The Difference Between Pre-Tax and Post-Tax Deductions

Every organization that offers benefits to employees has to deal with some type of pre-tax or post-tax deduction. While these deductions are common for employers, they can be tricky to navigate. For example, what are pre and post-tax deductions? Should you withhold contributions before taxes or after taxes? How much do you withhold? How do you withhold wages properly? What are the tax benefits of each?

We answer all of these questions and more in our article below. First, we’ll explain what pre-tax and post-tax deductions are. Then, we’ll discuss the different types of deductions so you can determine which payroll deductions are pre-tax and which are post-tax. Finally, we’ll provide examples of pre-tax and post-tax deductions so you can calculate them correctly.

What are Pre-Tax Deductions?

Types of Pre-Tax Deductions

Pre-Tax Deduction Example

What are Post-Tax Deductions?

Types of Post-Tax Deductions

Post-Tax Deduction Example

Which is Better, Pre-Tax or After Tax?

Voluntary and Involuntary Deductions

FAQs

How APS Can Help How APS Can Help

Types of Pre-Tax Deductions

The most common types of pretax deductions are health plan contributions, retirement contributions, disability insurance payments, and employee commuting programs. Although these are the most common forms of pre-tax deductions, several others exist. Those include, but aren’t limited to:

- Child Care Plans

- Dental Plans

- Flexible Spending Accounts

- Health Savings accounts

- Life Insurance

- Medical Expenses

- Parking Permits

- Tax-Deferred Investments

- Vision Benefits

So now that you know what the various types of pre-tax deductions are let’s look at the most common deductions used by employees.

Health Plan Contributions

Employers deduct health plan contributions from employee’s pay before withholding additional taxes. These contributions then get paid to the appropriate savings account or health provider accordingly. Pre-tax health contributions typically come in employer-sponsored plans, dental plans, vision benefits, flexible spending accounts, and health savings accounts. Let’s take a look at each type of contribution:

- An Employer-Sponsored Health Plan is a type of health coverage where employers purchase health insurance for employees and their dependents. Usually, the employer splits the cost of pre-tax premiums with the employee. Types of employer-sponsored health plans include:

- Group Health Insurance Plans

- Dental Insurance Plans

- Vision Insurance Plan

- A Health Savings Account (HSA) is when employers provide employees with fixed health dollar amounts. Employees spend the money on their preferred health benefits. These amounts are set up and deducted from employee’s pay before income or payroll taxes get withheld.

- A Flexible Spending Account (FSA) is an employee-owned account that employees can use to pay for out-of-pocket healthcare expenses. Employers may choose to contribute to the account or decide not to.

Retirement Contributions

A pre-tax retirement contribution is a payment made towards an employee’s retirement. The employee doesn’t pay income tax on their retirement until they withdraw money from the account. Because pre-tax contributions reduce the amount of taxes an employee owes each year, employees can afford to contribute more to pre-tax retirement programs. Types of retirement accounts that allow for pre-tax advantages include:

Disability Insurance

According to an article by the Employee Benefit Advisor, 20% of men and 28% of women under the age of 35 will become disabled for 90 days or more before they retire. Disability insurance aims to help this statistic by providing coverage for employee’s wages if illness or injury prevents them from working.

An employee can have two types of disability depending on their coverage preferences: short-term disability and long-term disability:

A Note About Disability Insurance

If employees choose to pay for pre-tax disability and end up ill or injured, they will owe taxes on the disability payments received. Disability payouts generally cover 50-80 percent of an employee’s salary.

- Short-Term Disability Insurance: This type of insurance covers employee wages for a short period. That timeframe usually ranges from three months to a year.

- Long-Term Disability Insurance: Long-term disability insurance has an elimination period of at least 90 days. After that, benefits are paid for a longer term, typically, two years, five years, ten years, to age 65, or for life, depending on the policy. The longer the benefit period, the higher the premium.

Through company group plans, employees who purchase disability coverage can choose to pay for it with pre-tax or after-tax dollars. When employees choose pre-tax deductions, a portion of their wages goes towards disability insurance premiums before receiving a paycheck.

Employee Commuting Programs

A pre-tax commuter program lets employees deduct the monthly cost of their work commute from their pay. This type of pre-tax deduction benefits employees because it increases their take-home pay. It also provides a variety of alternative commuting options for employees, reducing personal vehicle expenses. Alternative commuting options covered by commuting programs include:

- Train

- Bus

- Ferry

- Rideshare (Uber Pool, Lyft Shared)

- Parking

- Biking

A Note About Employee Commuting Programs

Commuter program deductions aren’t available in every U.S. location. Program availability depends on the type of transportation offered in each city and state. Employers also aren’t required to offer commuter programs. Check with your local government to see what’s available for both you and your employees.

