According to a study by Smallbizgenius, more than 4.3 million people in the USA work remotely. As we see the trend of remote positions continue to increase across the United States, the need to understand payroll taxes for remote employees becomes more important. That’s why we’ve created a comprehensive list of tax information that’s easy for you to navigate.

As you read, you will gain a solid understanding of payroll taxes for remote employees, as well as factors employers should consider before navigating employee payroll taxes. Our goal is to provide you with an overview of how payroll taxes for remote employees work, so you can avoid stress and maintain compliance.

What Makes Payroll for Remote Employees Different?

Unlike employees who work at one location and live within that area, payroll for remote employees is trickier. It’s more challenging because local and state taxes vary depending on where a person lives and works. If your employee works remotely in the same state your company is licensed, there is less to navigate. You will continue to withhold state income taxes in the same state your company is registered and pay state unemployment insurance (SUI) in your same state. The only real difference is if your state has local income tax regulations across cities or counties.

If your employee works in a different state than where your company is registered, that’s where things get more complicated. Your organization will need to register with local and state tax agencies for each state where you have employees. Your payroll and HR managers will also need to speak with that state’s labor and unemployment agencies to make sure they are following proper protocols and procedures.

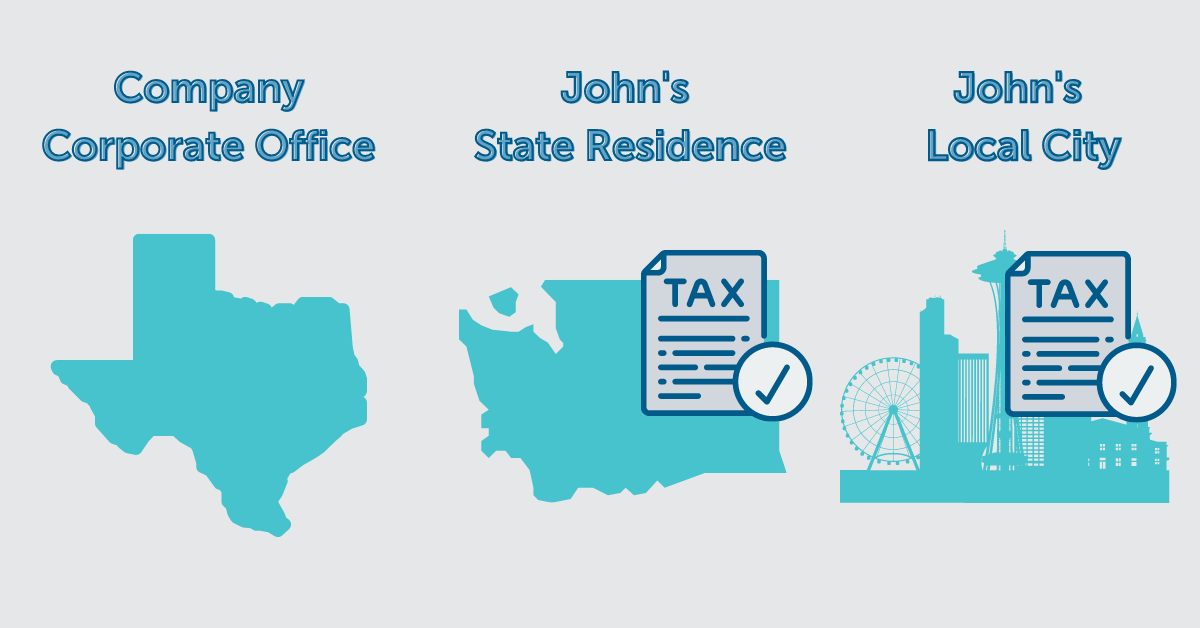

For example, John works for a Texas company, but he lives in Seattle, Washington. Washington has various state tax withholdings, and Seattle has various local tax withholdings. John’s company has to withhold state and local income taxes for Washington and Seattle from his pay. It also means John’s company will have to pay Seattle unemployment taxes.

Types of Remote Employees

1. Commutes Across State Lines

- Your organization has employees who travel across states to different company locations.

- Your organization is expanding to another state.

- Your organization is changing to a remote, hybrid, or flex structure.

Reciprocal Agreements

Unemployment Witholdings

2. Lives Out of State and Works From home

If you have out-of-state remote workers on your payroll, it’s essential to understand how payroll taxes for out-of-state remote employees work. When you have an employee on your payroll that lives in another state and works from home in that state, you will withhold their income taxes for the state in which they work and live.

