APS is pleased to announce a partnership with Immediate, a leading earned wage access solutions provider. This partnership integrates with Immediate to offer employee financial wellness tools with APS’ best-in-class payroll technology.

This article will discuss who Immediate is and how this partnership is beneficial to you. Then, we’ll provide a closer look into how this partnership enhances the APS platform.

What Is Earned Wage Access?

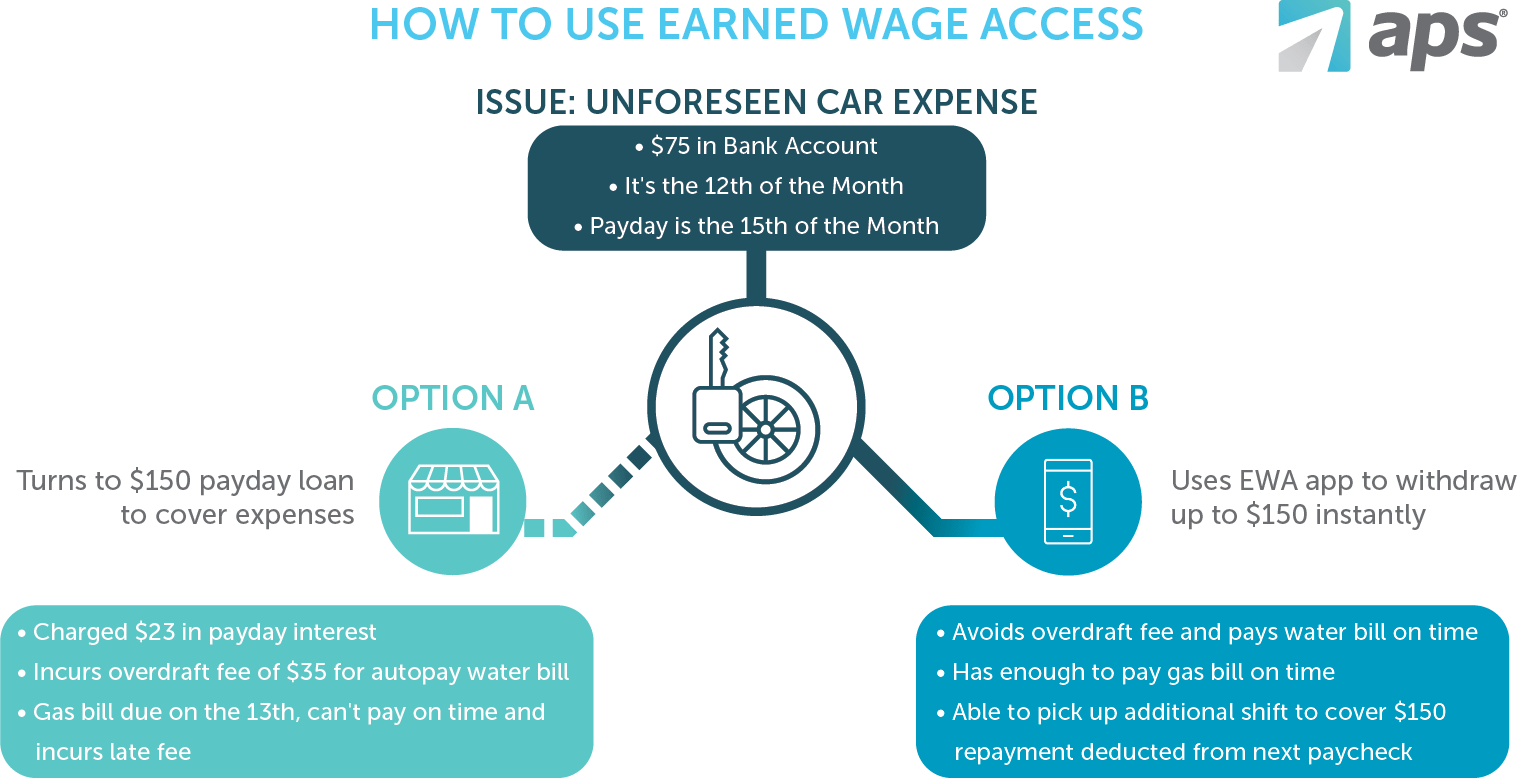

Earned wage access provides employees with access to a portion of their accrued wages before the end of the pay cycle. Earned wage access is a relatively new benefit for employees that focuses on their financial wellbeing. Same-day access to earned wages reduces the need to live paycheck to paycheck and rely on predatory payday loans.

Earned wage access is not a loan and the accessed funds are deducted from an employee’s pay at the end of the pay cycle. Employees gain peace of mind in knowing they can cover unforeseen expenses without worrying about overdraft fees or payday loan interest.

Who is Immediate?

How Does Earned Wage Access Benefit Employers?

