Do Churches Pay Employment Taxes?

Dealing with payroll taxes is a complex task, and when it comes to church payroll taxes, the challenges are even more unique. How does the IRS define a church? What sets clergy members apart from regular church employees? Do churches indeed pay payroll taxes? These are the types of questions we’ll answer.

This article provides an overview of what payroll taxes churches pay and how compliance differs for religious institutions. We’ll also discuss how a knowledgeable payroll and tax compliance partner, experienced in church payroll taxes, can streamline this process.

What is Considered a Church or Religious Organization Under the IRS?

When determining what qualifies as a church or religious organization under the IRS, it’s essential to understand the specific criteria and definitions outlined by the IRS. Here are the factors that define a church or religious organization according to the IRS:

Defining a Church

The IRS does not have a rigid definition of a church, but it provides guidelines that include several characteristics commonly associated with churches. These characteristics help to determine if an organization qualifies for tax-exempt status under Section 501(c)(3). They include:

- Distinct Legal Existence: The organization must be legally recognized as a distinct entity.

- Recognized Creed and Form of Worship: There must be a specific set of beliefs and a recognized system of worship.

- Definite and Distinct Ecclesiastical Government: The organization should have a clear governance structure.

- Formal Code of Doctrine and Discipline: A formalized set of doctrines and practices should be established.

- Distinct Religious History: A church typically has a historical presence or continuity of religious beliefs.

- Membership Not Associated with Any Other Church or Denomination: Members are usually exclusive to that church.

- Ordained Ministers: Churches often have formally trained and ordained ministers.

- Regular Religious Services: The organization holds regular worship services.

- Regular Congregations: There should be a stable and regular body of members.

- Religious Instruction for the Young: Many churches provide religious education for children.

- Schools for the Preparation of Ministers: Churches may have educational institutions for training clergy.

Defining a Religious Organization

While churches are a specific type of religious organization, the IRS also recognizes broader categories of religious organizations, which must meet specific criteria to be tax-exempt. These organizations might not have all the characteristics of a church, but they still serve religious purposes. They include:

- Primary Purpose of Religion: The organization’s main purpose must be religious.

- Non-Profit Status: The organization must operate on a non-profit basis.

- Organized for Charitable, Religious, Educational, or Scientific Purposes: This aligns with Section 501(c)(3) requirements.

Considerations for Tax-Exempt Status

To be recognized as tax-exempt, churches and religious organizations must adhere to the following:

- No Substantial Part of Activities Can Be Political: Engaging in political campaigns or substantial lobbying activities can jeopardize tax-exempt status.

- Non-Discrimination: They must not engage in discriminatory practices based on race, color, or national or ethnic origin.

- Compliance with IRS Filing Requirements: Although churches are automatically considered tax-exempt and do not need to apply for exemption or file annual information returns, they may still be required to submit certain forms under specific circumstances.

Thanks to the First Amendment of the United States Constitution, churches are automatically granted tax-exempt status. They don’t have to file any paperwork with the IRS to receive their tax exemption. However, in certain circumstances, churches may still choose to file with the IRS to recognize their tax-exempt status officially.

Unrelated Business Income Taxes

Nonprofit organizations and churches do not have to pay income taxes on unearned income. This guideline includes donations, grants, gifts to the organization, and investment income. However, they are still subject to income taxes on unrelated business income for their profits.

This tax is called the unrelated business income tax (UBIT). Churches that earn an unrelated business gross taxable income of $1,000 or more in a tax year must file Form 990-T, Exempt Organizations Business Income Tax Return, for that tax year. Income earned from thrift shops, volunteer work, donor lists, low-cost giveaways, and advertising is not subject to UBIT. For income to be classified as UBIT, the activity must:

- Constitute a trade or business

- Be regularly carried on

- Not substantially related to the church’s exempt purpose

UBITs can also hurt a church’s tax-exempt status. Generally, if more than 15% of the religious group’s total earnings come from unrelated business income, the organization risks losing its tax-exempt status. There are two exceptions for UBITs, though:

- If “substantially all” of the labor for the trade or business is provided by volunteers.

