No matter the size and industry, all businesses have one thing in common: they all have to process payroll for their employees. However, payroll processing can look different from organization to organization. Therefore, it’s essential to understand how to process payroll and determine the best way to create a simplified workflow for your company.

This article will provide a seven-step guide on how to process payroll. We’ll also explain how a payroll and HR provider helps you automate this time-consuming process. Your journey to simplified payroll starts here.

What is a Payroll Process?

A payroll process manages all the steps of paying your workforce, from gathering employee information to sending your staff their paychecks. Depending on your company, this process is either handled manually or is automated using a payroll system.

Payroll processing involves calculating employee wages, withholding taxes, tracking employees’ number of worked hours, and more. Therefore, it’s crucial to leverage professional assistance to ensure compliance. This professional assistance could be in the form of a tax compliance department through your payroll vendor or a certified professional accountant.

Whichever the case, it’s crucial that you understand the steps involved in a payroll process so you can pay employees accurately and on time. Processing payroll adequately also helps your business operations stay on track.

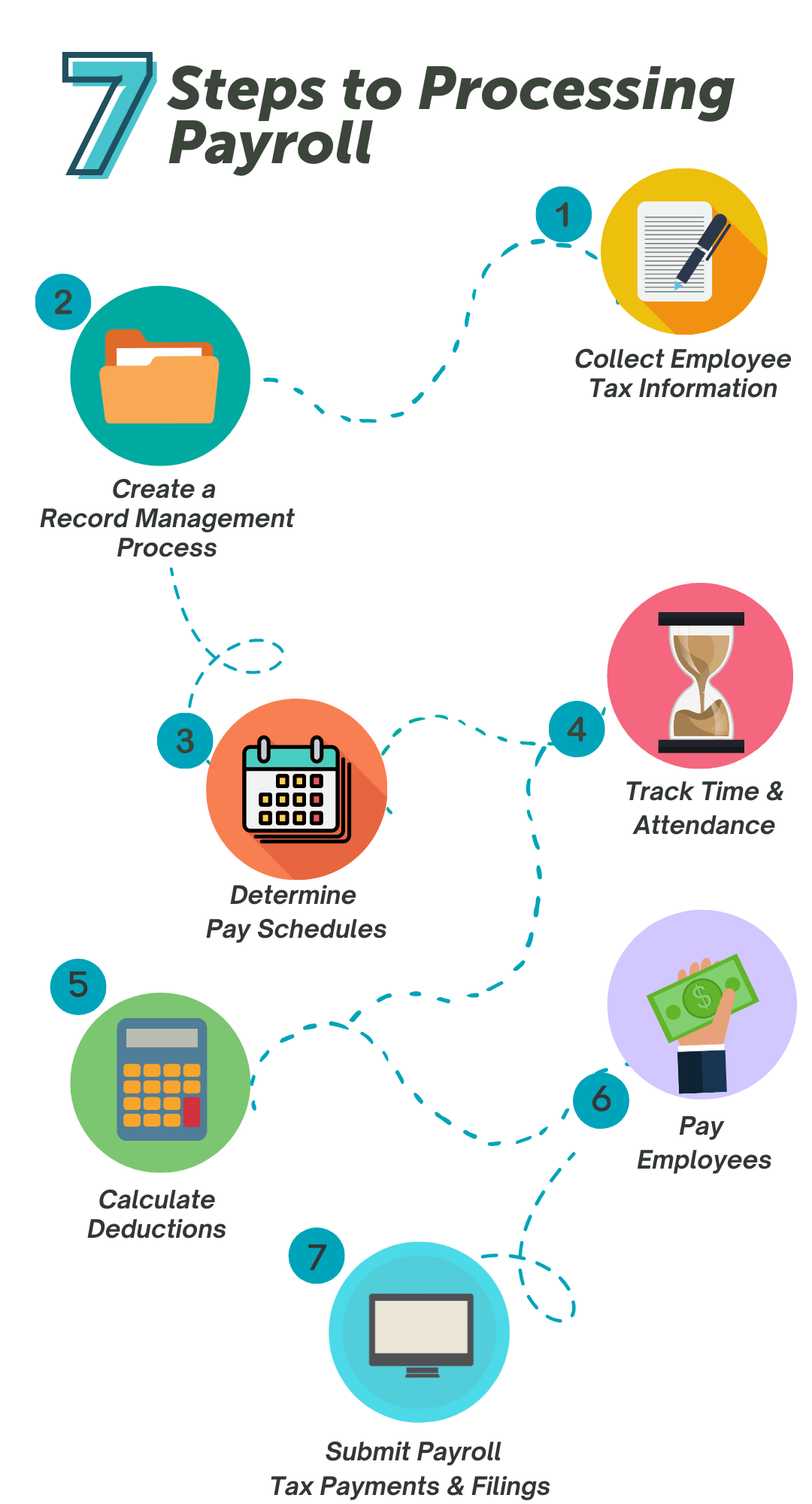

7 Steps to Processing Payroll

When establishing a new payroll process, it’s not just about paying your employees. Processing payroll is part of business operations, so it’s essential to understand how state and federal laws impact your company. Mid-sized and small business owners need to be aware of laws like the Fair Labor Standards Act (FLSA) and more.

