How has your restaurant handled the new Fair Labor Standards Act (FLSA) rule for tipped employees? The ruling has left restaurant owners with new minimum wage calculation requirements. Therefore, it’s essential to understand how they impact your business.

This article will discuss the new regulation and explain how it affects your restaurant’s tipped employees. Below, you’ll also find out what determines tipped and non-tipped work and how to calculate those wages. Read on to ensure that your restaurant remains compliant.

What is the FLSA Rule for Tipped Employees?

The U.S. Department of Labor (DOL) announced a rule limiting the amount of time an employer can claim tip credit towards the minimum wage for tipped employees. The regulation was amended to clarify that employers may only take a tip credit when the tipped employees perform tasks within the scope of the employee’s tipped occupation.

This guideline includes tip-producing work and work that directly supports tip-producing work, providing that the latter is not performed for a substantial amount of time.

Payroll Doesn't Have to be Hard

How Has the FLSA Change Affected Your Restaurant?

The tipped minimum wage change is challenging for restaurants due to the fast-paced nature of their work. Restaurant employers need to track their employees’ duties accurately. The FLSA update details when an employer should pay the tipped employee a minimum cash wage or the full minimum wage.

To ensure you’re paying your employees accurately, make sure you’re tracking your tipped employee’s duties, categorized into:

- Tip-producing work

- Directly supporting work

- Work that is not part of a tipped occupation

You can ease this process by utilizing an online system where your employees can easily log their hours via a mobile app.

What Defines a Tipped Employee?

According to the DOL, a tipped employee is a person who works in a job that typically receives more than $30 per month in tips. These tips include amounts designated as a tip on the charge slips by customers who pay via credit card.

The employer is typically only required to pay a tip credit of $2.13 per hour in direct wages if that amount, combined with the tips that the employee receives, equals the federal minimum wage. If it does not equal the federal minimum hourly wage, the employer will need to make the difference.

Depending on which state your restaurant is in, the direct wage amounts for tipped employees may be higher. Refer to the DOL for a complete list of tipped minimum wage by state.

Are Tips Included in the FLSA Regular Rate of Pay?

Generally, the FLSA requires that covered and nonexempt employees receive at least the federal minimum wage for their regular working hours and overtime pay at no less than time. Meanwhile, employers must pay their employees one-half the regular rate of pay for all hours worked over 40 hours in a workweek.

In this opinion letter issued by the DOL, any tips received by an employee in excess of the tip credit need not be included in the regular rate of pay. However, the tip credit should not exceed the amount of tips received and may not exceed $5.12 per hour under the current minimum wage.

What is the 80/20 Rule in Restaurants?

The new law for tipped employees reinstates a revised version of the 80/20 rule. Under the 80/20 rule, employers may utilize the tip credit if:- 80 percent or more of the employee’s weekly work hours are tip-generating

- No more than 20 percent is directly supporting work

For example, servers need to perform other tasks such as setting tables, folding napkins, stocking the busser station, and more when not waiting on patrons.

If an employee’s directly supporting work exceeds 20% of their work hours or exceeds a continuous period of 30 minutes, you must pay them the full minimum wage of $7.25 per hour.

With this new rule enforced, it can be highly challenging to manage shift planning and time tracking, particularly if you have employees doing various categories of work. Leveraging a transparent restaurant policy and employing the right technology can help you stay compliant while efficiently managing timekeeping, scheduling, and overtime calculations.

When to Pay a Tipped Employee Cash Wage or Full Minimum Wage?

Now let’s discuss when you need to pay your FLSA tipped employees a minimum cash wage or full minimum wage.

First, you will need to understand the three categories of work that a tipped employee performs:

1. Tip-producing work

2. Directly supporting work

3. Work that is not part of tip-producing work

1. Tip-Producing Work

Tip-producing work encompasses all customer-facing tasks that a tipped employee performs, earning them tips. For restaurant servers, this includes servicing customers, taking their orders, retrieving cooked food and then serving it to customers, collecting payments, and removing plates during and after the meal.

