Who is an Independent Contractor?

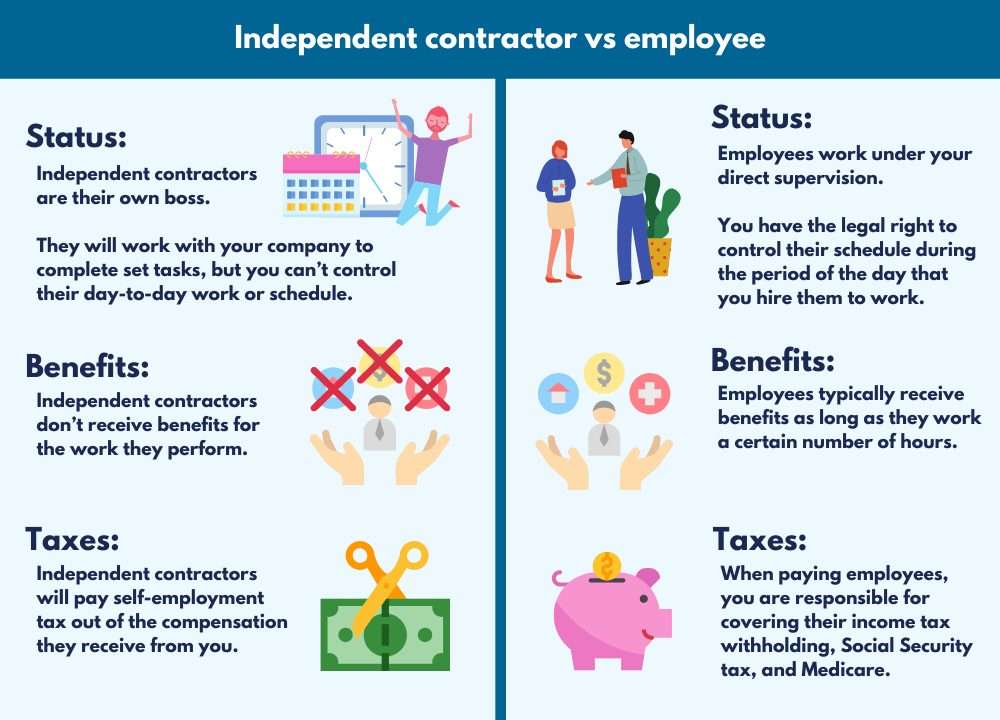

An independent contractor is someone you hire to do specific work, but they’re not classified the same as a full-time employee. Contractors run their own businesses, set their own working hours, and usually have multiple clients. They often use their own tools and supplies, too.

Employees, on the other hand, typically work set hours, use company equipment, and follow your direct instructions.

Understanding the distinction is essential because independent contractors are treated differently regarding payroll taxes, social security, overtime pay, and other payroll regulations.

Why Contractor vs. Employee Matters

The government takes the classification of workers seriously. Misclassifying employees as independent contractors can result in heavy fines from both federal and local governments. Here’s why:

- Payroll taxes: Employers must withhold payroll taxes from employees’ paychecks, but contractors are responsible for paying their own taxes. Misclassification could mean you’re not withholding enough taxes, leading to trouble with payroll tax compliance.

- Overtime pay and working hours: Under the Fair Labor Standards Act (FLSA), employees who work more than 40 hours per week are eligible for overtime pay. Contractors don’t receive overtime pay because they are independent and control their own schedules.

- Benefits and protections: Employees benefit from protections like the Equal Pay Act (EPA), which requires employers to pay employees fairly. Contractors don’t have these protections.

Because misclassification can lead to serious issues, you must carefully track your payroll records and make sure you’re clear about each worker’s status.

Common Payroll Mistakes to Avoid

Even with a strong payroll process, mistakes happen. Here are common pitfalls businesses make when paying independent contractors — and how to avoid them:

- Misclassifying workers: Always double-check the difference between employees and contractors to avoid costly fines.

- Late or incorrect tax filings: Be sure to file forms like the 1099-NEC on time to avoid penalties from the IRS.

- Poor record-keeping: Maintain organized payroll records so you’re prepared for audits or questions from local governments.

- Confusing pay periods: Clearly define pay periods and payment schedules to avoid disputes or confusion.

- Ignoring state rules: States have unique payroll regulations; make sure you comply with both federal and local laws.

By being aware of these common mistakes, you can proactively avoid them.

Key Payroll Requirements for Independent Contractors

Still wondering what the rules are when it comes to paying contractors correctly? Here are the key payroll requirements you must understand when hiring independent contractors:

1. No Payroll Tax Withholding

Unlike when you pay employees, you don’t withhold payroll taxes from payments to contractors. Employees have payroll taxes withheld automatically from each pay period, including federal income taxes, social security, and Medicare.

Contractors, however, are responsible for managing their own tax payments. Your business doesn’t need to withhold these taxes, but you must report what you pay them.

2. Tax Forms You Need

When you hire independent contractors, you must use specific tax forms. The most common is Form 1099-NEC, which reports how much you paid a contractor each year. You’ll send one copy of this form to the contractor and another to the IRS.

