The Relationship Between HR and Finance

Today’s HR duties associated with labor, payroll, and salary administration were traditionally financial officers’ tasks. The phrase “human resource” was even created by an economist in the late 1800s. But, as time went on, the focal points of HR changed. Financial projections traditionally used for onboarding had to make room for personalized training programs. Even though finance and HR have a historical relationship, the two departments have spent the past few decades struggling to work together towards organizational goals.

This opposition between departments is primarily attributed to differences in business mindsets. The language of finance is mainly number-driven, which means most financial departments prefer an overview of how an expense will bring a valid return on investment. Meanwhile, HR views new employees as a human return on investment. For HR departments, recruiting and hiring employees are justifiable expenses that don’t need to demonstrate ROI.

While these two departments have often been on different sides of the business equation, there is a lot of overlap. Both finance and HR work towards a common goal of higher workforce performance and profitability. HR needs to consider the cost and benefits of onboarding new employees, and so does finance.

Likewise, HR must put company policies in place that ultimately impact the profitability of the organization. All of these combined factors are why HR must speak the language of finance and vise versa.

Why Integrate Human Resources and Finance?

According to America’s Back Office, 50% of a Chief Financial Officer’s time is spent handling HR-related functions. Why? The costs of recruiting, hiring, and onboarding, new talent is often an organization’s most significant expense. The costs are so considerable that the United States average company spends approximately $4,000 hiring a new employee.

With human resource initiatives costing so much, an HR and finance integration makes logical sense. A company can benefit immensely from an alignment between HR and finance. Finance can help HR make data-driven hiring decisions. Meanwhile, HR can help finance align employee incentives with budget forecasts. As a result, more informed decisions are made, labor expenses decrease, and the employee retention rate increases. Let’s look at a few more reasons why integrating HR and finance may be beneficial to an organization.

Labor Costs Continue to Increase

Salary

Many HR factors affect salary amounts, such as job seniority, job type, salaries for similar positions, salaries for different functions, and the job market. While HR personnel sometimes utilize calculators and tools to determine salary amounts, it’s equally crucial for HR to involve the finance department in these decisions.

Compensation changes affect the company-wide budget. An individual salary increase could shift a department’s account into a net loss, requiring revenue to be pulled from other income streams to make up the difference. Similarly, a bonus structure that isn’t mapped out against a system of checks and balances can cause ripple effects throughout an organization.

Benefits

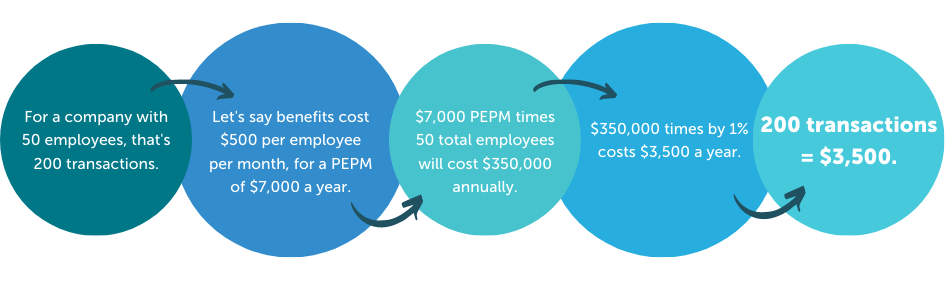

The cost associated with benefits dramatically impacts an organization’s overall financial decisions. However, when people think of benefits, health insurance is often the only thing that comes to mind. While health insurance is a benefit, items like tuition reimbursement, sick leave, sign-on bonuses, and maternity leave also make up an organization’s offerings. Because of the large number of benefit offerings, labor costs have been increasing for HR departments globally. According to a study by Benefits Pro, benefits cost the average employer $21,726 annually per employee.

With such high costs, HR and finance departments must work together to determine the company’s best offerings. Sometimes benefits are more critical to a job candidate than the salary itself. This situation places HR departments in a delicate role of balancing salary offerings and benefits to keep the company competitive. Working with a financial department that understands how to forecast budgets and map out company projections ensure informed decision-making about employee offerings.

Leverage Data to Improve the Bottom Line

Cloud-based HR technology that integrates with finance data opens up a world of possibilities for both finance and HR. According to a PWC study, the average organization utilizes 3-4 separate systems to accomplish their HR and Finance functions. Multiple departments operating different systems lead to duplicate data entry, errors, and hidden costs. Such costs include the $310 that the average company spends per employee per year on HR technology.

With so much focus on recruiting, hiring, and onboarding, HR can overlook technology costs such as those pictured above. These costs are why finance and HR collaboration can positively impact an organization’s bottom line. A technological integration between the two departments allows them to transfer data fluidly and mitigate extra expenses associated with multiple system transactions.

For example, HR data such as employee headcount housed within a unified system is automatically available for other workflows like benefits administration and time tracking. This automation eliminates the need for multiple HR systems, reducing costs.

Likewise, the data in a unified solution is also available for use in other departments like finance. HR can utilize employee headcount data to determine business recruiting needs. Meanwhile, finance can use the HR data to assess key expense metrics around how many new hires the company can afford.

Want to Plug Profit Leaks in Your Organization?

Hiring Decisions Aren’t Just Financial Decisions

In addition to labor costs and HR data, the impact that an HR and finance collaboration can have on employee hiring and retention is also high. Finance departments have tendencies to look at new hires as financial assets. This approach means hiring and training administrative costs have large allocations on a company’s general ledger.

While these costs are significant to budget and track, it’s just as important to view employees as humans. Finance needs to remember that new hires are team members and leaders contributing individually to the workplace’s overall performance.

