Deciding whether or not to outsource payroll services is challenging. While payroll functionality is essential, factors like cost and compliance also contribute to the decision-making process. It’s necessary to understand the pros and cons of outsourcing payroll, so you’re confident in your choice.

In this article, we’ve created a list of the advantages and disadvantages of outsourcing a company’s payroll function. This list will help you decide whether to outsource your company’s payroll services.

What’s the Difference Between In-House Payroll Vs. Outsourcing Payroll?

In-house payroll processing is when a business handles all matters associated with employee pay internally. These tasks include:

- Calculating timesheets and wages

- Ensuring the correct amount of payroll taxes are deducted from each paycheck

- Applying any deductions for items like retirement contributions and health benefits

- Printing checks and initiating direct deposits

- Calculating deductions and payroll taxes

In-house payroll is managed either by an individual administrator or a team. The advantages of in-house payroll processing include maintaining control over sensitive company data and when paychecks are issued. However, there are still several risks associated with doing in-house payroll. These risks include payroll errors, incorrect deductions, and noncompliance.

Payroll outsourcing is when an organization uses a third-party service provider to handle the administrative and compliance tasks associated with employee pay. Depending on the payroll outsourcing firm, this may include filing payroll taxes and payments on your behalf.

Many companies choose outsourced hr and payroll services due to the manual, time-consuming nature of these tasks. This automation of payroll processing allows HR and payroll managers to focus on more strategic tasks in their organizations.

What are the Advantages and Disadvantages of Outsourcing Payroll Services?

There are many factors to consider when deciding on payroll outsourcing services, such as time to implement and return on investment. That’s why we’ve come up with a list of potential pros and cons of outsourcing payroll services to consider before making your final decision.

1. Time

Pro: Time Savings

According to Technology Advice, 26 percent of small businesses spend three to five hours per month processing payroll manually. Many solutions provide a centralized database for payroll and attendance information. This unified approach automates the process from time capture to paycheck into a closed-loop workflow. Payroll software achieves this through the following:

- Employees clock in on the payroll system, triggering an automatic capture of hours worked.

- Employees request time off on the same system, merging attendance data with time data captured.

- Automatic calculations transfer data from hours worked, multiplied by preset rates of pay, eliminating cumbersome Excel spreadsheet formulas.

- The results from these calculations are placed against W-4 withholding information to streamline tax compliance.

- An employee receives his or her accurate paycheck each pay period.

Outsourcing payroll to a provider allows you to take back valuable time in your workday. You’ll be more productive and have time to focus on more strategic initiatives for your organization. That massive to-do list won’t seem quite so challenging to tackle.

Con: Time to Implement

Depending on what solutions you need and if custom development is required, it can take time to implement a new system. It will require collaboration across departments to gather employee information or meetings with leadership to determine how quickly you can implement a new system.

The good news is most payroll and HR providers understand how important it is to have a smooth transition and have developed more efficient implementations. Some provide implementation timelines or more hands-on customer experiences. Here are a few questions you can ask when vetting a potential provider:

- Do you train new customers in the software using their data?

- Is there lifetime training to make sure essential employees can confidently use the new system?

- Will I work with a customer success team to ensure we meet our business goals beyond implementation?

2. Cost

Pro: Return On Investment

According to a Greenhouse statistic, a payroll and HR solution saves an organization an average of $97,180 per year. That’s because a payroll solution reduces the time spent each month, manually processing payroll, from days to hours. Here’s how a business can break down payroll software savings into an overall return on investment:

COMPLIANCE

According to a study by the National Small Business Association, business owners pay over $83,000 in regulatory costs in their first year of operation. Managing payroll tax compliance in-house increases the risk of an organization over or underpaying employer taxes.

Staying on top of ever-changing federal and state guidelines is complicated when you’re already handling payroll and HR manually. The return on investment that comes with reducing tax penalties and compliance risk is enormous.