To complete Form 1099-NEC, you’ll need them to fill out a Form W-9 first. This form gives you their taxpayer identification number and business details. Make sure you keep these forms organized in your payroll records.

3. Keeping Good Payroll Records

Even though you don’t manage payroll tax withholding for contractors, good payroll records are essential. Payroll regulations require employers to keep detailed records of payments made to all workers, including contractors.

Your records should include:

- Contractor name and contact information

- Dates worked and hours worked (if applicable)

- Payment amounts for each pay period

- Copies of tax forms (W-9, 1099-NEC)

Maintaining these records helps protect you during payroll audits and makes payroll tax compliance easier at year-end.

4. Compliance with Labor Laws

Labor laws like the Fair Labor Standards Act (FLSA) and the Equal Pay Act (EPA) apply specifically to employees — not independent contractors. Contractors set their own rates, hours worked, and methods for completing tasks, so laws requiring overtime pay or equal pay typically don’t apply to them.

Still, you need to ensure you’re not misclassifying workers. Otherwise, you could unintentionally violate labor laws. Regularly review the payroll compliance checklist to keep your business safe.

How to Avoid Misclassification Issues

Because misclassification can cause trouble with federal and local governments, it’s important to distinguish between independent contractors and employees clearly. Here are tips to help you stay compliant:

- Evaluate control: If you have significant control over how, when, and where someone works, they’re probably an employee, not a contractor.

- Contracts matter: Always use clear written agreements stating that someone is an independent contractor. Define roles and responsibilities clearly.

- Check with professionals: If you’re unsure about worker status, seek guidance from HR professionals or legal experts to avoid expensive mistakes.

Understanding Local and State Requirements for Contractors

While federal laws cover the basics of payroll tax compliance, don’t forget that local governments and state agencies often have rules for paying independent contractors. Many states require employers to report contractor payments for tax purposes, and some even mandate electronic filing for Form 1099-NEC.

State-specific rules can also vary around worker classification. For example, California uses the “ABC test,” which is stricter than federal guidelines and makes it harder to classify someone as a contractor. If your business operates in multiple states — or hires contractors across state lines — you must follow all applicable regulations in each location.

States may also have rules around unemployment insurance or workers’ compensation. Even though contractors generally aren’t covered by these programs, failing to classify someone properly could result in you owing back payments or penalties. That’s why you should have a clear, documented agreement outlining the scope of work, project duration, and expected outcomes.

Keeping up with these rules can be overwhelming, especially as they change often. This is where choosing the right payroll software comes into play. A good platform should help you stay updated on changing compliance rules, track payments by location, and organize your payroll process across state lines. APS does just that — so you can focus on running your business, not memorizing tax codes.

Simplify Your Payroll Process with Payroll Software

Managing payroll— especially with both employees and contractors — can feel overwhelming. Investing in quality payroll software can make a huge difference. Reliable payroll software helps you:

- Keep accurate payroll records

- Manage tax forms easily

- Automate payroll tax compliance

- Track payments clearly each pay period

If you’re unsure how to choose the best system, check out our resource on how to choose the best payroll software for your business.

Using payroll software saves you time and ensures accuracy. Make payroll taxes, federal income taxes, and payroll regulations less stressful.

How APS Can Help

At APS, we know payroll can be complicated — especially when managing independent contractors. That’s why we offer a comprehensive, unified payroll solution designed to simplify payroll processes.

With APS, you’ll easily:

- Stay compliant with payroll tax requirements

- Accurately manage employee and contractor payroll records

- Generate and file required tax forms (like 1099-NEC)

- Automate payroll tasks to reduce errors

- Access real-time payroll data to quickly handle any issues

APS is specifically built to help you meet federal, state, and local government requirements. Whether you have five contractors or five hundred, APS ensures your payroll remains efficient and accurate.

Ready to Simplify Your Payroll?

Hiring independent contractors can be an excellent move for your business, but understanding payroll requirements is key. With good planning, clear processes, and the right payroll software, you’ll confidently manage your payroll tasks and stay compliant.

Want an even easier way to manage payroll and HR? APS is here to help. We’ve designed a powerful, user-friendly solution trusted by businesses nationwide.

Download our helpful handout, “How APS Makes Payroll and HR Easier” to learn more. See why APS customers save time, reduce stress, and feel confident their payroll is done right every time.

Whether you’re hiring your first independent contractor or managing a large team, APS is here to simplify your payroll process — every step of the way.

Sources

- Independent Contractor (self-employed) or employee? | IRS

- In Recent Legislation, States Shore Up Public Workforce | NCSL

- Wages and the Fair Labor Standards Act | IRS

- Equal Pay for Equal Work | DOL

- Instructions for Forms 1099-MISC and 1099-NEC | IRS

- Fact Sheet 13: Employee or Independent Contractor Classification Under the Fair Labor Standards Act (FLSA) | DOL

- The Pros and Cons of Hiring Independent Contractors | Business Management Daily

- Independent Contractor versus Employee | DIR