Pre-tax commuter programs benefit employers as well. When employees enroll in a commuter program, their take-home pay reduces. Reduced take-home pay results in fewer payroll dollars getting taxed. When payroll costs lower, employers save up to an average of 7.65% on payroll taxes.

Pre-Tax Deduction Example

Now that you know what a pre-tax deduction is and the types of different pre-tax deductions available for employees, let’s look at how a pre-tax deduction works. For this example, we’ll use a 401(k) deduction.

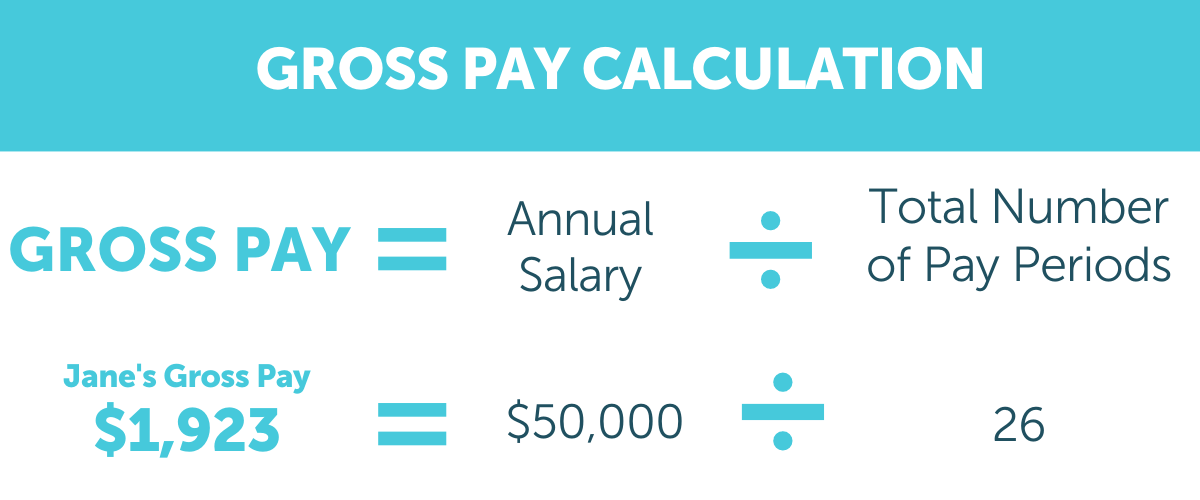

Jane’s gross salary is $50,000 per year. She is paid bi-weekly and has recently elected to have a 3% 401(k) contribution deducted per paycheck. Before we calculate Jane’s pre-tax deduction, we first need to determine her gross pay. To determine Jane’s gross pay, we’ll divide Jane’s annual salary by the total number of bi-weekly pay periods in a year. This number will give us Jane’s gross pay amount.

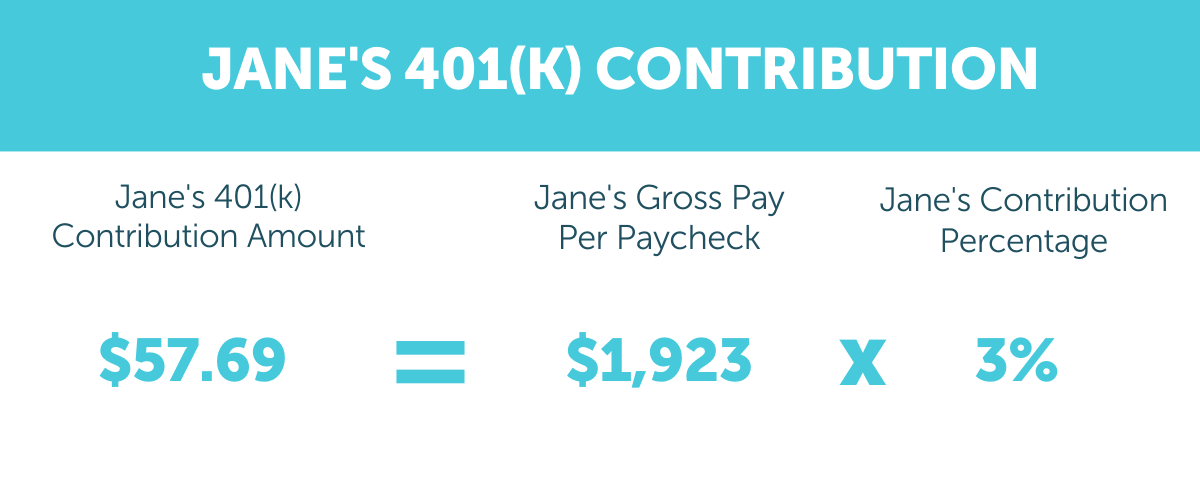

Once we determine Jane’s gross pay, we’ll multiply that number times 3% to determine the 401(k) amount to withhold per paycheck.

