Integrating key business systems is not just a convenience—it’s a necessity. Efficiently managing financial and payroll data is crucial for any organization to make informed business decisions. At APS, we understand the importance of seamless data integration in streamlining business processes. That’s why we’re excited to announce the launch of our QuickBooks Online (QBO) integration.

The APS and QuickBooks Online integration automates the General Ledger data to save time and eliminate manual data entry. In this blog, we’ll discuss how the cloud-based QuickBooks Online integration works and how it solves the challenges of unifying payroll and finance data.

Why Develop the QuickBooks Online Integration?

At APS, our focus is on enhancing the customer experience. We seek feedback regularly to understand and address our clients’ needs. A recurring theme emerged from these conversations: many of our small business customers use QuickBooks Online as their primary accounting software but struggle with issues like:

-

Relying on their CPA to make journal entries monthly, quarterly, or annually -

Dealing with inaccurate or outdated financials since payroll is processed in a different system -

Financial reporting that doesn’t provide visibility into labor costs -

Lack of support options or having to pay additional to receive the support they need -

Ability to view classes and accounts

These types of gaps often lead to inaccuracies in financial reporting and unnecessary complications in managing payroll information.

Recognizing these challenges, we developed our QuickBooks Online (QBO) integration as part of our ongoing mission to make payroll and HR easier for our clients.

How Does the QuickBooks Online Integration Work?

With the QBO integration, companies can connect their QuickBooks Online accounts in APS in minutes. Once connected, users can view their chart of accounts in the following sections:

-

Company Wide Expenses (Debits) -

Income Expenses (Debits) -

Employer Expenses (Debits) -

Deduction Liability (Credits) -

Employer Liability (Credits) -

Net Pay (Credits)

QuickBooks Online Configuration Options

Companies will then have configuration options they can choose from:

-

Group payroll data by batch or check date -

Post the General Ledger to QuickBooks Online from APS by check date or at the end of the period -

Exclude employer deduction amounts from the General Ledger (employer match amounts will not be affected) -

