Healthcare employers can save thousands with the Work Opportunity Tax Credit (WOTC) by hiring eligible workers. This federal tax credit assists businesses in lowering costs. It also supports the growth and sustainability of the healthcare industry. By expanding the workforce, it creates job opportunities for specific groups.

This guide will explain how WOTC benefits healthcare organizations, which employees qualify, and how to maximize savings. You will also learn how recruiting and onboarding tools can simplify the process.

What is the Work Opportunity Tax Credit (WOTC)?

The WOTC is a federal tax credit that rewards businesses for hiring individuals who face employment barriers. Employers reduce their tax liability while providing job opportunities to workers in need.

In healthcare, jobs such as nursing assistants and senior care providers need less training. Therefore, these positions are more accessible for individuals eligible for the Work Opportunity Tax Credit (WOTC). Hiring from this group helps healthcare employers fill essential roles and save thousands in tax credits while expanding their workforce.

How Much is the Work Opportunity Tax Credit Worth?

The WOTC amount depends on the employee’s hours worked in their first year:

- 40% of qualified wages for employees who work at least 400 hours

- 25% of qualified wages for employees who work at least 120 hours but less than 400 hours

Businesses can accumulate substantial tax savings with no limit on the number of eligible employees.

How Do You Qualify for the Work Opportunity Tax Credit?

Employees must meet specific criteria to qualify for the federal work opportunity tax credit program. One key requirement is to work at least 120 hours during their first year of employment. Additionally, the employee you hire must be a member of one of these targeted groups:

- Formerly incarcerated or those previously convicted of a felony;

- Recipients of state assistance under part A of title IV of the Social Security Act (SSA);

- Veterans;

- Residents in areas designated as empowerment zones or rural renewal counties;

- Individuals referred to an employer following completion of a rehabilitation plan or program;

- Individuals whose families are recipients of supplemental nutrition assistance under the Food and Nutrition Act of 2008;

- Recipients of supplemental security income benefits under title XVI of the SSA;

- Individuals whose families are recipients of state assistance under part A of title IV of the SSA; and

- Individuals experiencing long-term unemployment.

Furthermore, each eligible group of workers has a statutory maximum amount of qualified wages that are WOTC-eligible. The total credit per WOTC employee would be 40% of those statutory limits. Here’s a breakdown of the maximum credits available:

Credit Type | Credit Type |

|---|---|

Receives SNAP (food stamps) | $2,400

|

Veteran Eligibility Based on Disability (hired one year from leaving service) | $4,800

|

Veteran Eligibility Based on Disability (unemployed at least six months) | $9,600