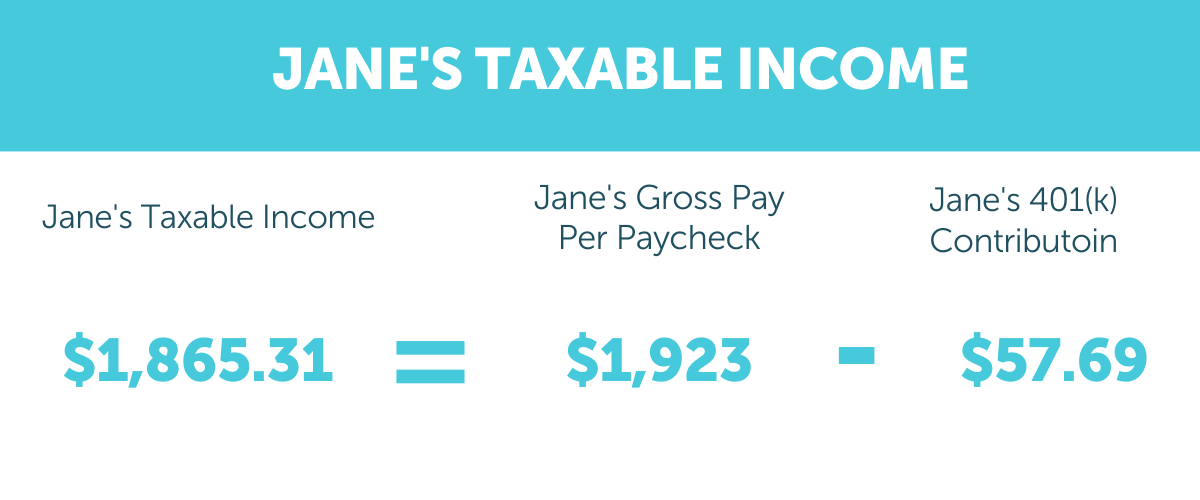

Next, we’ll subtract Jane’s pre-tax 401(k) contribution of 3% from her $1923 paycheck. This number lowers Jane’s taxable income to $1,865.31.

Pretax deductions can get quirky. The IRS dictates what qualifies as a pretax deduction for each tax, and it’s not always the same. For example, employee contributions to a traditional 401(k) plan are a pretax deduction for federal income tax purposes but not for FICA taxes. Your payroll software knows the rules and will calculate deductions when set up correctly.

What are Post-Tax Deductions?

A post-tax deduction is a payroll deduction taken out of an employee’s paycheck after taxes get withheld. As opposed to pre-tax deductions, post-tax deductions don’t lower tax burdens. This difference in tax liability is because post-tax deductions reduce after-tax pay instead of pre-tax pay.

Employees can choose whether or not they want to participate in post-tax deductions, except for wage garnishments. Court orders and other legislative authorities regulate wage garnishment deductions.

Types of Post-Tax Deductions

There are a variety of post-tax deductions for employers to offer employees. These include wage garnishments, Roth 401(k) plans, employer-sponsored pension plans, 529 college savings plans, union dues, disability, life insurance policies, charitable donations, flexible spending accounts, and Schedule A deductions.

In this article, however, we’re only going to focus on the most common types of post-tax deductions:

- Wage garnishments

- Retirement contributions

- Life insurance deductions

Let’s take a closer look at how each of these post-tax deductions works.

Wage Garnishments

A wage garnishment is a legal procedure where a court orders an employer to deduct an employee’s earnings on behalf of a debt. Employers must send these payments to the proper legislative authority or credit institution. Organizations must continue to withhold these wages until the employee’s debt clears.

Employers are also responsible for calculating garnishment amounts. While garnishment requirements sound tricky, payroll and HR providers can help. They often include wage calculations and garnishment prioritization in their platform. Some even handle garnishment deductions and payments on your behalf.

What are Pre-Tax Deductions?

A pre-tax deduction is a monetary amount withheld from employees’ paychecks before any tax withholdings. These types of deductions benefit both employees and employers because they reduce taxable income. When taxable income reduces, the amount employees owe in taxes lowers as well.