We created this 7-step guide to help you understand what a typical payroll process looks like and what legislative information you need to maintain compliance. As you read, you’ll discover important information about employee taxes and filing. We’ll also discuss other factors that can help you set up a successful payroll process once and for all.

Step 1: Collect Employee Tax Information

The first step in processing payroll is gathering the necessary tax information from your employees. To verify employee eligibility for U.S. workers, employers are responsible for completing and filing Form I-9. For this process, an employee must present proper identification documents to the employer before starting the new role.

In addition to Form I-9, employers also need employees to complete IRS Form W-4 and any state-required withholding forms. These forms are necessary because they provide the IRS and your state department of revenue with necessary tax withholding information. Unless your employee is an independent contractor, he or she is required to complete these forms.

Step 2: Create a Record Management Process

When you’re running a business, you must keep several types of documentation on behalf of employees. Any selections they’ve made for benefits and retirement needs documentation so that you can make adequate payroll deductions. Also, any employment contracts, tax forms, employee handbooks, and training need to be signed and stored for compliance.

An easy way to handle all of these moving pieces is an employee record management process. Employee records serve as the source of truth for everything from pay rates to deductions. If the information on an employee’s record is incorrect, this can result in an inaccurate paycheck. Here are a few types of employee record-keeping processes:

Paper Files

This is the process of storing physical copies of employee documents. Certain documents will need to be locked away in a secure filing cabinet or storage area with limited access. Many businesses start with an onsite paper-based recordkeeping system, but eventually, it can become cumbersome.

Onsite Servers

Some organizations prefer private, computer-backed systems to store and locate employee data. Onsite servers relieve the need for physical storage space for employment records, saving valuable administrative time. However, servers still mitigate the need for computer hardware space and secure storage facilities.

Cloud-Based Document Storage

Employers often choose to maintain cloud-based documents rather than hassle with paper files or onsite servers. When you store records in the cloud, you can access them anytime and anywhere you have internet access. Secure cloud-based solutions mitigate compliance risks and save organizations dollars on reduced administrative tasks and storage equipment.

Step 3: Determine Pay Schedules

Now that employee information is accurate and up-to-date, it’s time to determine the pay frequency you want to offer your workforce. We’ve found that bi-weekly, semi-monthly, or monthly pay periods are typical for businesses. However, regardless of the frequency you choose, it’s important you share your payment schedule with employees, so they know when they’ll get paid. To determine which pay frequency is best for your organization, we’ve included an example below:

Step 4: Track Time and Attendance

Payroll processing and time tracking go hand in hand. Time components like hours worked determine employee pay. It’s vital to have a streamlined time and attendance process to ensure employee hours are captured and recorded accurately. Don’t forget to track time-related items like lunches, breaks, and accruals so employees aren’t over or underpaid.

For an effective payroll run, consider offering various time capture options for your employees to use. Options like time cards, timesheets, and mobile apps meet the needs of all kinds of workforces, as well as the ability to clock in across locations, time zones, and projects. This granular type of attendance tracking makes it easier to keep workers accountable.