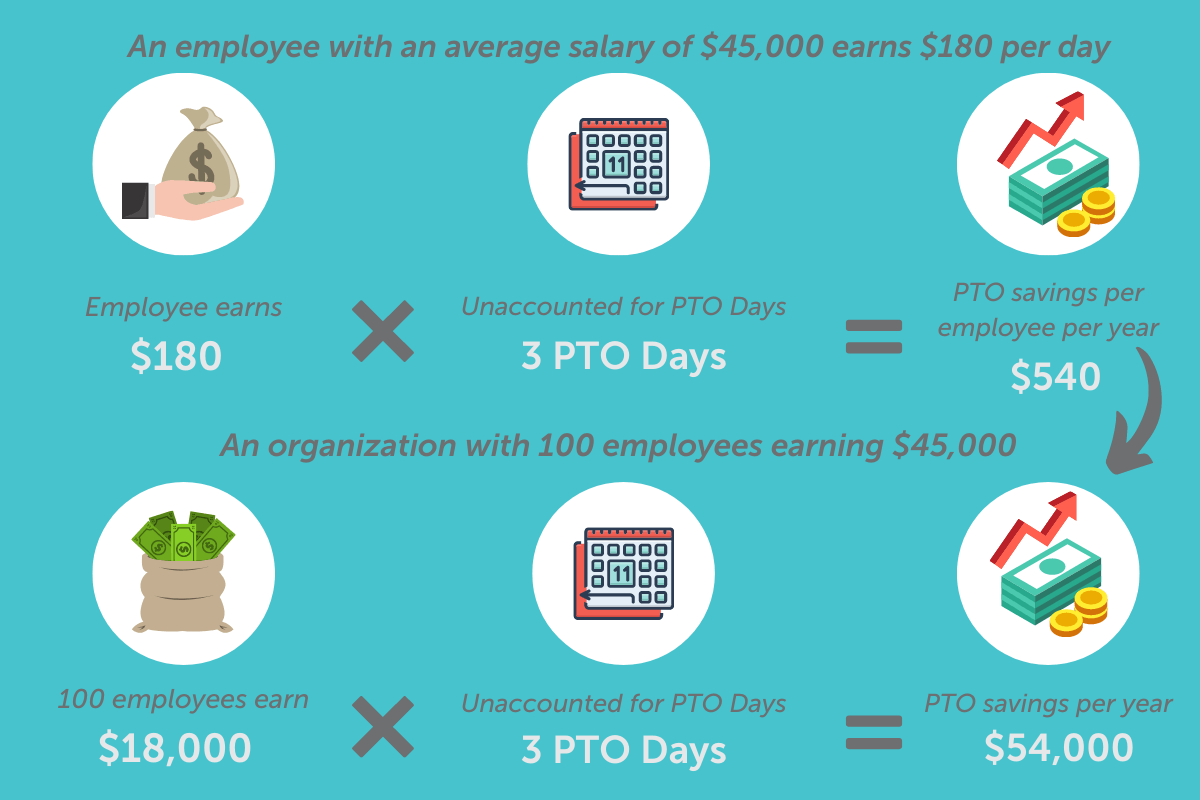

PTO

E-SIGNATURE

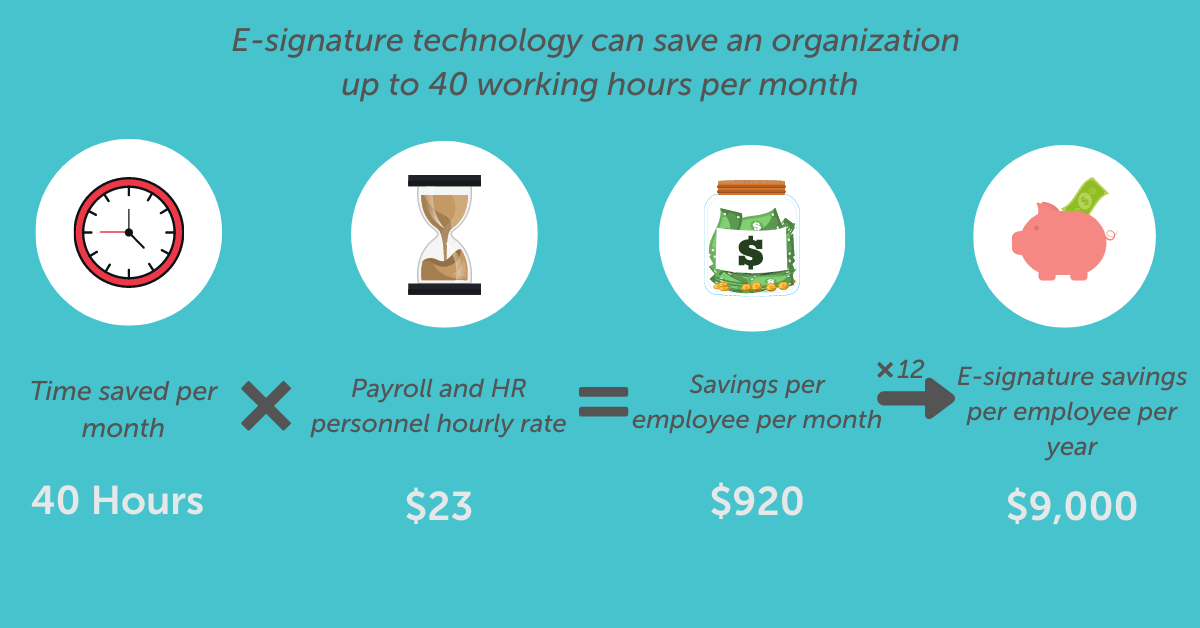

E-signature technology provided by a payroll and HR solution can save an organization up to 40 working hours per month. If you multiply 40 hours by the $23 average hourly rate of pay for a payroll or HR personnel, that’s a yearly savings of $11,040.