Some pre-tax deductions even exempt employees from federal, state, and local taxes. Other pre-tax deductions aren’t eligible for exemptions. This variation is due primarily to different legislative regulations. For example, adoption assistance is exempt from federal income tax. However, it isn’t exempt from Social Security, Medicare, or FUTA taxes.

In some scenarios, pre-tax deductions also cause tax delays. While employees might not owe taxes now, the employee might owe taxes in the future. For example, 401(k) contributions are often pre-taxed. However, when employees retire and start withdrawing money from their 401(k)plans, they will have to pay taxes on the amount withdrawn.

Want to Know More About Garnishments?

Check out our blog today.

Learn about Garnishment

Retirement Contributions

An after-tax retirement contribution is money employees pay into an account after income taxes get deducted from their wages. There are two types of post-tax retirement accounts available: Roth IRA and 401(k).

A Roth IRA lets individuals pay taxes when they make the retirement contribution. When employees make Roth IRA contributions, earnings held for five years or more grow tax-free. Most individuals prefer to take advantage of Roth IRAs as they aren’t subject to future taxes. In addition, Roth IRAs make sense if employees believe they will pay higher tax rates in the future.

401(k) accounts also offer post-tax retirement contribution options. Once companies deduct payroll taxes from employee pay, individuals may choose to make additional 401(k) contributions. These after-tax 401(k) contributions enable employees to invest more money into retirement. Making after-tax 401(k) contributions also provides employees with tax-deferred growth until withdrawals begin.

Life Insurance

Life insurance provides employees with security for their loved ones if something happens to them. While life insurance isn’t pre-taxed, premiums are deductible as a business-related expense. This type of deductible is often called a life insurance post-tax deduction.

A Note About Life Insurance

If employees want to add supplemental coverage or purchase life insurance for a dependent, you typically deduct these funds from their pay on a post-tax basis.

One common type of post-tax life insurance deduction is group-term coverage. Group term life insurance is a contract issued to employers. The employer then offers life insurance coverage as a benefit to employees. Employers that offer group term coverage can make post-tax deductions on premiums they pay on the first $50,000 of benefits per employee.

Post-Tax Deduction Example

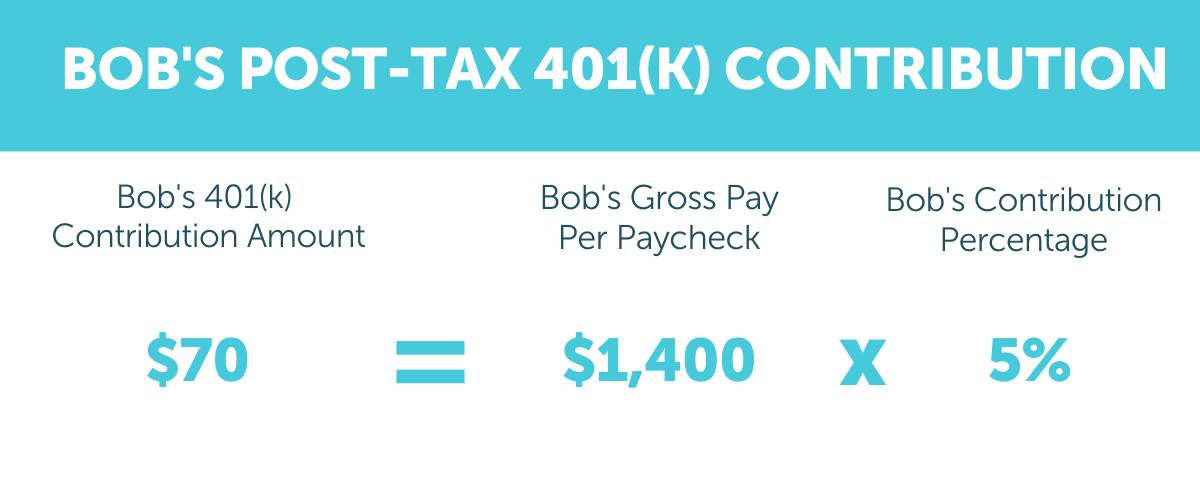

Now that you know what a post-tax deduction is and the types of different post-tax deductions let’s look at how one works. For this example, we’ll use a post-tax 401(k) deduction.