Step 5: Calculate Deductions

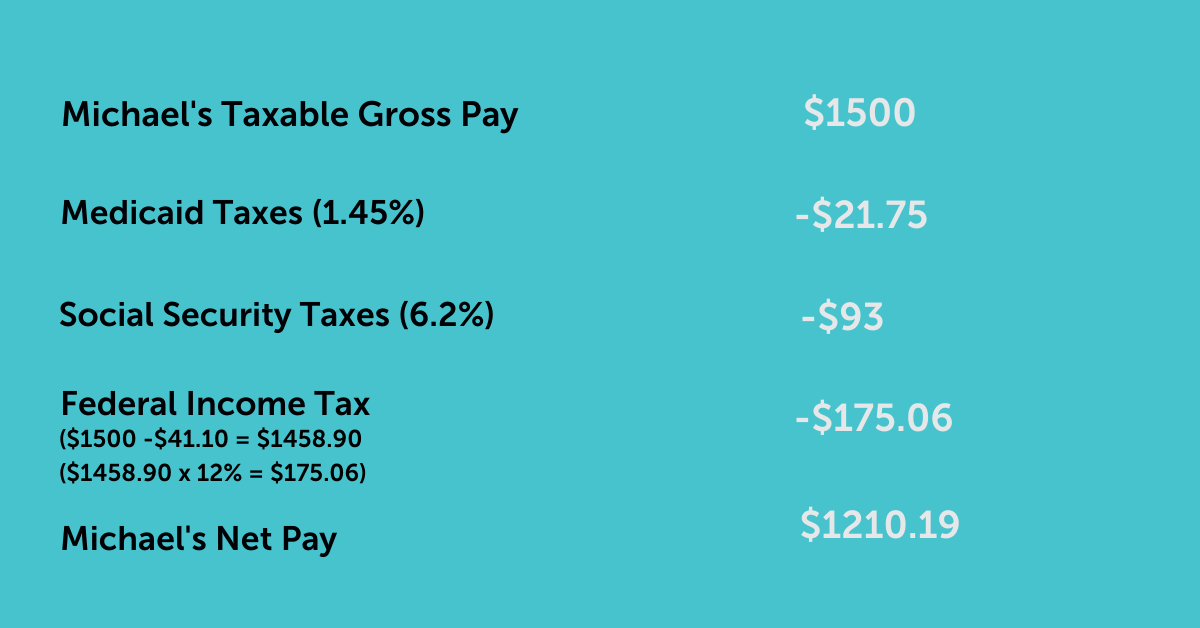

Now that you have time and attendance tracking in place, the next step in your payroll process is calculating deductions. To do this, you will first need to understand what the different types of deductions are. Here are the various categories deductions can fall into:

- Pre-Tax Deductions: These are deductions taken out of an employee’s paycheck before withholding taxes. Examples include employer-sponsored health insurance, employee retirement contributions, and employer retirement contributions.

- Tax Deductions: These are deductions for federal payroll taxes. Employers have to calculate how much tax to withhold from each employee’s paycheck and send that money to the appropriate government agencies. Some employees also have state payroll taxes withheld from their paychecks.

- Post-Tax Deductions: These are deductions taken out of an employee’s paycheck after withholding taxes. Examples include employee insurance premiums, Roth employee retirement contributions, and garnishments.

Once you know the different types of deductions out there, it’s time to calculate your deductions. To do this, you need to know how to calculate gross pay. A simple equation for this calculation is:

Step 6: Pay Employees

Now that you’ve calculated your employee’s take-home pay, it’s time to start running payroll. Whether employees prefer direct deposit, paycards, or printed checks, it’s crucial to ensure employee’s compensation is accurate and timely. Depending on your pay frequency, make sure you take holidays into account when processing payroll.

If you’re processing payroll manually, consider the effect federal non-banking holidays can have on employee pay. These holidays cause delays with direct deposit payments. If you’re printing checks, make sure you always have the appropriate supplies on hand. Even if you’re working with a payroll provider, holidays can still impact your processing schedule. The important thing is to plan so you can pay employees regardless of the situation.

Step 7: Submit Payroll Tax Payments and Filings

Once payroll is processed, employers still have work to do. Employers must send payroll taxes withheld to the appropriate government agencies. You also have to pay the employer portion of payroll taxes via Form 941. This quarterly federal tax return reports an employer’s federal income taxes and FICA taxes withheld during a calendar quarter.

In addition to Form 941, Form 940 reports any federal unemployment tax (FUTA) employers withheld during the calendar year. Depending on where your organization conducts business, you might also have to submit state payroll tax filings and other payments.

Note: Check with your payroll tax administrator and local tax authority to determine the filing requirements for your business.

How Long Does Payroll Processing Take?

Days to Hours

Sherry Arnold

How Software Providers Can Help You Create An Efficient Payroll Process

1. Manual Payroll

You process payroll by hand, using paper or a spreadsheet.

2. Outsourced Payroll

You hire someone else to manage your payroll process.

3. Payroll Software Providers

You use a payroll system to automate your process. The functionality can vary depending on the software but can include time tracking, recordkeeping, and tax compliance services.

Using a payroll software provider can alleviate manual burdens associated with payroll processing. Payroll and HR software streamlines employee recordkeeping from the point of onboarding to retention. Employees can input their personal information using an employee self-service portal or app. Employers can utilize automatic verification tracking and online document management solutions to keep track of necessary tax forms.

The data collected in a provider’s payroll and attendance platform helps you stay on track with your payroll budget. It’s measured against built-in error checking algorithms so you can review incomes and deductions before processing payroll. This configuration enables you to fix mistakes like potential employee overpayment before payroll is even processed.

Payroll and HR providers help you manage compliance risk. Certain software providers have experienced payroll tax compliance staff who operate on your behalf as the reporting agent. These experts use defined processes to manage tax funds daily. Their set systems help businesses ensure payroll filings and payments are accurate and up-to-date.

Payroll processing looks different for every company. Understanding the steps involved in how to process payroll is vital to your organization’s operations. Partnering with a software provider to automate those steps can help you create an efficient payroll process.

Disclaimer: This article is intended to provide an overview of the typical payroll process and does not replace legislative advice. Consult with your local tax authority about any questions or concerns you might have.