According to a recent study conducted by Deloitte, labor costs often make up 50-60% of an organization’s total overhead fee. During year-end especially, labor costs and additional cash flow needs can put added stress on organizations. Many employers turn to payroll funding options to meet this need for a more flexible end-of-year cash flow.

Payroll funding provides organizations with the money needed to pay employees year-round. It closes the gap between cash flow needs and labor expenses so you can continue operating your business anytime, anywhere.

This article will discuss what payroll funding is and its impact on year-end processing. Then, we’ll discuss the benefits payroll funding provides to end-of-year cash flow deficits. Finally, we’ll provide tips that finance and human resource departments can use to avoid year-end cash shortages.

What is Payroll Funding?

Payroll funding is a tool that organizations can use to access immediate cash to finance their labor expenses. An employer uploads their payroll summary into a financing platform and requests funds to pay its employees. It is a transaction that helps businesses meet their payroll obligations and keep operations running smoothly.

Payroll can take several days to accomplish, especially when processed traditionally through the Automated Clearing House (ACH). Companies often face year-end cash constraints when waiting on customer payments to finish these payroll tasks. Payroll funding helps organizations access the cash they need during this time-lapse.

How Payroll Funding Benefits Businesses During Year-End

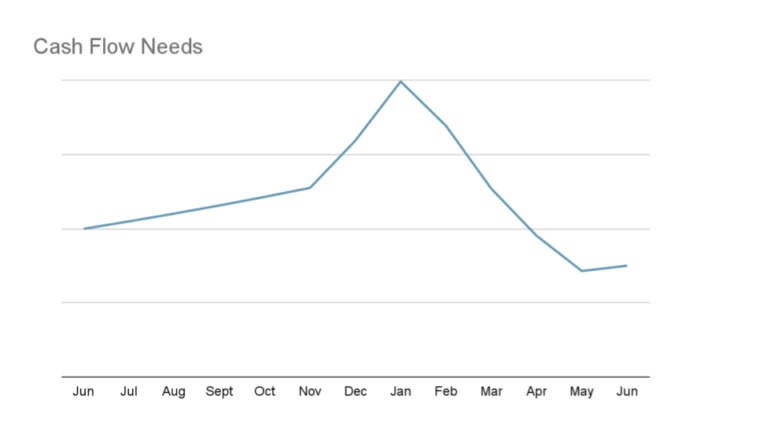

According to a recent study by Nivelo, businesses need up to 50% extra cash flow to solve year-end payroll. The graph below shows how cash flow needs significantly spike from December to February.

Source: Nivelo User Research

This increase in cash flow needs during year-end typically stems from the following:

Cash for Overtime

Year-end brings additional business to many industries, such as transportation and hospitality, and a need to work overtime or during holidays. Companies must ensure they can cover those overtime expenses to pay their employees promptly.

Cash for Seasonal Workers

Another benefit of payroll funding is the flexibility it offers businesses during peak seasons. Approximately 120 million Americans travel between Christmas and New Year’s Day, making year-end the most popular time for employee PTO usage.

In industries like retail and hospitality, the holiday period brings an influx in business and a need for seasonal employees to manage the added workload. The need for seasonal employees means being able to hire those workers quickly and ensure your business grows during this time.

Cash for Bonus Payments

Year-end between December and February is a popular time for employers to issue employee bonuses. However, this process can be challenging between managing other end-of-year tasks and ensuring adequate cash flow. With payroll funding, your employees can receive their well-deserved bonuses without missing a beat.

Even when businesses have enough income to pay for these extra cash needs, it’s not always possible to wait for collections to pay workers. Ensuring you have enough cash in the bank to satisfy these year-end payroll needs is essential to maintain compliance and keep your employees happy.

Ask How We Can Make Payroll & HR Easier for You

Tips To Avoid Year-End Cash Shortages

Now that you understand the impact cash shortages can have on year-end payroll, here are some tips you can use to avoid them:

Identify Payroll Funding Gaps

You must identify year-end cash shortages before taking steps to prevent them. Monitor your balance versus your payroll bills to discover potential funding gaps.

For example, let’s say your company’s weekly payroll costs are $100,000, but your clients need 30 days to pay their invoices. Therefore, you have determined that you will need $400,000 to cover four weeks of payroll to pay your staff on time and keep operations running. Taking a proactive approach allows you to better prepare for year-end and take steps to improve your cash flow.

Work Out Payment Arrangements With Vendors

The vendors you do business with may be able to work out alternative payment plans with you during year-end. Therefore, your company could benefit from net-term payment arrangements and installments.

Payment arrangements allow you to pay your vendors with more flexibility until the invoice is paid in full. This approach helps reduce your potential for funding gaps during the end of the year.

Create Early Pay Incentives with Clients

Incentivizing clients who make early payments is a great way to increase cash flow throughout your business. You can offer a discount on services for a limited time or even a gift card to clients.

This strategy of accelerating your receivables ensures cash continually flows through your business all year. Here are a few additional ways to encourage customers to send payments early:

- Send invoices as soon as service has been rendered, or at the very least a few days before they are due.

- Put a team in charge of overdue accounts. Have them make personalized phone calls if need be. Ask for partial payments to keep the account active.

- Ask new customers for a deposit upfront. This approach increases cash flow because you aren’t waiting on a total lump sum after services have been rendered.

Choose a Payroll Schedule that Aligns with When Businesses Pay

While many businesses operate on a bi-weekly payroll schedule, exploring a payroll schedule that aligns with when clients are paying you might be beneficial. For example, moving to a bi-monthly schedule will allow your business to process payroll a specific number of times throughout the year on predetermined dates. This approach gives you a more predictable cash flow and better control over your budget.

Work with a Payroll Funding Partner

The most efficient way to close year-end funding gaps is to partner with an expert in payroll funding. Payroll funding partners can work with you to provide access to money that is otherwise stuck in unpaid invoices so you can operate with a more positive cash flow.

When choosing a funding partner, consider vendors that understand your business and can turn around funding requests quickly.

Bonus Tip: Add Payroll Funding to Your HR Tech Stack

When exploring payroll funding options, ask them about their partnerships with payroll and HR providers. Adding payroll funding to your HR tech stack can make it easier to request cash when you need it. APS has partnered with third-party service provider Nivelo to offer a convenient way to access financing to manage end-of-year cash flow needs. The process is as simple as:

- Uploading your APS payroll invoice

- Receiving your funds in mere hours before the end of the day

- Selecting the desired payback date

With the APS and Nivelo partnership, applying is free and 100% online. Contact Nivelo today to learn more about instant payroll funding options to optimize your cash flow and pay your workers without risk.

About APS

APS has a mission: to make payroll and HR easier. We design our unified solution to simplify workforce management tasks for mid-market organizations. We provide our clients and partners with personalized service and support to accomplish their goals. Streamline payroll processing, automate HR workflows, and elevate the employee lifecycle with a single-system platform. We are APS, your workforce partner.

Mid-sized businesses choose APS as their workforce partner because of our focus on the customer experience. As a result, we continually maintain 98% customer retention and satisfaction rates. For more information on APS and how we can help make payroll and HR easier for your mid-market business, visit https://www.apspayroll.com.

About Nivelo

Nivelo is a New York based all-in-one automated payroll financial infrastructure payments company focused on helping payroll companies improve their payment operations and the payment experience for their clients with differentiated check-out features such as Instant Payroll Funding On-Demand Payroll and Same-Day payroll without risk. The company is led by a group of technologists with deep experience in money movement and risk mitigation.

Learn more about our instant payroll funding options.