The Benefits of APS’ Partnership With Immediate

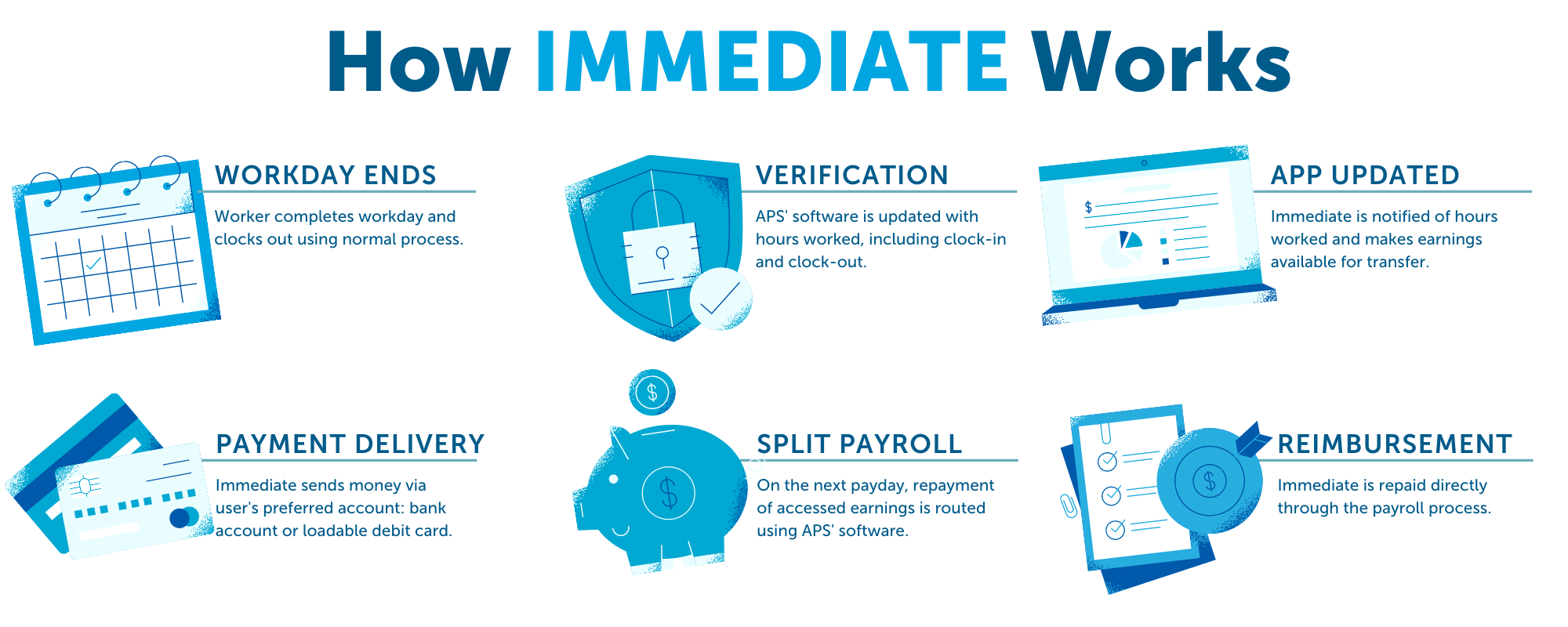

APS’ all-in-one HR and payroll software combined with Immediate’s financial wellness solution helps businesses recruit, engage, and retain employees with on-demand access to earned wages. Employees simply utilize APS’ time tracking management software, which updates Immediate in real-time with hours worked and wages earned.

Earnings are then transferred with the click of a button to a bank account or a loadable debit card. The partnership provides turnkey solutions that support and engage employees on an ongoing and recurring basis. Here are a few more benefits of our partnership with Immediate.

Recruit More Competitively

A recent survey showed that 72% of U.S. workers want on-demand access to their wages. However, most organizations do not offer the option to use an EWA solution. Our partnership with Immediate allows employers to differentiate themselves in the job market and attract top talent by providing on-demand pay.

Employers can stay competitive with their recruitment strategy by offering EWA as part of their employee financial wellness program. Employees will value the option of having same-day access to their earned wages. EWA solutions give workers a healthier financial option to weather unexpected expenses. Instant pay services are a safer alternative to payday loans and predatory lender fees, reaching upwards of 400% interest.

Retain Quality Employees

According to a study by ThrivingWallet, 35 percent of Americans report losing sleep to financial stress. Emergencies don’t occur on a schedule, and people have to pay bills at inconvenient times. Immediate’s EWA solution offers employees the option to access a percentage of their earned wages in between pay cycles.

Employers that offer same-day access to earned income are supporting employees in their financial wellness journey. Workers can request a portion of their wages instead of dealing with payday lenders. When financial stress is eliminated, employers can retain their workers, improve job satisfaction, and reduce turnover.

Evolve Your Payroll Process

With 74 percent of Americans living paycheck to paycheck, employees must have flexible wage access. Immediate’s earned wage access solution helps organizations offer employee pay in real-time, on-demand, or off-cycle. EWA is an option for salaried and hourly workers so that all employees can benefit from this service.

Leveraging This Partnership In Your Organization

Last year, 86% of U.S. workers experienced unexpected expenses, which led to:

- 42% of these employees turned to credit cards

- 25% used high-interest loans

- 20% overdrafts to their accounts

Employees need a safety net that allows them to gain more financial independence and eliminate cycles of debt. APS’ partnership with Immediate will enable employers to play a more active role in their staff’s financial wellness. There are no upfront costs and no contracts to sign. Organizations can be at the forefront of offering this in-demand benefit to their employees and play an active role in their financial wellness.

How APS Makes Payroll Easier

APS has a mission to make payroll and HR easier for its clients. We consistently earn payroll software awards on G2, Gartner, and Digital.com for our award-winning technology and our commitment to the customer experience. These awards demonstrate how our platform’s intuitive design creates a streamlined workflow for accurate and timely payroll processing.

As a payroll provider, we offer the tools necessary to make the payroll process easier. When you utilize APS’ logically designed software, you can reduce your payroll process from days to hours. Here are some ways we help you maximize your payroll efforts:

- Payroll Batch Comparisons: Compare previous and pending payrolls to catch any variations in incomes, deductions, and tax amounts before processing.

- Error-Checking Algorithm: Our built-in automated processes highlight errors and validate payroll information to make any needed adjustments.

- Payroll Tax Compliance Team: Our certified payroll tax compliance experts use a defined process for the daily management of tax funds to ensure accurate filings and payments.

Schedule a demo with us to learn how we can help make payroll and HR easier for you.