It’s also important to note if your employee lives and works out of state, you are not required to report that employee’s wages to your state tax office. Instead, you would report wages to and pay unemployment taxes to the state in which the employee works.

Note: To keep your documents current and consistent across state guidelines, consider obtaining a Certificate of Residency from the employee to keep in your files.

3. Temporarily Working from Another State

Another type of remote employee you might have is a temporary remote employee. A temporary remote worker is an employee who typically works in one state but who currently works elsewhere. For example, your employee’s spouse is in the middle of a job transition. Your employee might need to work in another state temporarily while they finish up selling their home.

Understanding how to navigate payroll taxes for employees working out of state will help your company remain consistent and compliant. If employees perform most of their work in-state, you report wages and pay regular unemployment rates to that state, regardless of where the temporary work occurs.

Remote Employees Vs. Contractors

Remote employees are individuals who work for your organization outside of a corporate office setting. Payroll and HR managers are responsible for withholding payroll taxes for remote employees, regardless of where they are working. They do this by using W-4 withholding forms that employees fill out before their hire dates.

Unlike employees, independent contractors are business owners themselves. They are technically self-employed and required to handle their taxes. Therefore, when you process payroll for contractors, your organization isn’t responsible for withholding payroll taxes from their pay. Contractors are responsible for reporting their earnings via Form 1099-NEC.

The transfer of tax responsibility is one reason why organizations choose to hire contract workers for remote work. However, there are still a couple of things you will need to do when hiring a U.S. contractor to maintain compliance:

- Have your contractor fill out an Official Request for Taxpayer Identification Number and Certification via Form W-9.

- Complete a 1099 form for contractors that receive more than $600 in a calendar year. One copy gets sent to the IRS, and the other will go to the contractor.

Questions About Employee & Contractor Forms?

What Taxes for Remote Workers are Employers Responsible for?

Employers are required to withhold income tax and the employee portion of Social Security and Medicare taxes from employees. However, this isn’t as simple as withholding monetary amounts from local employee paychecks. Payroll taxes for employees working remotely can be challenging.

While businesses are responsible for withholding taxes for remote employees, there isn’t a simple fix-all solution. Withholding amounts are different across federal, state, and local governments. Additionally, remote work classifications are different based on a company’s location, where an employee lives, and where an employee works. Let’s look at the different kinds of taxes employers are responsible for and how to report taxes for remote employees.

Withholding Federal Income Tax for Remote Employees

If your company has remote workers, your organization is responsible for withholding federal taxes from those employees’ paychecks. Companies are also responsible for paying their portion of payroll taxes for remote employees. Here are the federal taxes employers will need to withhold from remote employee’s wages:

Income Taxes

The United States uses a progressive, seven-tier tax bracket system for personal income taxes. This system bases itself on employee income earned. The rationale behind this model is as an employee’s income increases, the employee’s ability to pay more in taxes also increases. Employers are required to utilize these brackets to conduct income tax withholding from employee wages.

You’ll deduct income taxes from remote employees the same way you do on-site employees. Utilize the employee’s Form W-4 to determine the appropriate withholding amount. From there, you can select an accurate tax bracket for each employee. For a breakdown of payroll taxes, consider utilizing our payroll tax table for employers.

FICA Taxes

Unemployment Taxes

FUTA is the Federal Unemployment Tax, which provides compensation to workers who lose their jobs. Employers pay this tax, so it isn’t withheld from employees’ wages. You pay FUTA taxes for remote workers the same way you pay for FUTA taxes for local employees. FUTA employer tax is 6% of the first $7000 in wages paid to an employee.

While the IRS generally grants a tax credit of 5.4% to employers who pay these taxes on time, payroll and HR managers are still required to pay these taxes on behalf of their organization each quarter.

State Tax Withholding for Remote Employees

State tax withholdings for remote employees are similar to withholdings for in-state employees. Both remote and in-state employees have to pay state taxes. These come in the form of income taxes and State Unemployment Tax Assessment (SUTA) taxes. However, state taxes for remote workers can differ based on where the employee works and lives.

How do State Taxes Work For Remote Employees?

- Alaska

- Florida

- Nevada

- New Hampshire

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

For the rest of the country, state income taxes vary based on where an employee performs services. Generally, the employer’s location is the employee’s place of service, and therefore the service state in which a worker pays taxes.

However, there are some exceptions to this rule. If the employee works in multiple states, then state pay is determined by looking at the employee’s base of services, the employer’s base of operations, or the employee’s residence. One of the following scenarios must occur for an employee to get taxed from his/her residential state:

- An employee is working in an employer-designated site that has no state-imposed income jurisdiction.

