determined affordability under ACA guidelines. Whether referred to as 1095 C 2H, ACA code 2H, or 2H code on 1095-C, it all signifies that the employer met their obligation by offering coverage deemed affordable based on the employee’s income.

Choosing the correct 1095 line 16 codes is essential for accurate ACA reporting. Line 16 on Form 1095-C provides the IRS with information about whether the employer met its obligations under the Affordable Care Act (ACA) regarding the offer of coverage to employees. The ACA line 16 codes indicate specific circumstances, such as whether the employee was enrolled in coverage, not employed, or in a waiting period.

To determine the correct line 16 1095-C code, consider the following:

- Enrollment Status: If the employee was enrolled in the coverage offered for the entire month, you would use code 2C. This is one of the most common 1095-C line 16 codes.

- Employment Status: If the employee was not employed during the month, use code 2A. This is another crucial form 1095-C line 16 code that indicates the employee did not work during the month in question.

- Affordability Safe Harbors: There are several ACA line 16 codes that relate to affordability, such as 2F (W-2 Safe Harbor), 2G (Federal Poverty Line Safe Harbor), and 2H (Rate of Pay Safe Harbor). These codes are used if the coverage offered was affordable based on specific safe harbor calculations, even if the employee did not enroll.

- Waiting Period or Other Relief: If the employee was in a waiting period or other non-assessment period, you would use code 2D.

You can refer to resources that provide 1095-C line 16 codes explained for a detailed breakdown. These explanations will help you choose the correct code based on the employee’s circumstances for each month. Using the proper IRS form 1095-C line 16 codes ensures that you meet your reporting obligations and avoid potential penalties.

Carefully review each month’s circumstances to select the accurate 1095-C line 16 code. This will ensure that your form 1095-C line 16 entries accurately reflect the employee’s status, whether using 1095-C line 16 codes or consulting line 16 on W-2 for guidance. Properly selecting these codes is crucial to maintaining compliance with ACA requirements.

If an employee declines coverage, the appropriate code to use on Form 1095-C could be 1H, indicating that no offer of coverage was made, or other relevant codes like 2A, which shows the employee was not employed during the month. The specific code depends on the situation.

Understanding how to read a 1095-C is crucial for employers and employees to ensure accurate reporting and compliance with the Affordable Care Act (ACA). The 1095-C form is divided into several sections, each providing specific information about the health coverage offered to an employee by their employer.

Here’s how to read a 1095-C:

- Part I: Employee and Employer Information: This section includes basic information such as the employee’s name, Social Security Number, and the employer’s name, address, and Employer Identification Number (EIN). Understanding this section is the first step in how to read 1095-C forms.

- Part II: Offer of Coverage (Lines 14-16): This is the most critical section when learning how to read 1095-C. It details the type of health coverage offered by the employer.

- Line 14: Indicates the type of coverage offered to the employee, their spouse, and dependents. Each code reflects a different scenario regarding the offer of coverage.

- Line 15: Shows the employee’s share of the lowest-cost monthly premium for self-only minimum essential coverage providing minimum value.

- Line 16: Provides information on whether the employee enrolled in the coverage offered and whether any safe harbor provisions or exemptions apply.

Knowing how to read a 1095 C involves interpreting the codes in these lines to understand what coverage was offered and whether it was accepted.

- Part III: Covered Individuals: This part is only completed if the employer provided self-insured coverage. It lists the names and Social Security Numbers (or other Taxpayer Identification Numbers) of individuals covered under the plan.

To fully understand how to read a 1095-C, pay close attention to the codes in Part II. These codes provide the necessary details about the coverage offered and the employee’s enrollment status. Each line and code communicates the type and scope of health coverage provided by the employer during the reporting year.

How to read a 1095-C involves carefully reviewing the details in each section, particularly the codes on Lines 14-16, to understand the employer’s offer of coverage and the employee’s response. Whether you want to understand how to read 1095-C for compliance or personal records, this step-by-step approach will help clarify the information presented on the form.