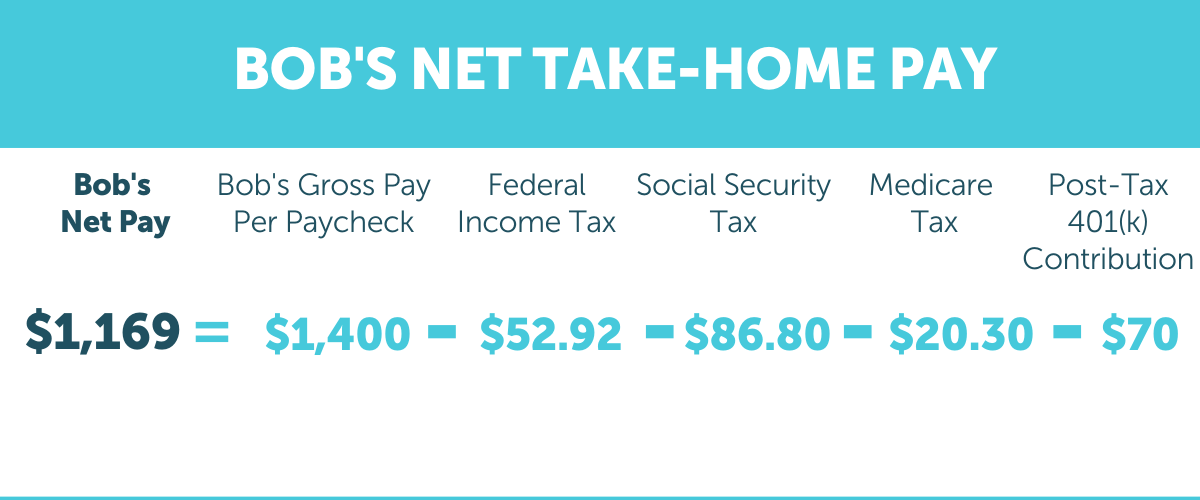

Bob decides to make a 5% contribution to his post-tax retirement plan. Bob’s bi-weekly gross pay is $1,400. So first, we’ll withhold any payroll taxes from Bob’s gross paycheck. These consist of income taxes, Social Security, and Medicare taxes. For this example, we’ll assume Bob lives in Texas, where he doesn’t owe state income taxes.

