[et_pb_section bb_built=”1″][et_pb_row][et_pb_column type=”4_4″][et_pb_text _builder_version=”3.0.76″ background_layout=”light” border_style=”solid”]

ACA Compliance: Applicable Large Employer Calculation

Applicable Large Employer Calculation

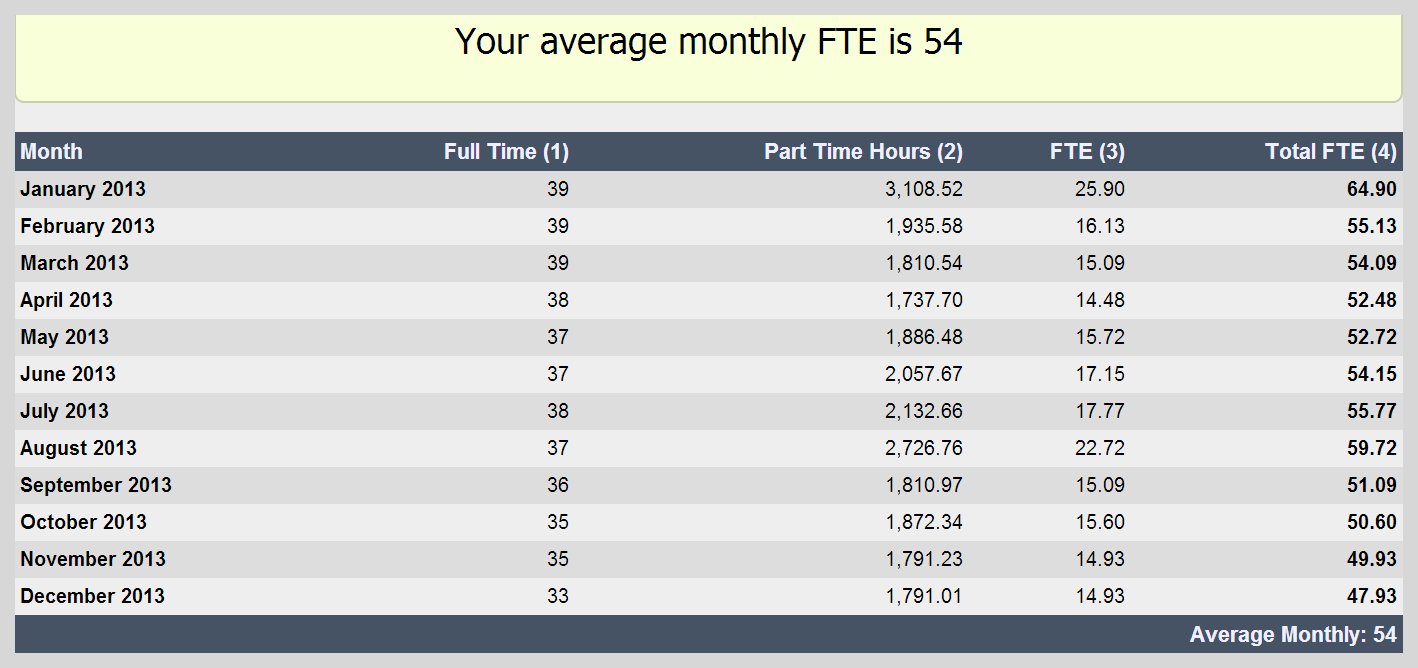

The first step in determining an ACA strategy is to determine if you are an applicable large employer (ALE) and are subject to the provisions of the ACA. As defined by the ACA, an ALE has 50 or more full-time equivalent (FTE) employees.

With APS, employers can use the ACA FTE report that uses the ACA formula based on hours of service to calculate the number of full-time equivalent employees (FTEs) for a specified lookback period. The report can be run in either a summary or employee format:

- Summary Format – provides a count of the full-time employees and the FTE calculation for part-time staff per month for the lookback period selected.

- Employee Format – shows the same information as the summary format, plus displays the names of the employees that are in the counts per month for the lookback period selected.

ACA FTE Report Shown in Summary Format

ACA FTE Report Shown in Summary FormatThis information is excerpted from 8 Ways to Manage ACA Compliance with APS, a comprehensive ACA resource for employers. Download the full guide here.

Sources

IRS Affordable Care Act Tax Provisions for Large Employers

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]