What is On-Demand Pay?

On-demand pay, or daily pay, is a way for employers to give employees access to their wages immediately. This approach eliminates the need for individuals to wait for a standard payday. Employers achieve this functionality in two ways:

- Use an on-demand pay app that integrates with a payroll system.

- Use a payroll provider that offers earned wage access solutions (EWA).

What is Earned Wage Access?

Earned wage access is the system that allows users to receive on-demand pay. It’s the payroll and HR technology component employers use to pay workers portions of their earned wages each day.

*Note: Some providers might require a convenience fee to run this portion of their system. Check the terms and conditions of your bill pay with your existing payroll provider.

What are the Different Types of Pay Frequencies?

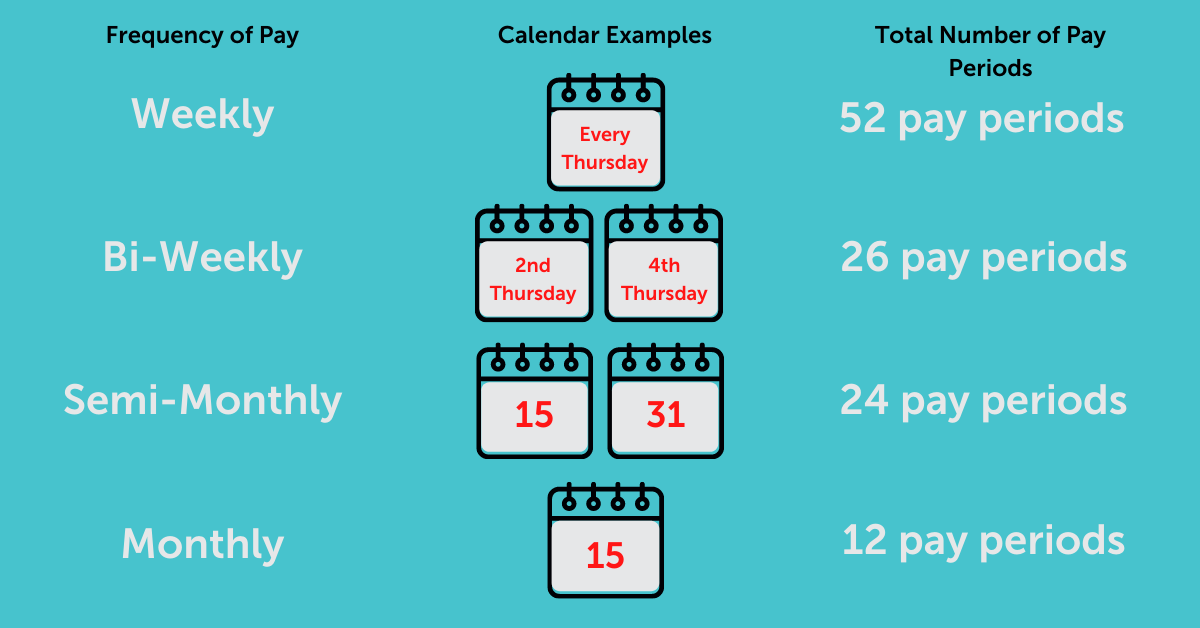

Pay frequency determines how often employers pay employees. A pay frequency determines how often employees are paid, designated by the amount of time between paydays. The most common pay frequencies are:

- Weekly: An employer pays an employee once every week on the same day.

- Biweekly: An employer pays an employee once every other week, on the same day.

- Semi-monthly: An employer pays an employee twice per month on the same dates.

- Monthly: An employer pays an employee once per month on the same date.

4 Ways On-Demand Pay Benefits Employers

1. Reduce Employee Turnover

A study conducted by the Federal Reserve found that 40% of Americans couldn’t cover an unexpected expense of $400. That number has almost doubled two years later, where 75% of workers say they live paycheck to paycheck. As this year of uncertainty continues, more HR managers are searching for ways to stabilize employee paychecks and reduce turnover.

