How Many Pay Periods in a Year?

Understanding Bi-weekly, Weekly, and Monthly Pay Schedules

Establishing a consistent and informed payroll process is crucial in a business setup. It’s about meeting employee expectations for reliable and timely payments and understanding the various pay schedules and their implications. You can avoid legal issues, improve financial planning, and enhance employee satisfaction.

We’ve created a comprehensive guide covering everything you need to know about pay periods. This article includes the number of pay periods in a year. It also discusses how to align the pay period you choose with your business model and legal requirements.

Importance of Pay Schedules

Employers must adhere to federal regulations like the Fair Labor Standards Act (FLSA). The FLSA mandates timely payment of wages on designated paydays. Additionally, each state may have its own requirements regarding pay periods and frequency. Striking a balance between these legal obligations and your company’s financial rhythms is crucial for effective payroll management.

Establishing a pay schedule that aligns with federal and state laws ensures compliance and avoids potential legal issues. It also helps maintain employee satisfaction by providing predictable and reliable pay dates. When employees know when to expect their paychecks, they can better manage their personal finances, leading to higher job satisfaction and retention rates.

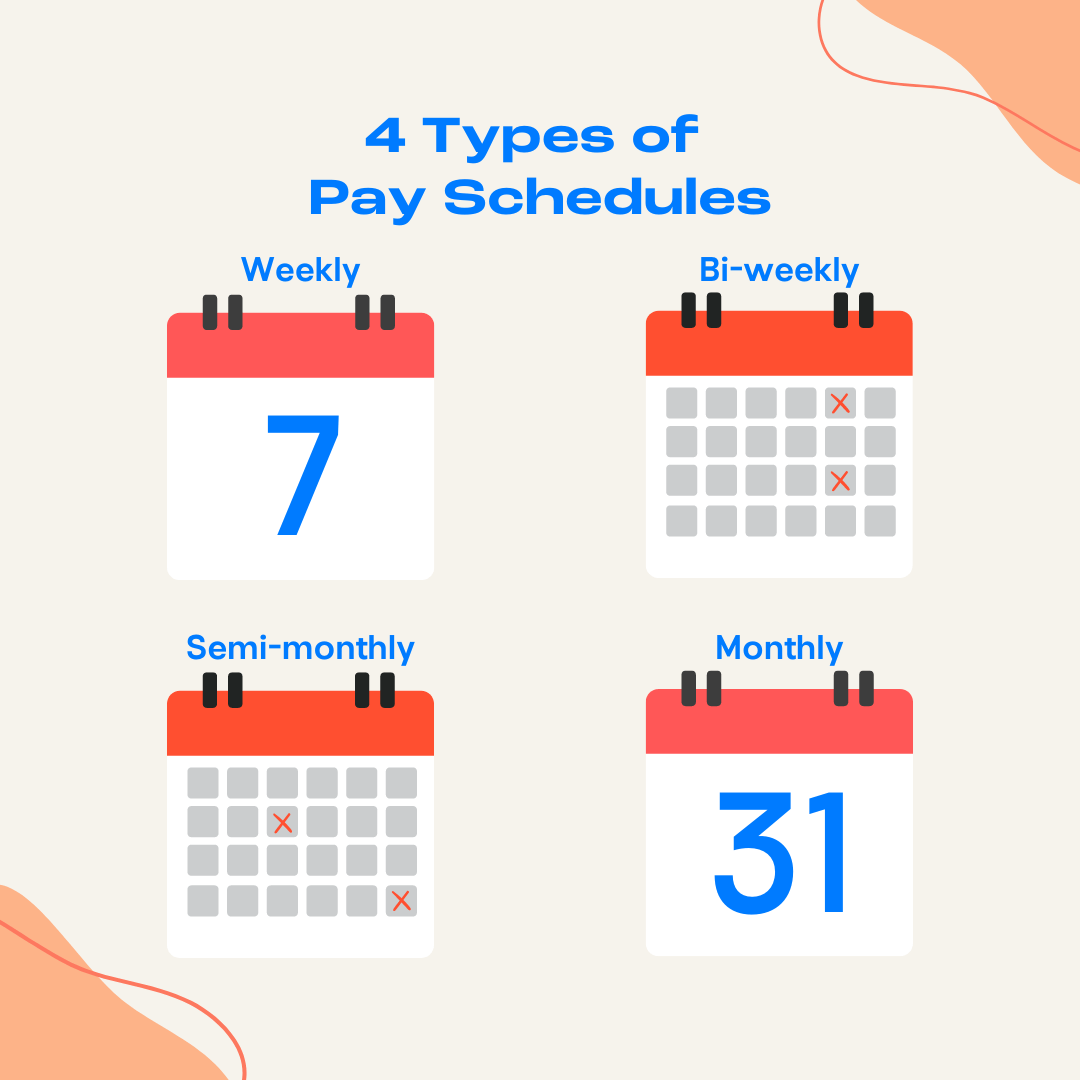

Common Payroll Frequencies

Employers usually follow one of several types of pay periods: bi-weekly, weekly, semi-monthly, or monthly. Each schedule has its advantages and can impact budgeting and financial planning differently. Understanding these benefits can make employers and employees feel confident in their financial planning, knowing they have chosen the best schedule for their organization.

Bi-weekly Pay Schedule

With a bi-weekly pay schedule, employees are paid every two weeks on the same day of the week. This results in 26 pay periods per year (52 weeks ÷ 2). Bi-weekly pay provides consistency, making budgeting and managing cash flow easier. However, it’s important to note that two months each year will have three paychecks, which can require some financial adjustment.

Bi-weekly pay is popular among employers and employees because it balances administrative ease and consistent employee cash flow. Additionally, this frequency aligns well with many billing cycles, making it more straightforward for employees to manage personal finances. This schedule can simplify the pay calculation for salaried employees as the amount remains constant across most months.

Employers favor bi-weekly schedules because they reduce the frequency of payroll processing compared to weekly schedules while offering employees regular income. This balance can improve financial planning and budgeting for the company and its employees.

Weekly Pay Schedule

Under a weekly pay period, employees receive a paycheck every week, typically on the same day. This schedule results in 52 pay periods per year or 53 during leap years. This option is the most frequent pay schedule, providing a steady cash flow and making it easier to manage weekly expenses.

This frequent payment schedule empowers you to stay on top of your financial commitments, knowing that a paycheck is just around the corner. However, it involves more administrative work to process payroll. Running payroll on a weekly basis can increase administrative costs and time spent on payroll tasks, but the benefits of higher employee satisfaction and retention can offset it.