- If “substantially all” of the merchandise sold was donated to the organizations, e.g., bake sales and thrift stores.

Do Church Employees Pay Taxes?

If you work for a church, do you pay taxes? The simple answer is yes; paid church employees are considered employees by the IRS for income tax purposes.

Churches must withhold income taxes from employees who are not ministers and report their income on a Form W-2. Churches are exempt from paying federal unemployment taxes for all employees.

Understanding Form W-4 for Church Employees

All church employees who are not ministers should complete IRS Form W-4, Employee’s Withholding Certificate, when hired. This form determines the amount of federal income tax the church should withhold from each paycheck.

Since ministers have different tax obligations, they typically do not complete a Form W-4 unless they’ve chosen to enter a voluntary withholding agreement. Churches should keep all employee W-4s on file and update them if an employee’s filing status or withholding preferences change.

Do Churches Pay Payroll Taxes for Pastors?

Churches should still issue ministers a Form W-2, even though they are considered self-employed because of their dual tax status. The answer to the question, “Do churches pay payroll taxes?” is more complicated for ministers, pastors, and clergy members. Most ministers have a dual tax status. Their ministerial income qualifies them as self-employed for Social Security purposes, and they are considered church employees for income tax purposes.

Church Employees and Federal Income Taxes

Yes, churches are required to withhold income taxes for their employees. However, clergy are treated differently because of their dual tax status—they’re considered employees for income tax purposes but self-employed for Social Security and Medicare (SECA) taxes.

Ministers are responsible for making quarterly SECA payments unless they enter a voluntary withholding agreement with their church. By voluntarily withholding taxes, the church deducts both income and estimated self-employment taxes from the minister’s pay, eliminating the need for separate quarterly payments.

This arrangement helps avoid late payment penalties and ensures timely tax compliance. The church reports these withholdings on Form W-2 and Form 941 as additional federal income tax—not Social Security or Medicare taxes. Church Employees and FICA (Social Security and Medicare)

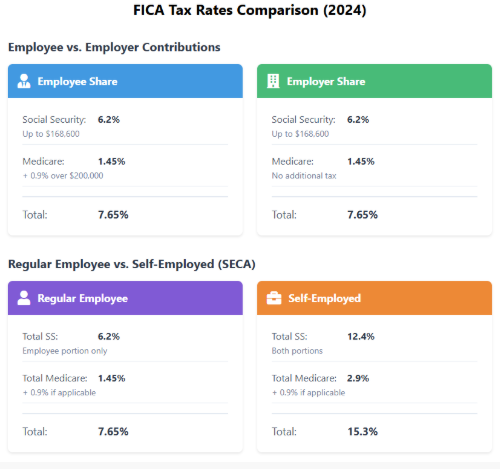

Churches must pay Social Security and Medicare taxes (FICA taxes) for non-clergy employees in addition to withholding federal income from their wages, according to the Federal Insurance Contributions Act (FICA).

Do Church Employees Pay Social Security Taxes?

Because clergy employees are generally considered self-employed, they are responsible for FICA tax obligations. The 7.65% FICA tax, as well as Social Security and Medicare taxes, are not withheld from a minister’s pay, and boxes 3, 4, 5, and 6 on their Form W-2 are left blank. Ministers are still responsible for paying the 15.3% SECA tax.

Suppose specific public insurance policies go against the religious beliefs of the church. In that case, ministers can file Form 4361 with the IRS to be exempt from self-employment taxes for their ministerial earnings. File this form by the income tax return due date for the second tax year in which a minister’s net earnings from self-employment are at least $400. These two years do not have to be consecutive, and the rule only applies if the net earnings came from performing ministerial services.

Housing Allowances Can Impact Church Payroll Taxes for Employees

Housing allowances, also called parsonages or rental allowances, can be excluded from a minister’s gross income for income tax purposes, but not from SECA taxes. To qualify, the allowance must be officially designated before payment, used within the same year, and cannot exceed the approved amount on the tax form.