SELF SERVICE

Con: Cost of Solution

As with any technological solution, there is a cost to license the software. Most payroll services require a base price, ranging from $10 to $85 per month and a per employee per month (PEPM) fee. Integrations can also result in additional costs. For example, if you want your payroll solution to transfer data to your accounting software, there might be an expense to set up that integration. There may also be charges for additional solutions and services.

These are all things to consider when looking to outsource your payroll. While there is a fee associated with a payroll and HR solution, losing sight of strategic company initiatives to calculate payroll manually can be more costly.

3. Compliance

Pro: Guaranteed Compliance

According to Businesswire, HR and payroll departments spend approximately 36 hours per week on compliance-related activities, ranging from tracking regulatory proposals to creating and communicating new policies. That’s a full-time job!

Two of the most significant benefits of outsourcing payroll are reducing the time spent on compliance and mitigating risk. Each year, the IRS assesses millions of dollars in employment tax penalties. Having a provider who acts as your payroll tax compliance partner and expert is vital to mitigating that risk.

A reputable payroll and HR provider can handle tax filing and payments for you. A company operating this kind of compliance will also stay up-to-date on tax regulation changes.

Note: See if the provider offers a compliance guarantee. This guarantee ensures they will take responsibility if you are assessed a tax penalty due to an error they made.

Con: Your Organization is Ultimately Accountable

If a provider fails to quickly and accurately pay the business’ taxes, the organization is still responsible for those taxes. Not paying them leaves your company vulnerable to compliance fines or penalties.

Luckily, many workforce management providers offer payroll processing with tax compliance. This service means the provider will calculate, file, and pay your taxes as the reporting agent on your behalf.

Note: Ensure the provider utilizes the Electronic Federal Tax Payment System to make payroll tax payments on time.

Learn More Advantages of Outsourcing Payroll Services

Is it A Good Idea to Outsource Payroll?

The answer to this question depends on what the outsourcing payroll risks and benefits are for your company. It’s essential to consider the risks and benefits and how they may impact your organizational processes.

For example, some HR professionals may be reluctant to provide third-party access to confidential company data for payroll processing and tax filing purposes. So it’s essential to perform due diligence and ask what types of security protocols a payroll outsourcing firm employs.

However, many payroll and HR outsourcing providers understand how critical data security is for businesses. They utilize industry-standard security protocols and undergo rigorous testing and certification, like SOC 1 Type 2 audits, regularly to ensure customer data is always protected.

Another example is understanding the knowledge and experience a payroll and HR provider brings to the partnership. Many payroll management outsourcing services require their support staff to be certified by the American Payroll Association (APA).

This certification verifies and validates an individual’s payroll expertise. Some outsourced payroll providers also have a dedicated tax compliance department on staff. These payroll tax experts handle the correct payments and filings for your company. They assist with federal, state, and local taxes to ensure your business maintains compliance.

If you’re still undecided on the pros and cons of outsourcing payroll to a third-party company, consider the following questions:

- How much time is manual payroll processing taking away from strategic initiatives?

- Is your organization experiencing growth, or will it in the future?

- How are you tracking employee time and attendance?

- What is your plan for managing payroll tax compliance?

- Do the risks of outsourcing payroll services outweigh the benefits to your organization?

There is a lot to think about when considering HR and payroll outsourcing. Partnering with a provider that offers payroll management outsourcing services can bring value to your business. The benefits of outsourcing payroll functions include time savings and reduced compliance risk. Consider the advantages and disadvantages of payroll and benefits outsourcing for your organization before you make a decision.

How APS Can Help

APS has been providing award-winning payroll and tax compliance services for over 20 years. Our all-in-one payroll and HR platform ensures accuracy for all payroll and reporting processes, eliminating manual data entry. Our experienced payroll tax compliance staff operates on your behalf as the reporting agent*. We’re a payroll tax partner you can trust, with a negligible tax fee ratio of 0.000001% per $700 million in payroll tax payments processed.

Contact us or call 855.945.7921 today to learn more about how we can help make payroll and HR easier for you.

*APS guarantees tax payments and filings to be accurate and timely, as long as the data provided to APS is accurate and timely, and the customer’s account is sufficiently funded to cover all payroll tax liabilities. If a tax penalty results from our error, we’ll maintain the abatement process and absorb any fines or interest due.