Step 1. Federal Income Taxes

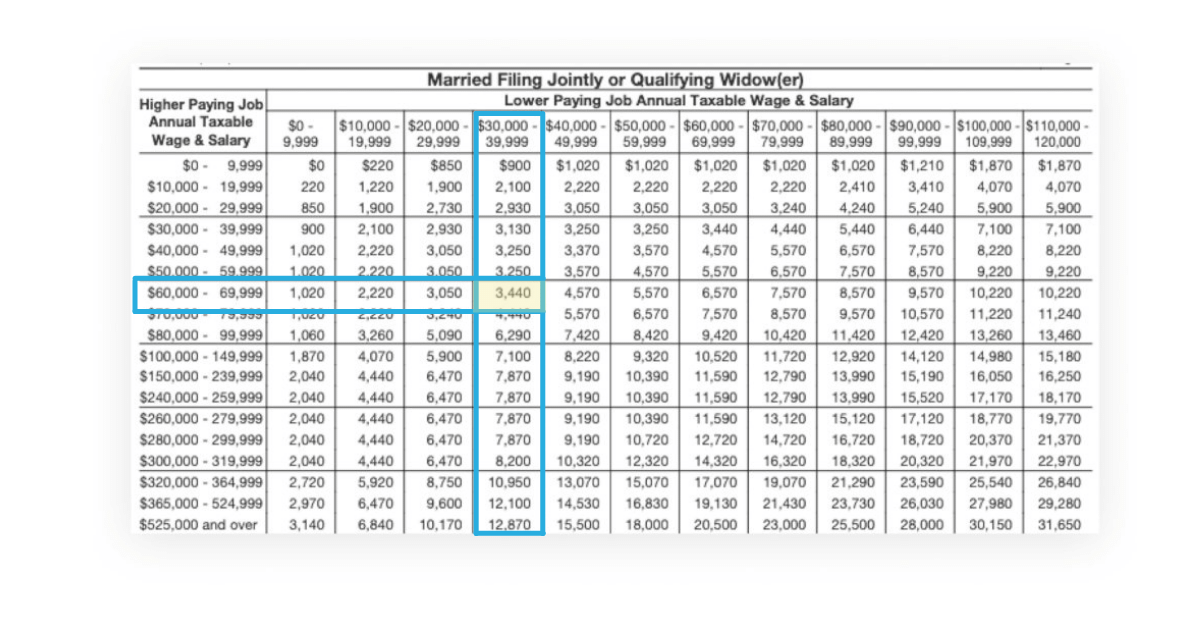

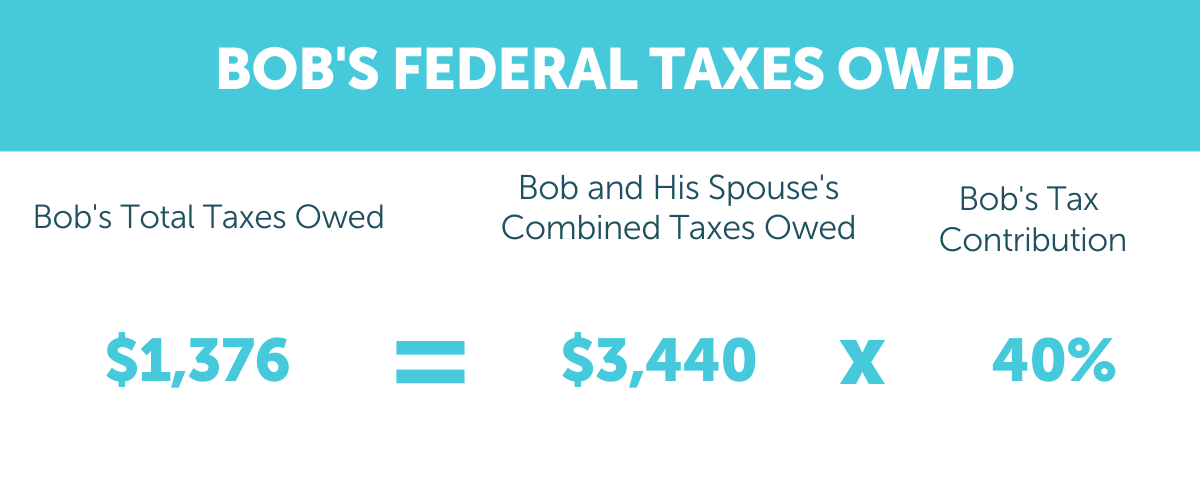

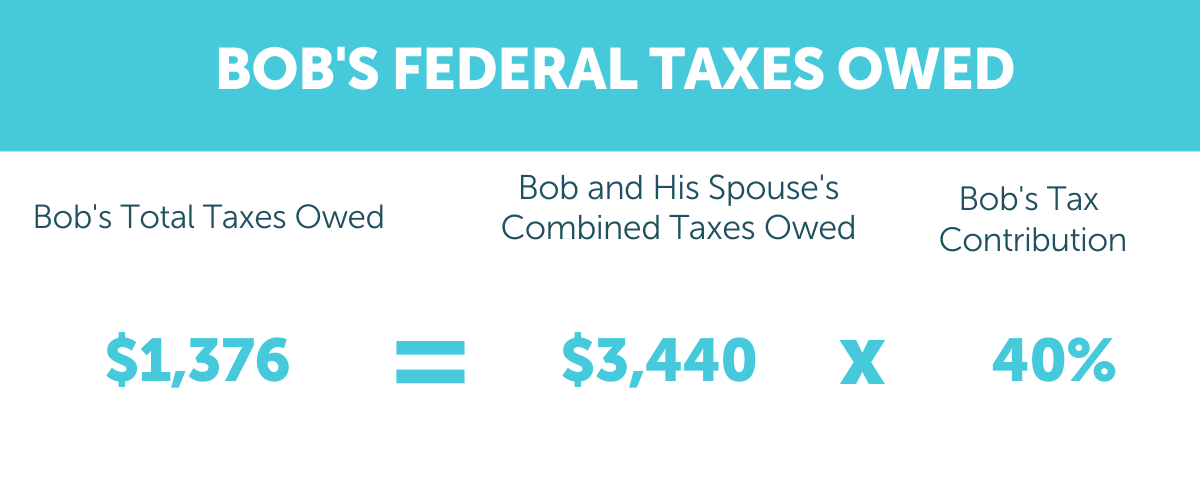

The first thing we’ll calculate is the amount Bob owes in federal income taxes. Bob is married, filing jointly, so the first thing we’ll need to do is look at the Form W-4 Married Filing Jointly table.

We’ll use the vertical columns for Bob’s income since he’s the lower earner making $33,000 per year. We’ll use the horizontal columns for Bob’s spouse since that individual is the higher earner, making $60,000 per year. The spot where the two columns meet is how much Bob and his spouse owe in federal income taxes: $3,440.

From there, Bob has several options:

- Since Bob’s spouse is the higher earner, his spouse can pay for all of the taxes out of their income.

- Bob can split the taxes with his spouse.