Finance managers must go beyond considering employees as costs to determine ways to improve profitability. It’s not enough to estimate the impact of salary increases, bonuses, and other motivational programs on the company’s profitability. Finance also needs to consider the impact employee churn has on the bottom line.

It costs the average organization 50-60% of an existing employee’s salary to find a replacement hire. For example, if Jill makes $60,000 per year and decides to leave, the organization will spend approximately $23,000 to replace her. That’s a lot of money for a business to spend continually. The good news is HR and finance collaboration can help mitigate this cost.

While finance departments focus on allocating future dollars to new hires and team growth initiatives, HR can focus on employee retention initiatives. Many HR personnel leverage HR platforms to track why employees leave an organization. That data can be used against finance projections to make decisions that improve employee retention.

Instead of investing money only in recruiting and onboarding efforts, finance can distribute the budget into other categories that increase employee engagement. If most employees said they left the company because of PTO policies, finance could allocate a specific amount to increased PTO time, which will improve employee retention.

In addition to this approach, a unified HR platform provides “flight risk” data that helps organizations determine who might leave the company. Finance and HR can use this data to develop strategies for these employees moving forward. HR can work with finance to budget resources that will retain “flight risk” employees influencing others in the organization. Similarly, finance can work on an alternative budget to replace the “flight risk” employees if someone decides to leave.

HR and Finance Working Together Provides Flexibility

Most of the time, finance and HR have different priorities when it comes to technology. Finance wants something that’s cost-efficient to get the job done, with quick insight into an organization’s expenses. HR needs a tool that allows for total employee lifecycle management and easy data accessibility. Typically, one department has to sacrifice their needs in a solution because there’s simply not enough in a budget for both to get what they need. However, when both departments work together, HR and finance go from a push-pull relationship to a winning collaboration.

When CFOs and HR managers work together, their tasks shift from reactive to proactive. It’s easier for finance to allocate funds towards company policy initiatives when kept in the HR data loop. Likewise, HR can determine the number of employees needed to keep the workforce running when finance is proactive in communicating with HR how many employees the business can afford to hire.

A collaboration between CFOs and HR managers is essential when utilizing HR workforce technology that adequately captures, analyzes, and reports workforce and labor data. When both entities use an integrated hr and finance system, they can:

Conduct benefits administration entirely online.

- Process time cards more efficiently.

- Keep compliance in check.

- Align employee retention and onboarding costs with budgeted forecasts.

CFOs and HR managers are two sides of the same coin, and joining forces leads to more data-supported conversations about the drivers of corporate performance. According to Ernst & Young, companies where the CFO and HR are strong collaborators experience:

- Faster Growth: 41% experienced earnings before interest, tax, depreciation, and amortization (EBITDA) growth greater than 10%

- Better HR Performance: 44% saw a significant improvement in employee engagement

- Higher Workforce Productivity: 43% saw significant improvement in workforce productivity

HR and finance working together means each department is kept in the loop, leading to organizational prosperity and decreased department sacrifices.

The Workplace - As We Once Knew it - is Gone

While the past few decades have pushed HR and finance departments to have individual responsibilities, 2020 has taught us that the workforce needs to evolve continually. The days of ‘The Office’ where everyone worked under the same roof have been replaced with hybrid teams, 100% remote workforces, and flexible schedules. Landlines and CD Roms have paved the way for cell phones, workforce apps, online chats, and AI automation.

This increased workforce flexibility creates a greater need for HR and finance collaboration throughout organizations and within company departments. HR needs to be able to collaborate with finance regardless of location. Likewise, finance needs HR’s personalized initiatives to maximize its data-driven objectives. This dual necessity is why finance and HR must collaborate.

How Does Human Resources Work With Finance?

HR works to provide the finance department the data they need for visibility into the business’s financials. Finance and accounting don’t necessarily need to access the details required in HR reporting. However, they need a high-level overview of HR’s costs and expenses, as payroll is typically the most considerable expense. When HR and finance combine interests, both the financial results and the business results of this collaboration scale together.

Finance depends on HR to accurately track employee information. This kind of information includes how many hours employees work, locations they work at, overtime to be paid, benefit deductions, etc. HR needs to know from finance where they stand in the budget to best communicate with employees how they should be working.

So, exactly how can finance and HR work together?

Here are three ways in which HR can work best with their finance counterparts:

- Ensure a collaborative business environment between HR and finance.

- Analyze HR information and make data-based decisions.

- Choose payroll/HR technology that integrates with your finance system.

Essentially, HR provides finance with the data they need to track costs associated with labor accurately. However, for this relationship to work, human and financial resources need to be transparent. That starts with having technology and processes in place to track data for both departments.

APS Can Help Bring HR and Finance Together

APS can help organizations integrate their HR and finance systems through unified data and seamless integrations. Bringing attendance, employee lifecycle management, benefits administration, payroll, and human capital management into an all-in-one solution that integrates with your accounting solution allows for more accurate data transfer.

It also helps align the business’s HR and financial goals. Plus, scaling down to only two solutions provides an additional long-term cost savings bonus and limits profit leaks for the organization.

Brian Sommer

APS’ integration with Sage Intacct’s General Ledger provides finance and HR with the two best-of-breed solutions. The APS and Sage Intacct integration is designed to aggregate general ledger, dimension syncing, and employee record syncing into a single workflow to expand visibility into financial metrics.

Both finance and HR get the data transparency they need in addition to an excellent user experience without compromising on technology, providing optimal customer satisfaction for all involved parties.