Weekly pay is often favored in industries where hourly employees rely heavily on tips or commissions, such as hospitality or sales. The regular influx of cash helps employees manage their finances more efficiently and can lead to higher employee satisfaction and retention.

For businesses that employ a large number of part-time or temporary workers, a weekly pay schedule can help accurately track hours worked and promptly pay employees for their time. It can also simplify overtime calculations, ensuring compliance with labor laws and avoiding potential disputes over unpaid wages.

Ask How We Can Make Payroll & HR Easier for You

Semi-Monthly Pay Schedule

A semi-monthly pay frequency means employees are paid twice a month, usually on the 15th and the last day of the month, resulting in 24 paychecks per year. This schedule offers predictable pay dates aligned with the middle and end of the month. However, the number of days between paychecks can vary, which may require careful financial planning.

For employers, a semi-monthly pay period can simplify accounting, as it aligns with monthly expense tracking. However, it’s crucial to communicate clearly with employees about the varying number of days between paychecks, especially during months with long stretches between pay dates. Ensuring employees understand the schedule can help them manage their finances and reduce confusion.

Semi-monthly schedules can also affect how benefits and deductions are calculated. For example, contributions to retirement plans or health insurance premiums may need to be adjusted to account for the semi-monthly pay distribution. Payroll software can assist in automating these calculations, ensuring accuracy and compliance.

Monthly Pay Schedule

Employees are paid once a month with a monthly pay schedule, typically on the same date each month, resulting in 12 paychecks per year. This option simplifies payroll processing and can help manage monthly expenses and long-term budgeting. However, the infrequency of paychecks can make budgeting more challenging for some employees.

Monthly pay is often used in higher-level positions or industries where salaried employees receive larger, less frequent payments. This schedule requires disciplined financial planning from employees but can streamline payroll processing for employers, reducing administrative overhead.

For businesses, a monthly pay schedule can significantly reduce the administrative burden associated with payroll processing. It also aligns well with monthly financial reporting and budgeting processes, making it easier to track expenses and revenues. However, it’s vital to ensure that employees are prepared for the longer intervals between paychecks and have the necessary tools to manage their finances effectively.

Custom Pay Schedule

A custom pay schedule is a pay period that does not fall into a standard weekly, bi-weekly, semi-monthly, or monthly frequency. This flexibility allows businesses to design a pay schedule that aligns with their cash flow, operational demands, and employee preferences. Custom pay schedules vary significantly, including options like paying employees at the end of specific projects or aligning paydays with major business milestones.