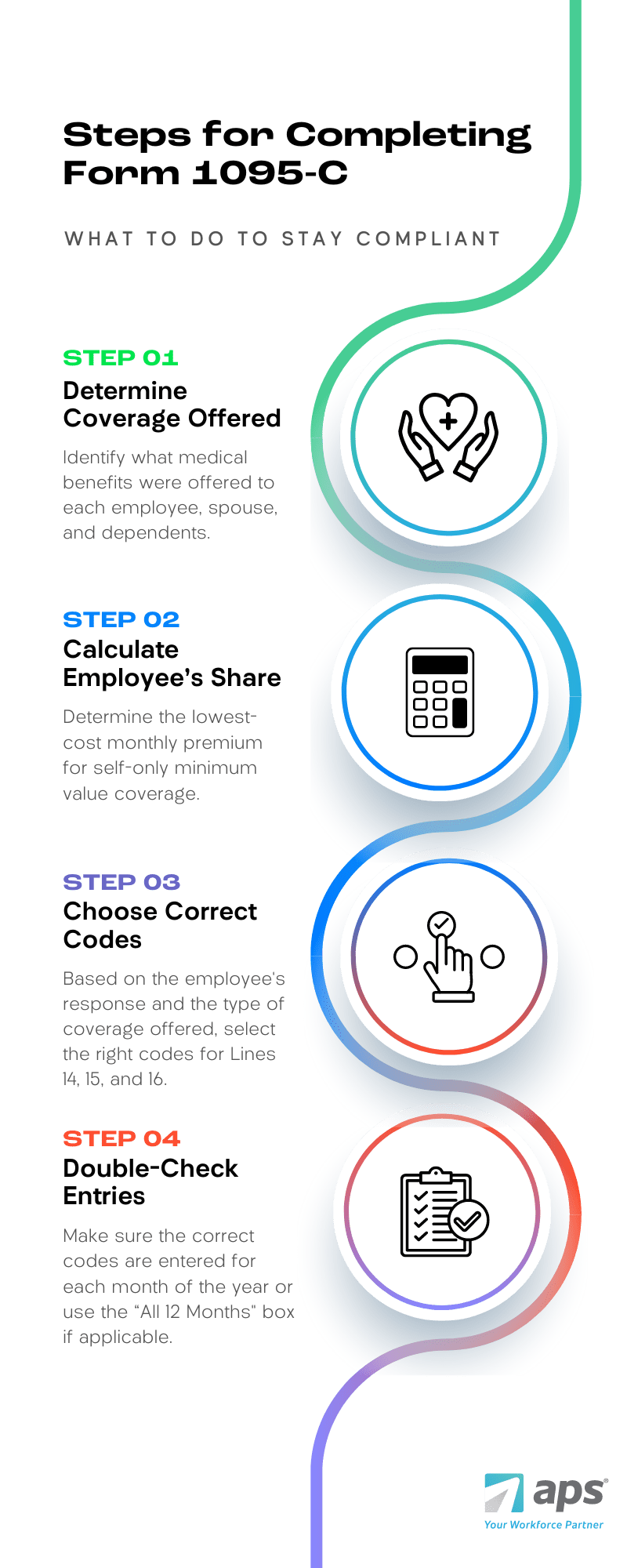

Step-by-Step Guide to Completing Form 1095-C

To ensure that your Form 1095-C is completed correctly, follow these steps:

- Determine the Type of Coverage Offered: Identify what medical benefits were offered to each employee, spouse, and dependents.

- Calculate the Employee’s Share: Determine the lowest-cost monthly premium for self-only minimum value coverage.

- Choose the Appropriate Codes: Based on the employee’s response and the type of coverage offered, select the correct codes for Lines 14, 15, and 16.

- Double-Check Your Entries: Make sure the correct codes are entered for each month of the year, or use the “All 12 Months” box if applicable.

Common Mistakes to Avoid

- Using Incorrect Codes: Misunderstanding the difference between codes like 1E and 1H can lead to errors. Make sure you understand what each code signifies.

- Failing to Report for All 12 Months: Even if an employee was only employed for part of the year, you must report coverage for each month.

- Not Understanding Safe Harbor Codes: Familiarize yourself with the Section 4980H safe harbor codes to avoid costly penalties.

How APS Can Help with Form 1095-C Reporting

APS offers a compliance and reporting solution that simplifies the complexity of the Affordable Care Act:

- Our error-checking algorithm ensures 1095-C codes are valid and data is formatted correctly for reporting.

- Pre-populated forms ensure you accurately capture and report health plan coverage information to the IRS.

- Dedicated tax compliance experts can help you with questions and answers, ensuring you maintain compliance.

We’ll even e-file on your behalf.

Contact us today to learn more about how APS can help you with Form 1095-C reporting!