|

Unemployed Veterans (at least four weeks) | $4,800

|

Unemployed Veterans (at least six months) | $9,600

|

All Other WOTC Target Groups | $2,400-$9,000

|

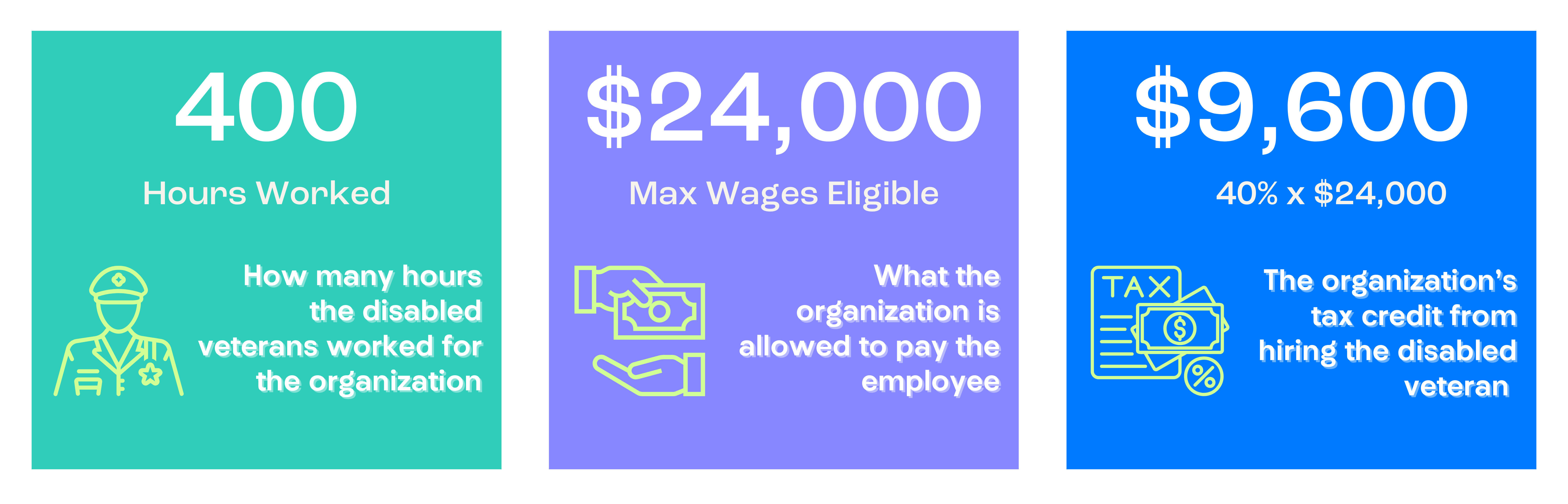

Here’s an example for a qualified veteran, one of the WOTC targeted groups of individuals.

You hire a disabled veteran who has been unemployed for six months in the one-year period ending on the hiring date. The employee performs at least 400 hours of service in their first year of employment, and the maximum eligible wages for such individuals is $24,000. Therefore, if you claim 40% of that amount, you will receive $9,600 in tax credits.

WOTC Groups Explained

In most cases, the maximum wages that qualify for the Work Opportunity Employer Tax Credit is $6,000. However, some specific groups have different maximum wage limits. Groups that meet the WOTC credit eligibility requirements are as follows:

Family received Temporary Assistance for Needy Families (TANF) for at least nine of the last 18 months

These are veterans who served on active duty in the United States armed forces for a minimum of 180 days and have been discharged for at least 60 days. Additionally, they must meet at least one of the criteria below:

- Has a service-connected disability that entitles him or her to compensation and who is within one year of discharge (maximum WOTC-eligible wages of $12,000).

- Member of a family receiving Supplemental Nutrition Assistance Program (SNAP) assistance for at least 3 of the past 12 months

- A veteran who was unemployed for at least six months during the prior year (maximum WOTC-eligible wages of $14,000).

- A veteran who was unemployed for at least four weeks but less than six months during the prior year.

Former felons can be hired within one year of conviction or release.

These are individuals between 18 and 39 who reside in an empowerment zone, enterprise community, or renewal community.

Individuals 18 to 39 years old on the date of hire who are members of a family that received SNAP benefits for the previous six months or at least three out of the last five months.

Individuals with a physical or mental disability who are receiving or have received services under a state vocational rehabilitation program, the Department of Veterans Affairs Vocational Rehabilitation and Employment Program, or an employment network through the Social Security Ticket to Work program.

These are individuals ages 16 or 17 on the date of hire who reside in an empowerment zone, enterprise community, or renewal community and are employed between May 1 and September 15 (maximum WOTC-eligible wages of $3,000).

These individuals have been unemployed for at least 27 consecutive weeks and received unemployment compensation under state or federal law at some point during this period.

These are individuals who are members of a family that has been receiving TANF benefits for the past 18 months or has exhausted TANF benefits in the past two years. Unlike other populations, an employer may claim the WOTC on behalf of a long-term family assistance recipient for two years. The maximum wages eligible for the WOTC for long-term family assistance recipients is $10,000 per year. During the second year of employment, the WOTC is equal to 50% of the eligible worker’s wages.

These are individuals who received SSI under Title XVI of the Social Security Act for any month ending within the 60-day period ending on the hiring date.

Who is Eligible for WOTC?

Employers of all sizes are eligible for WOTC, including taxable and tax-exempt. However, eligible WOTC employers must be located in the United States and certain U.S. territories. According to the IRS, taxable employers claim the WOTC against income taxes.

Eligible tax-exempt employers may claim the Work Opportunity Tax Credit (WOTC) solely against payroll taxes. This requirement applies only to wages paid to individuals classified as Qualified Veterans. To process WOTC-eligible employees, here’s the paperwork you may need:

- A confirmation letter from your state workforce agency showing an employee is eligible for these benefits.

- The completed pre-screening IRS Form 8850 from the eligible employee.

- A completed DOL Form 9061 after the employee starts work.

- A DD214 if your new hire is a veteran and an additional VA letter if the veteran is disabled.

How to Claim WOTC For Your Business

To claim WOTC for your business, you need:

- IRS Form 5884 for partnerships, S corporations, cooperatives, estates, and trusts.