Let’s say Bob chose to split the taxes with his spouse. Since Bob’s the lower earner, he will pay 40% of the total tax amount, and his spouse will cover the remaining 60%. We’ll multiply the 40% times the total married, filing jointly tax amount owed to get Bob’s total in federal income taxes.

Once Bob has his total federal income tax amount, we’ll divide the $1,376 by the number of pay periods Bob gets paid. Since Bob gets paid bi-weekly, his total number of pay periods is 26. $52.92 is how much Bob needs to take out of this check for federal income taxes each pay period.

Step 2. Social Security Taxes

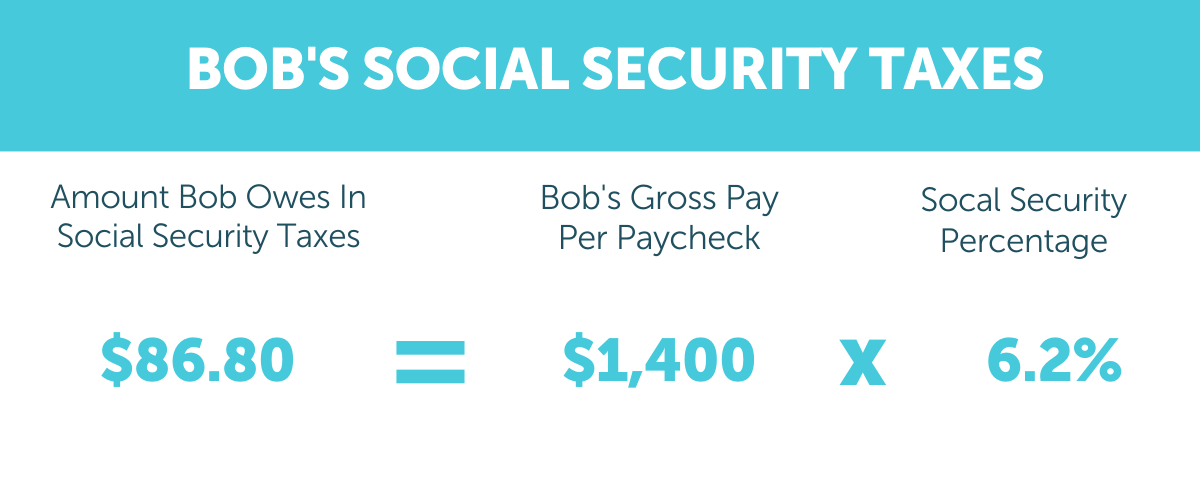

Bob’s $1,400 paycheck is also subject to Social Security taxes, so you’ll multiply his $1,400 paycheck by the employee Social Security tax rate. The result is what Bob owes to Social Security.

Step 3. Medicare Taxes

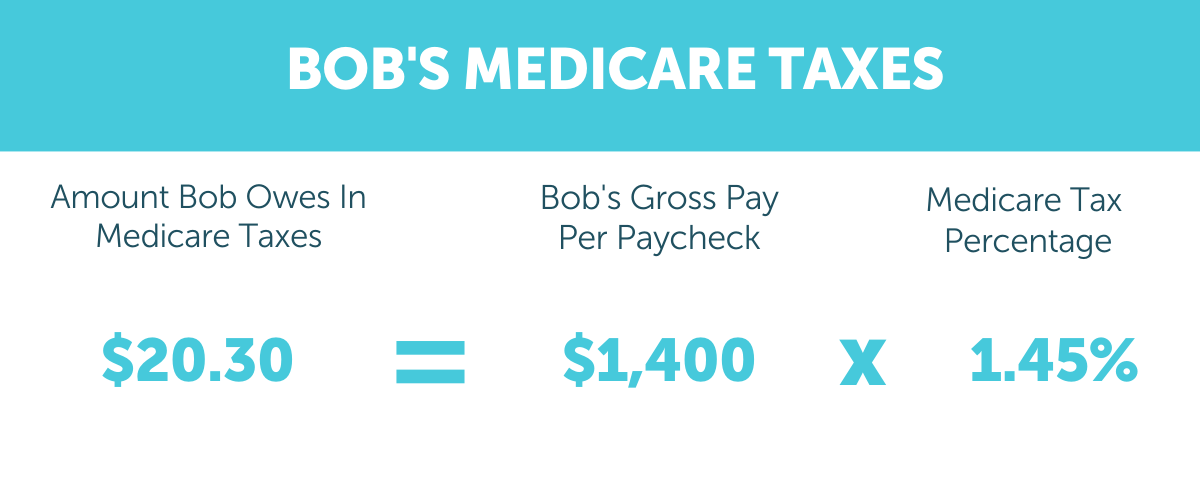

We’ll also need to calculate how much Bob owes to Medicare. We’ll multiply his $1,400 times the Medicare tax rate of 1.45% to get the $20.30 Bob owes to Medicare.