Businesses may opt for a custom pay schedule in various situations. For example, a company with seasonal operations might pay employees more frequently during peak seasons and less frequently during off-peak times. Another scenario could involve project-based companies, where employees are paid upon the completion of projects rather than at regular intervals. This approach can also benefit startups or businesses with irregular revenue streams, allowing them to manage cash flow and financial obligations better.

The benefits of a custom pay schedule are numerous. It allows businesses to align payroll with their financial situation, potentially improving cash flow management and reducing financial strain during low-revenue periods. Employees can also benefit from a pay schedule that matches their work patterns and economic needs, leading to higher satisfaction and retention. Additionally, this approach can help businesses attract and retain talent by offering a pay structure that aligns with the unique needs of their workforce.

Impact on Financial Planning

Understanding your pay schedule is crucial for effective financial planning. Different payroll calendars can impact your finances in several ways:

Budgeting

A company’s budget is impacted by the type of pay frequency it chooses. More frequent paychecks, such as weekly or bi-weekly, can make weekly and monthly expenses more manageable. Businesses would need to have cash available more often, potentially complicating cash flow management. These schedules also necessitate more frequent tax withholdings and deposits, which can increase administrative efforts and the potential for penalties.

In contrast, less frequent paychecks, like semi-monthly or monthly, allow businesses to retain larger sums of money for extended periods, aiding in cash flow stability and simplified tax processing. However, this may also require careful budgeting to ensure funds last until the next payday.

Savings

Knowing your pay schedule helps you set up automatic savings plans. For example, setting aside a portion of each paycheck for savings can be easier with a consistent pay schedule. This consistency allows for regular contributions to retirement accounts or emergency funds, promoting financial stability.

Bill Payments

Aligning bill payments with your pay schedule can help avoid late fees and ensure you have enough funds when bills are due. By synchronizing your pay dates with your bill due dates, you can manage your cash flow more effectively and reduce financial stress.

Overtime Calculation

Knowing the pay schedule is essential for businesses to calculate overtime accurately. Different pay schedules may require different methods of tracking and calculating overtime to comply with federal and state laws. For example, weekly pay schedules may necessitate weekly overtime calculations, while bi-weekly or semi-monthly schedules might require a more complex approach. Payroll software can automate these calculations, ensuring compliance and reducing the risk of errors.

How APS Simplifies Payroll Management

Managing payroll schedules can be complex, but with APS, you can feel a sense of relief and confidence. Our unified payroll management solution streamlines payroll processing for any pay schedule, ensuring timely and accurate payments. Here’s how APS can help:

- Flexible Payroll Processing: Support for bi-weekly, weekly, semi-monthly, and monthly pay schedules. Our system adapts to your preferred pay schedule, making it easy to manage payroll without manual adjustments.

- Automated Calculations: Reduce errors and save time with automated payroll calculations. APS ensures that all deductions, taxes, and benefits are calculated accurately, minimizing the risk of payroll discrepancies.

- Employee Self-Service: Employees can access pay stubs, view pay schedules, and manage direct deposits online. This feature empowers employees with the necessary information and reduces the administrative burden on HR departments.

- Payroll Services: APS offers comprehensive payroll services for mid-sized businesses. From handling payroll taxes to ensuring compliance with federal and state laws, our services are designed to make payroll management stress-free. Our tax compliance team stays up-to-date with the latest regulatory changes, ensuring that your business remains compliant and avoids costly penalties.

- Payroll Software: Our payroll software integrates seamlessly with your existing systems, making it easy to run payroll efficiently and accurately. Our platform is designed to handle the complexities of different pay schedules and state laws, ensuring compliance and ease of use. With real-time reporting and analytics, businesses can gain insights into payroll costs and trends, helping them make informed decisions.

Choose the Right Pay Schedule for Your Business with Confidence

Whether you are an employer determining the best pay schedule for your business or an employee trying to understand your paycheck frequency, knowing the differences between payroll frequencies is essential. By breaking down the bi-weekly, weekly, semi-monthly, and monthly schedules, we’ve clarified how many paychecks you can expect each year.

APS is here to simplify payroll management for businesses of all sizes. Our comprehensive payroll solutions ensure that your employees are paid accurately and on time, regardless of your pay schedule. Contact us today for more information on how APS can streamline payroll processes.