- There is a reciprocal agreement between the state where the employee works (where the service gets performed) and where the employee lives. For instance, the mutual understanding between NJ and PA is if you work in NJ and live in PA, your wages get taxed in PA, and your employer withholds PA taxes instead of NJ Taxes – and vice versa. – Source Mercadian State and Local Tax Considerations for Remote Employees.

- The state has a taxable nexus agreement, and your organization has met the required minimum amount of business activity in the employee’s working state.

In addition to the above income taxation levels, state regulations may also require an employee to pay taxes in two states: the employee’s state of residence and the employer’s state of headquarters. Check with your payroll and HR provider’s tax compliance department. They can help you navigate state income taxes for remote workers

Don’t Have a Dedicated Tax Compliance Department?

Unemployment Tax for Remote Employees

State Unemployment Tax Assessment (SUTA) is usually based on the employee’s work localization. For example, an employee performs services in Louisiana for an entire year. Since the employee has worked entirely in Louisiana, this is the state where the employee’s work is localized, even if the employer’s corporate office is in Arkansas.

Most states only require employers to pay SUTA taxes, but a few states require employee withholdings. Those states are:

- Alaska

- New Jersey

- Pennsylvania

For employers not in the states listed above, you are required to pay SUTA withholdings. Some states follow the federal unemployment tax assessment rates, while others apply complex formulas and percentages to their SUTA requirements.

To determine withholding amounts for remote employees, you’ll need to refer to each employee’s Form W-4. This process is why it’s critical you encourage employees to keep their W-4 information accurate and up-to-date.

From there, you’ll need to familiarize yourself with state guidelines, income tax tables, and SUTA tables. If you’re new to payroll and HR, this process can be overwhelming. Consider partnering with a payroll and HR provider who has tax professionals on staff. They can help you navigate compliance across states.

Withholding Local Taxes for Remote Employees

Local tax withholdings mostly follow state tax guidelines, but there are some adjustments. Suppose a business has employees in multiple taxable cities. In this scenario, your payroll and HR manager must examine each city and state’s nexus policy to determine if the organization is eligible for nexus within the state or city.

For an organization to have taxable nexus, it doesn’t need a physical building within that city or state. It simply must meet a minimum requirement of business sales within that state. These requirements range anywhere from $50,000 to $500,000, depending on state laws.

Once an employer has determined that it has nexus status, a payroll and HR manager must decide if that business owes tax payments or filings to local cities. Usually, if a company has nexus status, they must file payroll taxes for remote employees. An organization can also have a payment obligation solely based on the remote employee and regardless of whether it performs business in the city or state. Most states subject local nexus taxes based on the following pieces of information:

- Number of sales in the state

- Combination of sales, property, and payroll in the state

While many individuals might work in a nearby city, they might live in another town. Typically nexus taxes are imposed on out-of-state/city organizations working in places without reciprocity agreements.

However, during the pandemic, most states are temporarily waiving nexus taxes. Pennsylvania, for example, has several cities with locally imposed tariffs. Currently, Pennsylvania is waiving its nexus taxes and asking organizations to withhold employee taxes and pay taxes on behalf of their corporate location.

In cases like these, payroll software providers can help you navigate local laws and determine employer tax obligations.

Partner With a Payroll Tax Expert

Choosing to partner with a payroll tax expert helps you alleviate compliance stress for remote employees. Companies like APS help organizations across various industries handle taxation for remote workers. We make sure you receive personalized support and guidance for the lifetime of your partnership with us.

We monitor federal, state, and local tax regulations across the United States so you can remain compliant. We work to minimize tax burdens so you can spend that time focusing on your most important asset, your people. Here are a few specific things we do to ease remote workforce burdens for organizations across the U.S.:

- We stay up-to-date on federal and state income rates and update our tax tables to reflect any changes.

- We track FUTA adjustments and make necessary changes to help you maintain remote compliance.

- We work with you to make necessary SUTA adjustments as you receive them.

- Our payroll and tax compliance experts file local, state, and federal taxes with the IRS on your behalf.

- We offer cloud-based self service and mobile clock-in solutions so your workforce can clock in and out from anywhere.

- We help you run payroll and pay remote employees through our direct deposit, paycard, or printable checking solution.

- Our built-in error checking algorithm and validation rules allow you to review remote incomes and deductions before processing payroll to ensure accuracy.

In addition to these services, we update our blogs and Help Center and continuously train our customer support teams. This process ensures our clients receive remote workforce information across our entire platform. To learn more about what APS can do to help you handle payroll taxes for remote employees and teams, contact us today.