The amount used to provide the home and the home’s fair market rental value can be exempt from a clergy employee’s gross income. This value includes furnishings, utilities, and other home appurtenances. All expenses related to maintaining and running a household can be deducted as a housing allowance.

The IRS provides requirements for ministers who qualify for a housing allowance. However, the church determines which of its clergy employees are qualified to perform these essential functions:

- Ministers must have the ability to perform priestly functions.

- Ministers must be considered necessary to the overall worship experience.

- A board resolution must recognize ministers and have written documentation.

What About Independent Contractors Compensated by the Church?

The first step is determining if the worker qualifies as an independent contractor according to the IRS. Here are the questions to ask to define proper classification:

- Does the company control or have the right to control what the worker does and how they perform their job?

- Does the payer control the business aspects of the worker’s job?

- Are there written contracts or employee-type benefits (e.g., pension plan, insurance, vacation pay, etc.)?

- Will the relationship continue, and is the work performed a vital aspect of the business?

Still Have Questions?

For more information on how the IRS classifies employees versus independent contractors, see IRS Publication 15-A. The IRS also recommends filing Form SS-8 should an organization need help classifying employees versus independent contractors.

If the church considers a worker an independent contractor, the worker must complete Form W-9, Request for Taxpayer Identification Number and Certification. Churches must retain a copy of the Form W-9 for at least four years in case of an IRS audit. It’s also essential for religious organizations to keep a Form W-9 for paid guests and contractors, even though they are not required to file a Form 1099.

Churches must complete Form 1099-NEC, Nonemployee Compensation for independent contractors. Form 1099-NEC reports payments in excess of $600 for services completed by nonemployees.

Copies of the form must be submitted to the IRS and sent to the independent contractor. Churches must submit both documents by January 31 of the year following payment.

If a church classifies a worker as an independent contractor but the IRS reclassifies that worker as an employee, the church may be liable for substantial fines. This type of error highlights the importance of having an HR partner who understands payroll tax complexities. They can help an organization better comprehend how to classify workers.

How APS Can Streamline Your Church Payroll

Do churches pay taxes? It’s easy to see why church payroll taxes are complex and why it’s crucial to manage church employees and taxes correctly. The two biggest questions we answered were:

- Do churches pay employment taxes?

- Do employees of churches pay taxes?

The answer is the same for both of these questions. Yes, but it depends on the church employee and their duties. That’s why you need a payroll and HR partner who understands the complexities of church payroll services, such as payroll for clergy and payroll for church employees.

Since 1996, we’ve worked closely with churches to provide the necessary tax compliance expertise. We’ve learned the biggest frustrations that religious organizations face are:

- Their previous payroll partner did not accurately deduct and report housing allowances for their ministers.

- They are burdened with inaccurate tax reporting and filing for tax-exempt incomes versus UBITs.

- They struggle with employee classifications for clergy people versus the rest of their workforce and the tax deductions associated with those employee types.

At APS, we help churches manage parsonages, minister taxes, and dual tax statuses while accurately tracking employee time and pay across multiple campuses to avoid IRS penalties and maintain tax-exempt status. For Sage Intacct users, our automated general ledger integration supports dimension tracking, enabling easy allocation of grants and funds to the correct employees and locations.

Additionally, our team often connects with ministry leaders at events like the Texas Ministry Conference, including members of The Church Co+Op, to share how APS supports faith-based organizations with tools that simplify payroll and compliance.

To learn more about how APS helps churches, contact us today.

Sources

- Clergy Advantage | Who Qualifies for Housing Allowance

- Topic No. 417, Earnings for Clergy

- Publication 1828, Tax Guide for Churches & Religious Organizations

- Unrelated Business Income Tax | IRS

- Tax Reporting for Houses of Worship

- What Is FICA? | XOA Tax

- About Form 4361

- Topic no. 417

- Independent contractor (self-employed) or employee?

- About Publication 15-A

- About Form W-9

- About Form 1099-NEC