- Or IRS Form 3800, the General Business Credit, for all other taxpayers and business owners.

It’s important to note that if you claim WOTC on employee wages, you cannot reuse them to claim other employee-based tax credits. They include Employer-Paid Family and Medical Leave Credits, Employee Retention Credit, forgivable Paycheck Protection Program loan proceeds, and other disaster retention credits.

Healthcare Employers That Can Benefit From the WOTC

Now that WOTC is explained, let’s discuss how healthcare employers can benefit from this tax credit. Employment in the healthcare field is highly competitive, with many health facilities vying for the same prospects. Selecting from a pool that often gets overlooked may help to fill those positions more quickly. Since there is no limit on hiring WOTC-eligible individuals, the amount of tax credits accumulated can be pretty significant.

Lowering your corporate federal tax liability is another advantage of WOTC. By using it strategically, you may even be able to eliminate your tax liability for many years. Employers can apply for the credit even when there is no tax liability, as unused credits can be carried back one year and carried forward for up to 20 years. Hence, you can save your credits for when there is tax liability.

Reducing your business’ costs means more significant profit margins and more money for expansion or new projects. Here are some types of healthcare facilities that benefit from WOTC:

Assisted Living Facilities

Staffing is a consistent challenge in assisted living facilities. Over three-quarters of assisted living operators surveyed by the American Health Care Association and National Center for Assisted Living (AHCA/NCAL) said their overall staffing challenges have become “much worse” or “somewhat worse” in recent years.

The survey results included responses from 1200 nursing homes and assisted living facilities. More than half the facilities are actively trying to fill vacant positions for certified nursing assistants (CNAs), licensed practical nurses, registered nurses, dietary staff, and housekeeping.

Nursing Homes

Nursing homes face similar staffing challenges as assisted living facilities. In the same survey conducted by the AHCA/NCAL, 94% of nursing homes said they could not fill all shifts without agency or ask staff to work extra shifts.

This report and others recently released highlight the urgency of addressing the shortfalls in the long-term care workforce. Hiring WOTC-eligible individuals is one way to help mitigate the shortage of long-term care workers and ensure that your facility provides adequate care to the senior population.

Rehabilitation Centers

Rehabilitation centers help patients with physical and mental issues for various reasons, such as disease or surgery. Therefore, it can be challenging to fill these positions while still ensuring patients receive quality care. Services provided at a rehabilitation center may include:

- Physical therapy

- Occupational therapy

- Nutritional guidance

- Mental health counseling

With a wide range of services offered at rehabilitation centers, many of these positions can be filled by WOTC-eligible individuals once they’ve completed the necessary training and certification.

Home Health Care Agencies

According to the Bureau of Labor Statistics, home health care is one of the fastest-growing industries, with a projected growth of 34% from 2019 to 2029. With a large number of positions available in home health care, this is the right time to apply for WOTC benefits.

Home health care agencies offer a range of senior medical services by trained professionals. Care is provided at the patient’s home, and the agency does not need to be located in the home city to provide care. Therefore, home health agencies can cast a broader net in the WOTC targeted groups pool to find quality candidates.

How APS Can Help You Navigate the WOTC Program

Increased candidates mean additional time and paperwork. The most effective way to manage this process is to utilize recruiting and onboarding software that integrates with a tax incentive solution. APS’ employee recruitment and onboarding software for healthcare can automate your medical facility’s hiring process. Efficiently recruit candidates, track applicants, onboard new employees, and screen for WOTC-eligible employees with our all-in-one solution. Our software and services for healthcare facilities ensure that you:

Contact us today to learn more about how APS can help your healthcare facility automate its payroll and HR processes.

- Streamline your recruiting process

- Hire the right people

- Take advantage of maximum federal, state, and local hiring-related tax credits

- Reduce your onboarding time

Sources

- Work Opportunity Tax Credit

- Survey: 94 Percent of Nursing Homes Face Staffing Shortages

- 5 Out of 20 Fastest-Growing Industries are in Healthcare and Social Assistance

- Home Healthcare Workers: A Growing and Diverse Workforce at High Risk for Workplace Violence

- Top 2021 Hospice Worries: Accessing Facility-Bound Patients, Staffing

- What Is the Work Opportunity Tax Credit (WOTC) | Indeed

- WOTC Brochure | Texas Workforce Commission

- Work Opportunity Tax Credit Will Expand Labor Market and Boost Economy | Times Union