Step 4. Post-Retirement Tax Contribution

Next, we’ll calculate Bob’s post-tax retirement contribution based on his gross pay of $1,400. Bob is contributing 5% to his retirement account, so we’ll multiply his gross wages times by that percentage. We end up with $70, which is the amount we will withhold from Bob’s retirement account.

Now that we’ve calculated all taxes and deductions, we will subtract those amounts from Bob’s gross pay. What we end up with is Bob’s net take-home pay after he makes a post-tax 401(k) contribution: $1169.

Want to Automate Your Payroll Taxes?

Our team of tax compliance experts can help.

Get Help with Payroll Taxes

Which is Better, Pre-Tax or After Tax?

While the difference between pre-tax and post-tax deductions isn’t always straightforward, It’s essential to understand the benefits of both pre-tax and after-tax deductions so you can decide what’s best for your organization. So here’s a recap of each.

Pre-tax contributions reduce employees’ taxable income and provide immediate tax breaks for employees. Because these plans are advantageous for employees, they do have yearly contribution limits. Contribution amounts also get taxed during future withdrawals. Even so, pre-tax deductions are often the better choice when employees need to save more quickly.

Post-tax deductions offer employees the advantage of higher take-home pay. This higher pay is because individuals have already paid taxes on contributions. While post-tax contributions don’t lower tax burdens, they do provide long-term relief for employees. If employees want to save over time, post-tax deductions are often the better choice. For more information, see the FAQ section below.

Can pre-tax and post-tax deductions hit the same liability amount?

No, pre-tax and post-tax payroll deductions cannot hit the same liability amount. Post-tax deductions generally don’t reduce your liability amount as you have already made tax payments when they occur.

Can you claim post-tax deductions?

Since post-tax deductions get paid after taxes, so they generally can’t be claimed. However, there is an exception. Voluntary after-tax contributions made to a pension plan can get listed on Box 14 of Form W-2. Learn more about voluntary deductions below.

What payroll deductions are tax exempt?

Pretax deductions are tax exempt. These include medical, dental, vision, group-term life insurance, disability insurance, adoption assistance, dependent care reimbursement accounts, health savings accounts, qualified 401(k) plans, and commuter benefits.

Voluntary and Involuntary Deductions

Now that you know the different types of deductions, it’s crucial to understand deduction requirements for employers. There are some deductions that employers are required to withhold from employees’ pay. Others are voluntary and depend on employee decisions. Let’s take a look at each.

Voluntary deductions are payroll deductions chosen by employees. Workers decide whether or not they want to have benefit contributions removed from their paycheck. Some types of voluntary deductions include retirement contributions, health insurance, and college savings plans.

Neither employees nor employers have control over involuntary deductions. That’s because governing authorities control involuntary deductions. Specific laws require employers to deduct money from employee pay and send that amount to a person or government agency. The goal of involuntary deductions is to satisfy an employee’s debt. Types of involuntary deductions include:

- Federal Income Taxes

- State Income taxes

- Local Income Taxes

- Tax levies

- Wage garnishments

How APS Can Help With Pre-Tax and Post-Tax Deductions

APS helps organizations of all sizes and industries with their payroll and tax needs. We understand payroll deductions can be tricky. That’s why we closely monitor all tax regulation changes to ensure we minimize customer compliance burdens. Here’s how we can help you navigate payroll taxes:

- We automate the management of incomes and deductions during payroll processing to ensure accurate withholdings and paychecks.

- Our secure, centralized database stores and tracks required tax forms for employees for better payroll and tax compliance.

- Our Analytics and Reporting solution provides employee classification reports so that you can maintain compliance.

- Our payroll and tax compliance experts file federal, state, and local tax filings and payments as the reporting agent on your behalf.

- We provide wage garnishment services, including calculating and processing garnishment orders, so you don’t pay unnecessary penalties.

- Our built-in error-checking algorithm and validation rules allow you to review incomes and deductions before processing payroll to ensure accuracy.

- Our tax compliance department helps you with other tax regulations saving you time and money.

In addition to these services, we stay on top of new payroll tax laws and procedures to alleviate our customers’ burden. We update our Help Center and ensure our customer support team speaks with clients regularly to make payroll and tax compliance adjustments.

To learn more about what APS can do to help make payroll and HR easier, contact us today.

Sources

How Pre-tax Commuter Benefits Work

Investopedia: Life Insurance Guide to Policies and Companies