Checkers and Rally’s Restaurants, Inc wanted to solve its high employee turnover problem. The company decided to pilot a new on-demand pay frequency in 22 of its Tampa, FL, restaurants. If the earned wage access solution was successful, they would implement it in the rest of their 250 stores.

Shortly after launching the solution, Checkers and Rally’s started showing improvement. In the restaurants where on-demand pay had been implemented, with a 20% reduction in employee turnover.

2. Improve Employee Engagement

On-demand pay can also increase employee engagement. Many unforeseen expenses can arise between traditional pay periods. Organizations offering instant access to earnings ensure employees don’t resort to payday loans or credit cards. When employees feel that their organization is committed to them, they become more committed to the organization.

In the Checkers and Rally’s example above, employee engagement improved after implementing on-demand pay. According to their Senior Director of People Support, “Once workers realized that if they worked one day, they would get 50 percent of their pay the next day, with the balance of their wages processed on their regular payroll cycle, engagement improved and employees wanted to work more hours.”

Checkers and Rally’s are only one example of on-demand pay’s success. While the company’s primary focus was to reduce turnover, they gained much more in the process. Ultimately, on-demand pay reduced financial burdens for employees. This option increased their desire to work and met the needs of their struggling workforce.

3. Aid in Recruitment Efforts

In addition to retention and engagement, on-demand pay also benefits employers in their recruitment efforts. It’s a real game-changer. That’s because employers that offer on-demand pay are few and far between.

Therefore, employers that do offer it have the unique ability to leverage financial wellness benefits to prospects. If you’re an HR manager for an on-demand company, you can network financial security to prospective employees.

Managers can also recruit with the message that on-demand pay enables employees to meet their financial goals sooner. Employees can access earned money instantly for big purchases or emergencies.

On-demand pay provides a level of instant gratification, positioning employers with the likes of Amazon and Uber. Organizations offering instant pay access can give employees a meaningful pay experience. As more companies like Amazon, Uber, and Instacart emerge, an instant-experience expectations among workers will only increase.

4. Increase Paperless Processes

Even in today’s modern technology era, HR departments spend hours manually processing payroll and cutting paper checks. Instead of focusing on strategy, company culture, and recruitment, HR personnel correct paychecks and reconfigure payroll taxes.

One way businesses can go paperless is by using earned wage access systems that provide on-demand pay to employees. They can implement expedited pay solutions like on-demand using paycards or direct deposit. While direct deposit is the most popular, paycards offer an alternative pay solution for employees who don’t have traditional bank accounts.

Paperless eliminates the need to print and ship paychecks, saving employees time and employers money. In the event of an emergency, payroll processing occurs without missing a beat. Our article, The Benefits of Switching to Paperless Payroll, outlines ways businesses can automate paper processes to focus on more strategic tasks.

Things to Consider With On-Demand Pay

Now that you’ve read about the benefits of on-demand pay, you might consider an electronic payment software. However, before you start implementing an earned-wage solution, here are a few things to keep in mind:

- Does your payroll provider offer this option, and is there an additional charge?

- Will your provider or app meet all federal, state, and local minimum wage, overtime, and payday requirements?

- Will expedited payment methods assist your recruitment efforts, employee engagement, and turnover reduction?

When deciding whether to implement an on-demand solution, think about your organization at large. Will access to online banking help employees pay bills on time? Will the reduction of paper checks mitigate errors and streamline compliance? If instant access to pay will alleviate financial stress for employees and aid HR while helping your bottom line, it’s worth the investment.

How APS Can Help

The APS all-in-one platform offers paperless payroll processing and tax compliance services. Our intuitive payroll process allows you to apply deductions automatically, fix potential errors, and view payroll reports before you process payroll.

Payroll processing can be decreased from 2 days to 2 hours, saving you valuable time and money. Our technology supports a 100% paperless payroll so that you can offer your employees direct deposit and paycard options.

To learn more, call us at 855.945.7921.