Understanding the New FLSA Salary Threshold Changes for Exempt Employees

The Fair Labor Standards Act (FLSA) has long been a cornerstone of worker protection in the United States, ensuring that employees receive fair pay for their work. The recent significant changes to the salary thresholds for exempt employees under the FLSA, announced by the US Department of Labor (DOL), are a testament to the Act’s commitment to fairness.

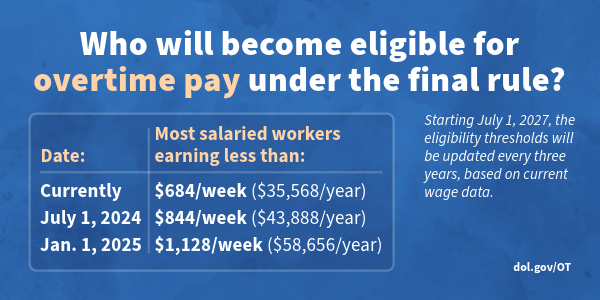

These changes, effective July 1, 2024, with another set coming into effect on January 1, 2025, are poised to impact millions of employees and their eligibility for overtime pay for more fair compensation.

This article delves into these changes, what they mean for employers and employees, and how businesses can prepare to comply with the new regulations.

Background on the FLSA and Salary Thresholds

The FLSA, established in 1938, sets out standards for minimum wage, overtime pay requirements, recordkeeping, and youth employment in the private sector and Federal, State, and local governments. One key aspect of the FLSA is its provision for exempt and nonexempt employees. Exempt employees are not entitled to overtime pay, while non-exempt employees are.

For an employee to meet the exemptions and requirements for executive, administrative, and professional (EAP) categories, they must satisfy three criteria:

- Salary Basis Test: The employee must be paid a predetermined and fixed salary that is not subject to reductions based on the quality or quantity of work performed.

- Salary Level Test: The employee’s salary must meet a minimum specified amount.

- Duties Test: The employee’s job duties must primarily involve executive, administrative, or professional tasks.

For more information, employers can view the DOL’s FAQs for the final rule on defining and delimiting the exemptions for executive, administrative, and professional employees for more information.

New Annual Salary Thresholds Effective July 1, 2024

Starting July 1, 2024, the DOL’s final rule raises the standard salary level from $684 per week ($35,568 per year) to $844 per week ($43,888 per year). This change is significant as it broadens the pool of employees eligible for overtime pay. The threshold for highly compensated employees (HCE) will also increase to the standard of $132,694 annually from $107,432 per year.

This higher threshold is designed to simplify the determination of exempt status for employees who would typically qualify for exemption under the standard tests but perform fewer duties.

New Updates as of January 1, 2025

- Planned January 1, 2025 Updates Delayed: The planned updates to increase the salary threshold to $1,128 per week and the HCE threshold to $151,164 annually were put on hold due to the court decision.

- Notice of Appeal: The U.S. Department of Labor has filed a notice of appeal regarding the court’s decision, and further updates may affect future compliance timelines.

Implications for Employers

These changes mean that employers must re-evaluate the status of their exempt employees to maintain compliance. If an exempt employee’s salary falls below the new thresholds, employers have two options:

- Increase Salaries: Raise the employee’s salary to meet or exceed the new threshold.

- Reclassify Employees: Reclassify the employee as non-exempt, making them eligible for overtime pay for any hours worked over 40 in a workweek.

Employers should start planning now to identify which employees are affected and decide on the best course of action. This approach may involve budgeting for salary increases or adjusting work schedules to minimize overtime costs.

Preparing for Compliance

To prepare for these changes, employers should:

- Conduct a Salary Review: Assess current salaries against the new thresholds to determine which employees will be affected.

- Update Payroll Systems: Verify that payroll systems can handle the new salary thresholds and calculate overtime for newly non-exempt employees.

- Communicate Changes: Clearly communicate any changes to employees, particularly those who will be reclassified as non-exempt. These employees must understand their new rights and responsibilities regarding overtime. This communication could involve one-on-one meetings, group discussions, or the distribution of written materials.

- Review Job Descriptions: Check that job descriptions accurately reflect the duties performed, particularly those positions evaluated for exemption status.

- Consult Legal Counsel: Engage with legal experts to ensure all changes comply with federal and state laws and navigate potential complexities.

Impact on Employees

These changes bring significant benefits for employees. Many who previously did not qualify for overtime pay will now be eligible, ensuring fair compensation for hours worked over the standard 40-hour workweek. This change particularly impacts lower-paid salaried workers who often work long hours without additional pay. It’s a clear sign of appreciation for their hard work and dedication.

The Road Ahead

Starting July 1, 2027, and every three years after that, the salary thresholds will be updated based on current wage data. This periodic adjustment keeps the thresholds relevant and effective in protecting workers’ rights.

Maintaining FLSA Compliance

The upcoming changes to the FLSA salary thresholds represent a significant shift in labor law aimed at extending overtime protections to millions of workers. Employers must act now to understand the impact of these changes on their workforce and maintain compliance. By conducting thorough reviews, updating systems, and communicating effectively with employees, businesses can navigate these changes smoothly and continue to support their workforce effectively.

For more detailed information, you can visit the official websites of the US Department of Labor and other trusted legal resources, which are listed below.

By staying informed and adjusting practices accordingly, businesses can ensure compliance and continue to effectively support their workforce. This knowledge empowers employers and employees, giving them a sense of control over the changes and their impact.

Sources

-

US Department of Labor Overtime Rulemaking

-

Frequently Asked Questions – Final Rule: Defining and Delimiting the Exemptions for Executive, Administrative, Professional, Outside Sales, and Computer Employees

-

Wyrick Robbins – DOL’s New Salary Threshold

-

Foley & Lardner LLP – DOL Increases Compensation Threshold

-

Earnings thresholds for the Executive, Administrative, and Professional exemption from minimum wage and overtime protections under the FLSA

-

https://www.jdsupra.com/legalnews/the-department-of-labor-significantly-3630331/