At times, this can also include kitchen work that directly affects their tip-producing tasks, such as garnishing a dish before serving and other similar duties. As the employee will be receiving tips while performing these tasks, they will be earning a minimum cash wage instead of the full minimum wage.

2. Directly Supporting Work

Directly supporting work refers to tasks that do not generate tips but are part of a tipped employee’s duties as it helps them perform tip-producing work. These tasks include setting tables, folding napkins, stocking the busser station, and other similar duties. Time spent waiting for customers to arrive (even if the employee is not necessarily doing anything) also counts as directly supporting work.

You can pay tipped employees the minimum cash wage if the amount of time they spend performing directly supporting work isn’t substantial. To determine this, use the 80/20 Rule—if the time they spend performing these tasks does not exceed 20% of their weekly work hours or 30 consecutive minutes, you may pay them the minimum cash wage. Otherwise, you must pay them the full minimum wage rate of $7.25 per hour.

3. Non-Tip-Producing Work

Finally, we have non-tip-producing work, which comprises tasks that neither generate tips nor support tip-producing work. These include preparing food, cleaning the kitchens or bathrooms, and cleaning anywhere else that isn’t in the immediate area of the tipped employee’s workstation.

As these tasks do not contribute to tip-producing work, you are legally required to pay your employee the standard minimum wage rate of $7.25 per hour.

What is a Tip Credit?

The bulk of a tipped employee’s earnings come from customer tips. Therefore, a tip credit is implemented to reduce the amount of wages the employer pays.

The tip credit refers to the amount of money an employer can offset from the amount of tips that the employee receives. This monetary difference makes up the amount that the employer pays for them to achieve the highest applicable minimum wage amount.

Employers are not allowed to take a tip credit from non-tipped workers—they must pay them a minimum wage.

How to Calculate Tip Credit for Your Restaurant

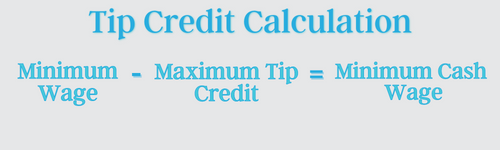

Most states do not subject tipped workers to the same minimum wage as non-tipped workers. Instead, they get a minimum cash wage, calculated by subtracting the minimum wage by the maximum tip credit.

Refer to the DOL page on the minimum wages for tipped employees to determine the maximum tip credit according to your state.

The FLSA sets the federal minimum wage and federal maximum tip credit, which is applicable to states that do not have a state minimum wage. The federal minimum wage is $7.25 per hour and the federal maximum tip credit is $5.18, which makes the federal minimum cash wage $2.13. Hence, $2.13 is the amount that you’ll need to pay your tipped employee when they perform tip-producing work and unsubstantial directly supporting work.

How APS Can Help

The new ruling on federal minimum wage for tipped employees can seem challenging for restaurant employers to adapt. However, partnering with the right payroll provider will ease the burden of maintaining a restaurant tip policy for employees.

APS’ unified attendance solution simplifies time and labor management to ensure your restaurant accurately tracks employee hours and stays compliant. Our restaurant payroll software makes it easier to manage tip regulations with FLSA so that you can focus on a better employee and customer experience.

APS’ unified payroll system and tax compliance services can help you:

- Manage employees’ schedules and accurately track time

- Automatically track employees based on their classification

- Ensure accurate payroll processing

- Manage tip-to-min calculations and overtime pay

- Calculate tip credits accurately

- Manage complex restaurant reporting, like tip credit reporting on Form 8846

- Keep up with federal, state, and local taxes

- Integrate with existing point-of-sale and accounting systems

- Run reports for salary exempt versus salary non-exempt employees per pay period

- Store important company and employee documents securely in our cloud-based solution

To learn more, schedule a demo today.