Apply deductions to employees’ base departments

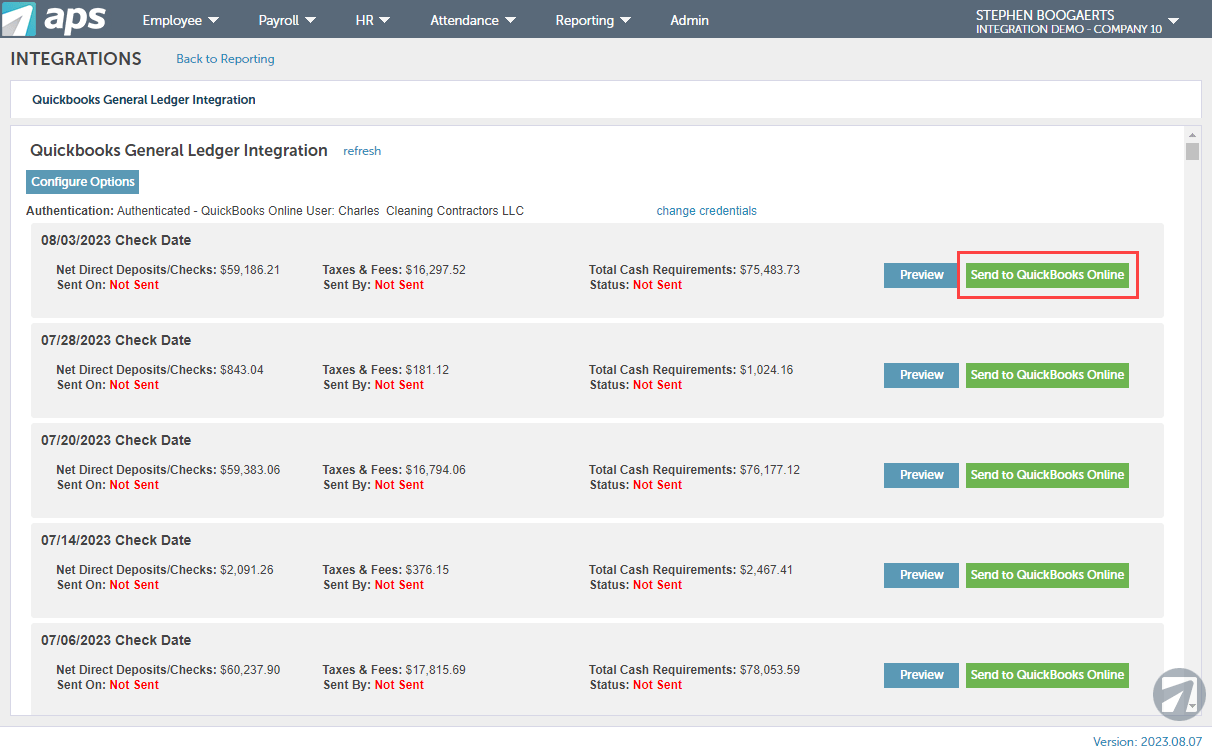

Once the integration is configured, businesses can sync payroll data to QuickBooks by either check date or payroll batch date. Our QuickBooks integration brings payroll and finance data together in the General Ledger. HR managers save valuable time with accurate, automated data management.

QuickBooks GL Preview

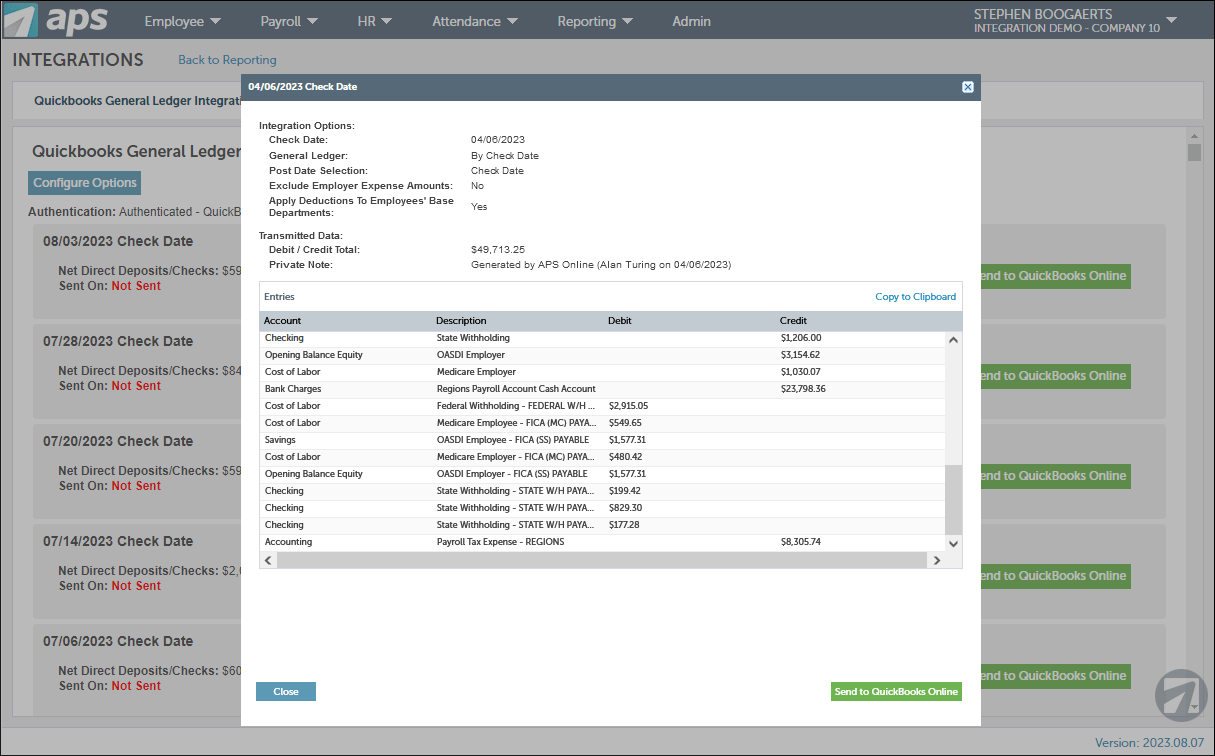

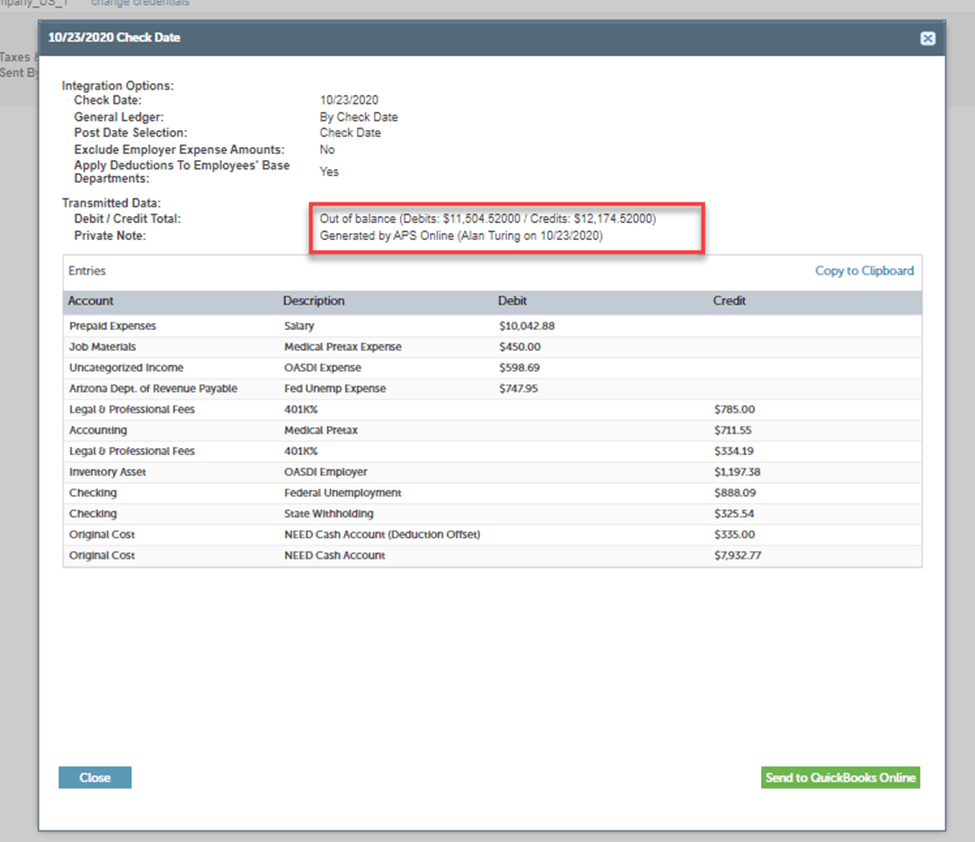

Users can preview the QuickBooks General Ledger in APS OnLine for the desired check date by selecting Preview. If the GL is out of balance, an error message detailing the Debits total against the Credits total will appear. This functionality allows the user to verify the setup and mapping of accounts with QuickBooks and view any errors if something isn’t mapped.

QuickBooks General Ledger preview in APS OnLine

Out of Balance Error Message in the GL Preview

After previewing the General Ledger data with no errors, it’s time to sync it to QuickBooks. A successful confirmation pop-up will appear, validating the submission.

Sending Payroll Data to QuickBooks in APS OnLine

Automating the payroll journal posting process will save you valuable time and minimize the risk of errors in your General Ledger. A simple one-time mapping is all it takes to bring your payroll and finance data together.

How Organizations Benefit from the QuickBooks Online Integration

The QuickBooks Online integration offers numerous benefits, significantly improving efficiency and accuracy in financial management for organizations.

-

Time Savings: The automation of data syncing between APS and QuickBooks significantly reduces the time spent on manual data entry. -

Accuracy and Reduced Errors: Manual data entry is inherently prone to errors. Our integration ensures the accurate transfer of payroll information, minimizing mistakes. -

Improved Efficiency: This streamlined process allows HR managers to focus on strategic tasks rather than repetitive data entry, optimizing resource use. -

Real-Time Data Syncing: Financial records are updated in real-time. Payroll processing is immediately reflected in QuickBooks, ensuring that financial statements are always current. -

Enhanced Financial Reporting: Direct syncing of APS payroll data into QuickBooks simplifies generating detailed financial reports, providing a clearer picture of financial health and labor costs. -

Compliance Management: APS handles tax calculations and deductions. Integration with QuickBooks ensures compliance with tax laws and accounting standards.

Bringing Payroll and Finance Together

Integrating APS with QuickBooks Online offers an efficient, streamlined process, significantly reducing manual payroll and financial reporting tasks. By bridging these two critical systems, businesses can achieve higher accuracy and efficiency, contributing positively to their operations. This integration further strengthens our commitment to simplifying payroll and HR tasks for our clients, continuing our mission to deliver exceptional customer experiences.

If you’re a current APS client, the QBO integration is available in your Early Access admin settings. You can visit the APS Help Center for more information about how to set up the QuickBooks integration.

If you’re interested in learning more about our integration with QuickBooks Online, reach out to your support team or contact us.